Total Shareholder Returns for Continuously Offered Nontraded REITs in June Are Impressive

August 4, 2021 | James Sprow | Blue Vault

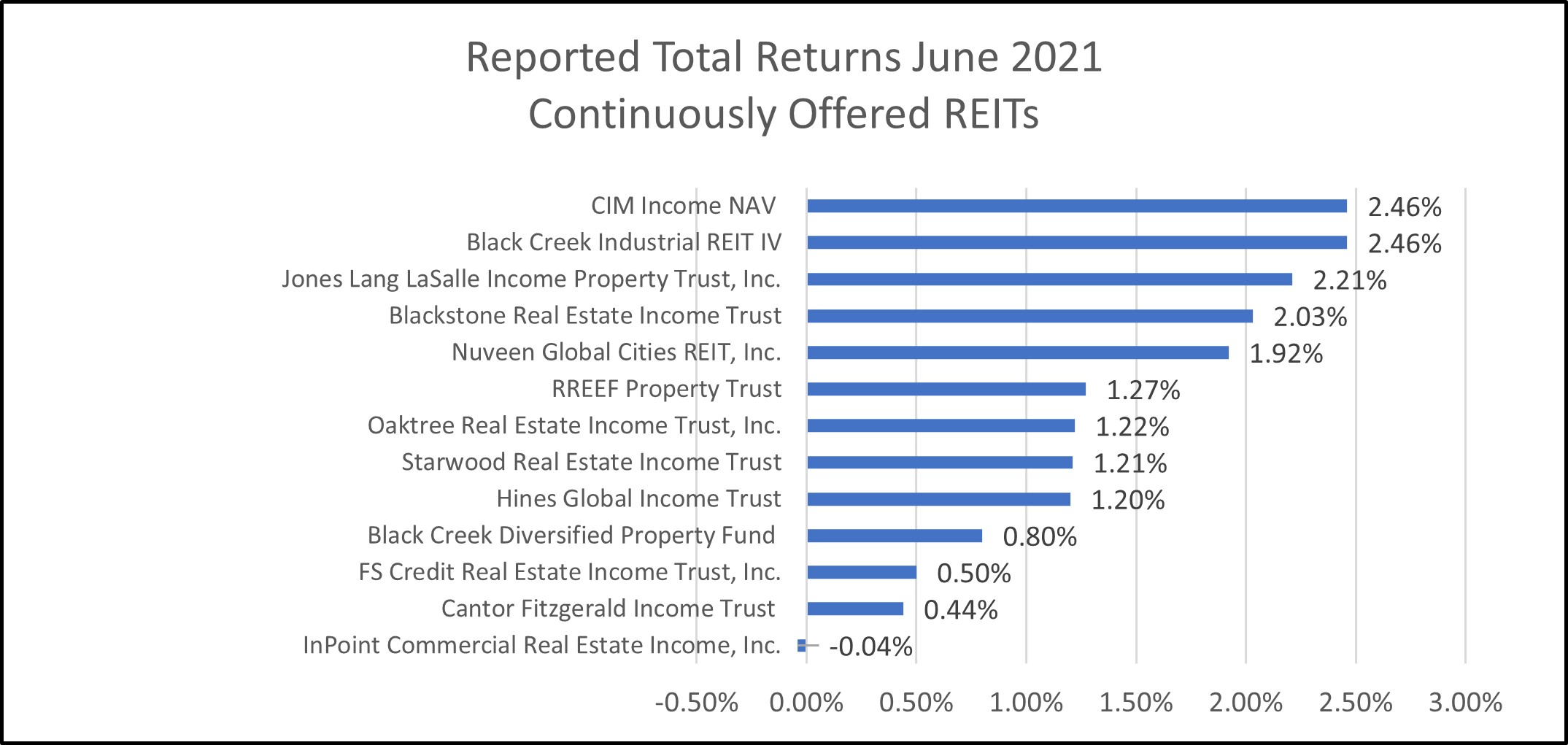

The total returns to shareholders in continuously offered nontraded REITs were consistently positive in June 2021 with all but one of the thirteen REITs reporting positive returns and a median total return for the group of 1.25%. If annualized, that monthly return would equate to approximately 15%. The total returns are calculated using the change in the net asset value per share (NAV) and the cash distributions as a percentage of those NAVs. Since all of these REITs have multiple share classes, we report total returns to Class I shareholders for 11 REITs and Class A shareholders for Jones Lang LaSalle Income Property Trust and Class IX for Cantor Fitzgerald Income Trust. These share classes do not have fees deducted from the distributions.

The total returns to shareholders in continuously offered nontraded REITs were consistently positive in June 2021 with all but one of the thirteen REITs reporting positive returns and a median total return for the group of 1.25%. If annualized, that monthly return would equate to approximately 15%. The total returns are calculated using the change in the net asset value per share (NAV) and the cash distributions as a percentage of those NAVs. Since all of these REITs have multiple share classes, we report total returns to Class I shareholders for 11 REITs and Class A shareholders for Jones Lang LaSalle Income Property Trust and Class IX for Cantor Fitzgerald Income Trust. These share classes do not have fees deducted from the distributions.

