Blackstone REIT’s Amazing Year of Acquisitions and Performance

March 28, 2022 | James Sprow | Blue Vault

During the year ended December 31, 2021, the Company acquired interests in 65 real estate investments for $36.9 billion, which comprised 672 residential properties, 272 industrial properties, 13 retail properties, eight hospitality properties, four office properties, 31 self storage properties, and two data center properties.

At December 31, 2021, Blackstone REIT had $66.9 billion in net real estate assets, plus $5.5 billion in unconsolidated entities and $9.0 billion in investments in real estate debt. This represents an increase of 106% over the net real estate assets total as of December 31, 2020. The investments in unconsolidated entities totaled only $816 million as of December 31, 2020. Investments in real estate debt increased 97% from the 2020 total of $4.6 billion.

At the end of 2021, the total asset value per the REIT’s balance sheet was $91.3 billion. By February 28, 2022, the total asset value for the REIT was stated at $97 billion in the most recent Fact Sheet. By comparison, the next largest continuously offered nontraded REIT, Starwood REIT, had a total asset value as of February 28, 2022, of $22.7 billion.

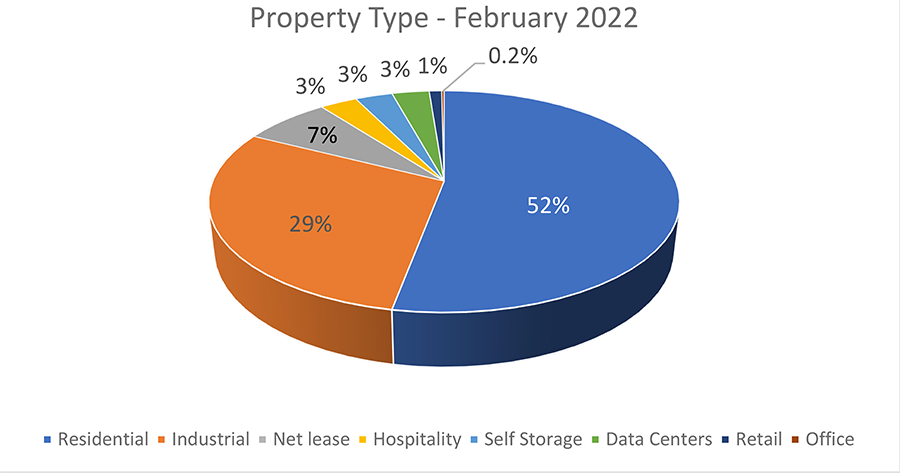

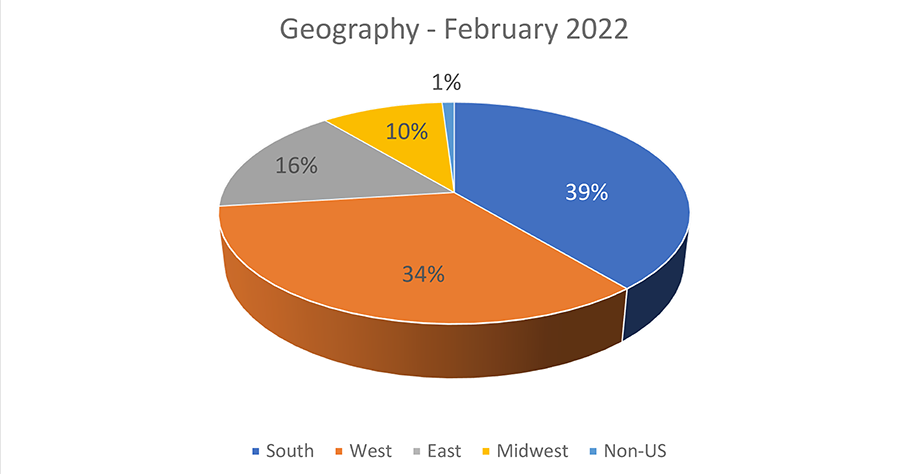

Measured by the asset value by property types in Chart I (excluding the values of third party interests) and geographic diversification in Chart II, the REIT’s portfolio as of February 2022 is illustrated below. Residential includes the following subsectors, each with over 1% of the real estate total asset value: multifamily, single family rental, student housing, affordable housing and manufactured housing.

Chart I

Chart II

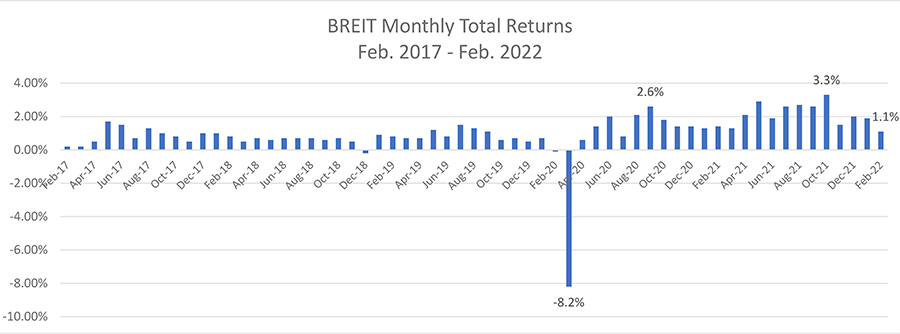

The monthly total returns are shown in Chart III for BREIT since inception for its Class S shares which are sold without upfront commissions. There were three months of the 61-month total thru February 2022 that had a negative total return. Notably the first month of the pandemic in the U.S., March 2020, was the worst at negative 8.2%. The total return to Class S shareholders in the year 2021 was 28.7%. Since inception, the annualized return to Class S shares has been 12.65%. In terms of risk, the standard deviation of the monthly returns since January 2020 was a low 2.10% compared to the standard deviation of returns to the S&P 500 stock index over the same 26 months of 5.65%. Since inception, the standard deviation of BREIT’s monthly returns was even lower, at 1.41%.

Chart III

Source: Blackstone REIT, Blue Vault, SEC