Q2 REIT and BDC Capital Raise Analysis (for Partners only)

August 10, 2018 | James Sprow | Blue Vault

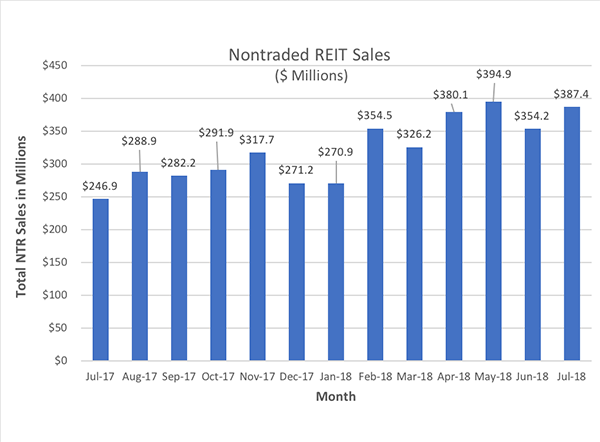

The apparent recovery of nontraded REIT sales continues as sales rose in July to $387.4 million. While the 9.5% increase in capital raise by nontraded REITs month-to-month is encouraging, even more impressive is the year-over-year change from July 2017 of plus 56.9%.

It is also interesting to see the changes in the sales by share classes for nontraded REITs in 2018 compared to 2017. The following table illustrates the share of total nontraded REIT capital raise by each individual share class. The July trend is away from Class A share sales toward Class D shares. In 2017, Class A shares made up 17.7% of the shares issued in open REIT offerings, but in July that percentage had dropped to just 4.9% of shares issued. Distribution reinvestment programs (DRIP) made a substantial increase in the portion of total capital raised, from 4.2% of the total in 2017 to 8.1% of the total in July 2018.

Share of NTR Capital Raise by Share Class

|

Share Class |

2017 |

Q1 2018 |

Q2 2018 |

July 2018 |

|

Class A |

17.7% |

6.1% |

7.4% |

4.9% |

|

Class D |

1.2% |

3.5% |

3.2% |

9.0% |

|

Class I |

8.7% |

22.4% |

21.7% |

16.9% |

|

Class S |

33.0% |

40.7% |

37.9% |

37.3% |

|

Class T |

29.5% |

18.2% |

17.2% |

17.8% |

|

Class W |

2.1% |

2.1% |

2.5% |

1.9% |

|

All Other Classes |

3.4% |

3.9% |

4.4% |

4.1% |

|

All DRIP |

4.2% |

3.2% |

5.6% |

8.1% |

Blackstone REIT continued to dominate the NTR sector with $233.1 million in July capital raise, up from $224.9 million in June, raising 60.2% of all capital in the sector. Among REITs, Griffin-American Healthcare Trust IV, Inc. was next with $21.7 million for a 5.6% share, followed by Jones Lang Lasalle Income Property Trust, Inc. with $17.6 million and a 4.5% share. Cole Real Estate Income Strategy (Daily NAV, Inc. raised $16.4 million, followed by Black Creek Industrial REIT IV at $15.6 million and Black Creek Diversified Property Fund at $14.6 million. Of these programs, all but Griffin-American Healthcare Trust IV revise their offering prices either daily or monthly based upon revised estimated NAVs per share and are continuous offerings.

Among the sponsors of nontraded REIT offerings, Blackstone’s single offering raised 60.2% of the total for all nontraded REIT sponsors. Black Creek Group, with two open programs was next with $30.3 million raised for 7.8% of nontraded REIT sales, followed by Griffin Capital Company with two programs and $26.8 million in sales for 6.9% of the total, and CIM Group (formerly Cole Capital) with $23.7 million and a 6.1% share.

Among the REITs with significant increases in capital raised between June and July, the largest percentage increase was achieved by Cole Credit Property Trust V, Inc., from $1.6 million in June to $4.4 million in July, an increase of 174%. Jones Lang LaSalle Income Property Trust, Inc. increased from $6.7 million in June to $17.6 million in July, a gain of 163%. Of the $33.5 increase in capital raise for the industry, Jones Lang LaSalle accounted for $10.9 million of the increase followed by Blackstone REIT’s sales increase of $8.2 million.

Nontraded BDC Sales Down 12.5%

Nontraded BDC sales decreased from $30.7 million in June to $26.9 million in July, a fall of 12.5%, with only three nontraded BDC programs raising funds in July compared to six in April and seven in February. Owl Rock Capital Advisors again led nontraded BDC sponsors with sales of $23.6 million by its Owl Rock Capital Corporation II program, 88% of all nontraded BDC sales in July, but down 13% from June. MacKenzie Realty Capital was a distant second with $2.8 million in sales for a 10.3% share of all BDC sales, and with July sales 48% higher than in June. Sierra Income Corporation reported no sales in July.