Chart I shows the total returns reported by the REITs on their websites on the “Performance” pages. These performance figures are usually updated on the REIT websites several weeks after the end of the month, which means the performance data for July 2021 have yet to be posted. The net asset values for each share class are typically reported within a week of each month end and these NAVs for continuously offered REITs are the basis for share prices.

Chart I

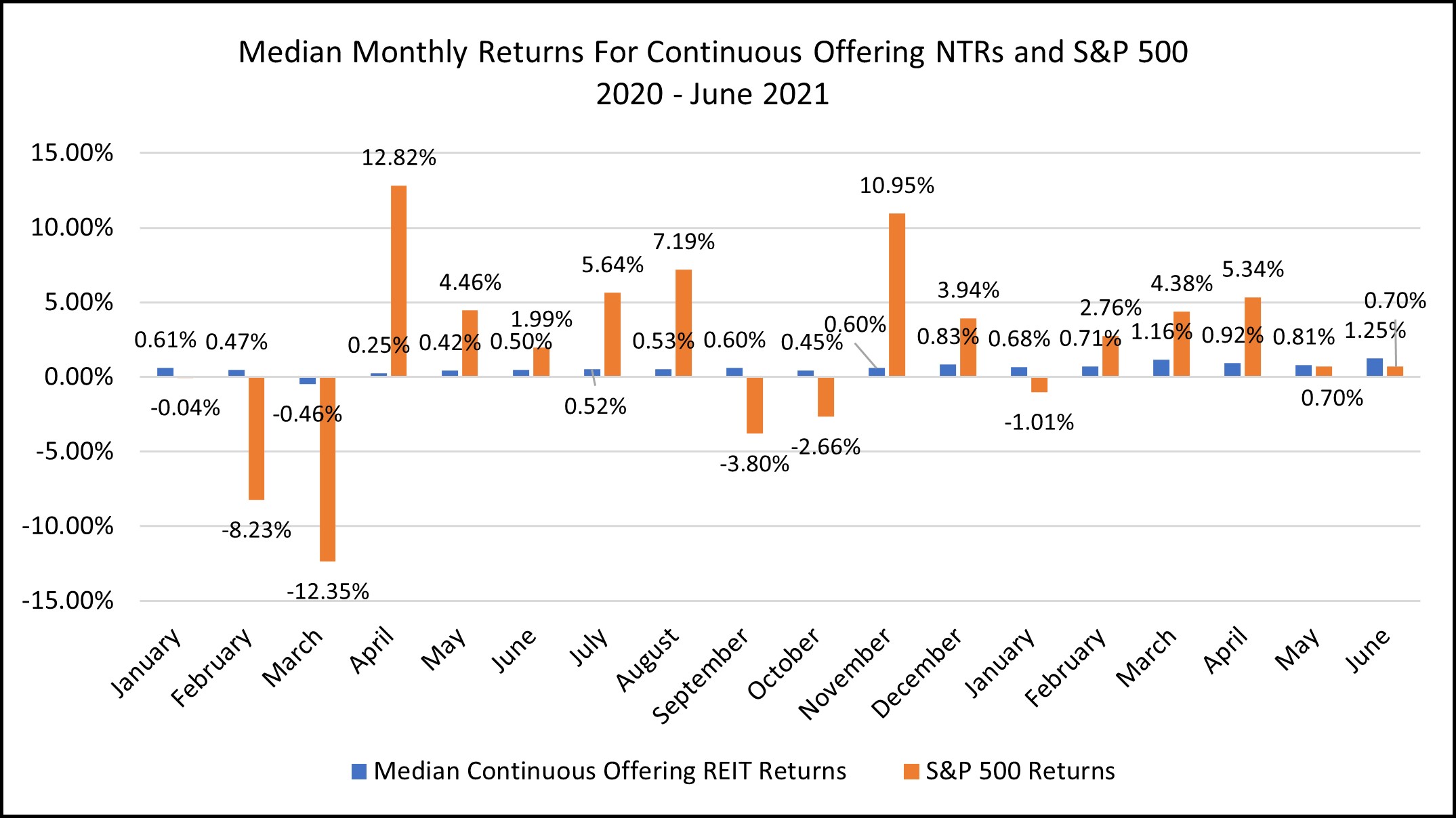

Chart II shows the median total shareholder returns for all continuously offered nontraded REITs for each month since January 2020 for those share classes with no shareholder servicing fees deducted (Class I, Class A and Class IX as stated above). For comparison, the total returns for the S&P 500 Index are also shown. The median returns for the nontraded REITs have very low month-to-month variation and had a negative return for only one month during the 18-month series. The S&P 500 returns were negative six months out of 18. The average standard deviation for the nontraded REIT returns over the 18-month series was just 1.0% while the standard deviation for the monthly S&P 500 returns over the same period was 6.17%.

Chart II

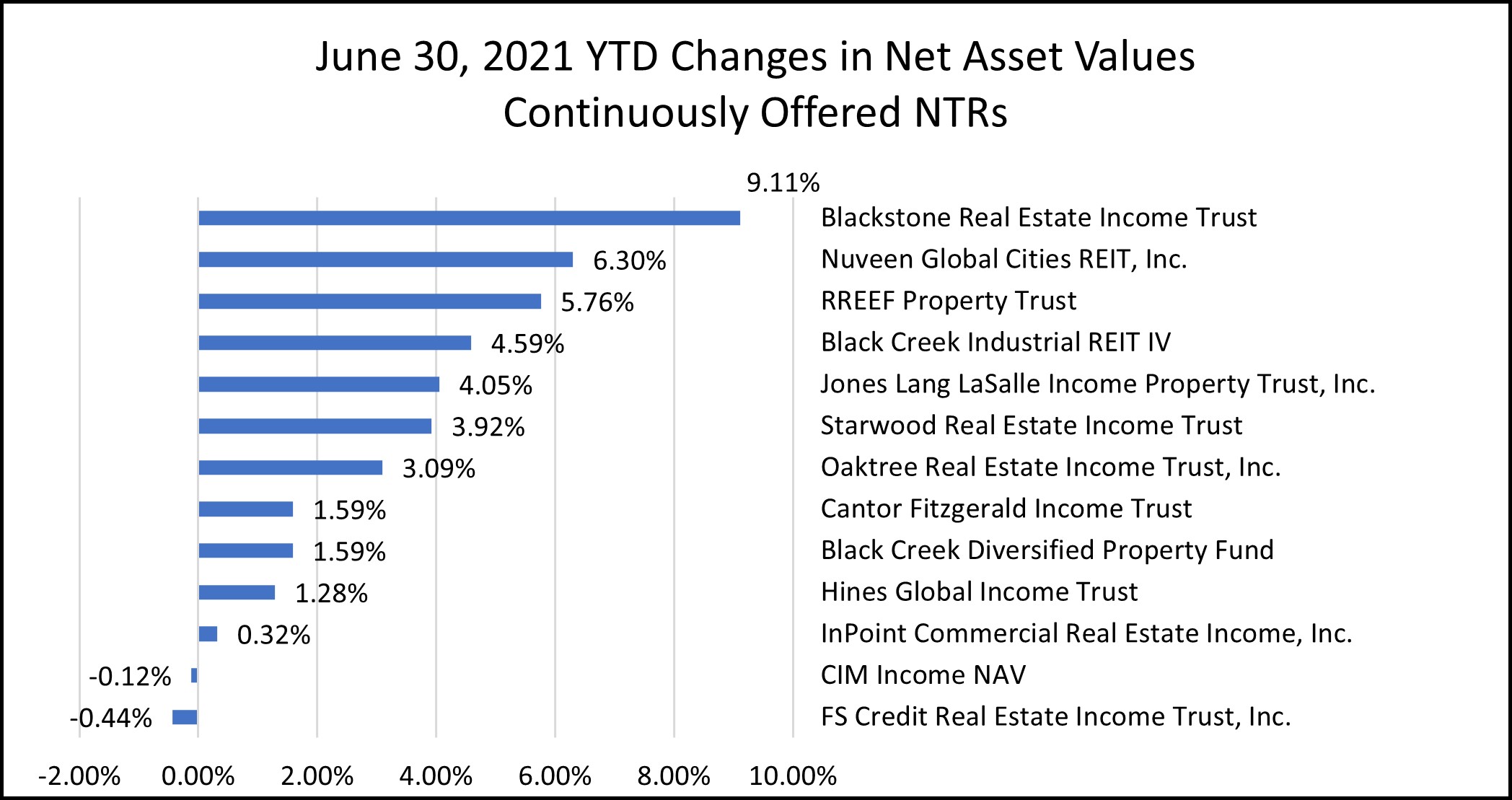

In Chart III we see the impressive increases in NAVs for the continuously offered nontraded REITs for the year-to-date 2021 through June 30, 2021. Blackstone REIT outshines the group with a YTD increase in the NAV per share for Class I shares of 9.11%. With the addition of cash distributions to the returns, the REIT’s total return YTD has been 12.05%. The annualized rate of return since the fund’s inception in January 2017 has been an equally impressive 11.20% for its Class I shares. The median change in net asset values in June for all of the 13 continuously offered nontraded REITs was 0.82%, and the median YTD change in NAVs was 3.09%, with just two of the 13 with a negative YTD change in NAV per share.

Chart III

Source: Blue Vault and REIT websites