Where Did Blackstone REIT Invest in Q4 2021?

December 30, 2021 | James Sprow | Blue Vault

Blackstone Real Estate Income Trust (“BREIT”) is by far the largest nontraded REIT program. As of September 30, 2021, the REIT had total assets of $63.45 billion and 1,599 individual properties. In the third quarter of 2021 alone, the REIT had acquisitions that totaled $10.40 billion. As the year 2021 closes, we can look closely at where the REIT was making acquisitions in the 4th quarter. We have individual property data for 119 properties acquired by BREIT between October 1 and December 31, 2021. Besides the individual properties that we can identify, there were two portfolio acquisitions. On November 19, 2021, BREIT acquired a high-quality industrial portfolio from Cabot Properties Inc. for $2.3 billion. The portfolio consists of 102 assets located in established industrial markets throughout the U.S. On December 9, 2021, BREIT acquired a high-quality portfolio of 20 newly built multifamily properties totaling 6,341 units for $2.1 billion. The portfolio consists of primarily suburban, garden-style properties concentrated in growth markets in the Western and Southern U.S.

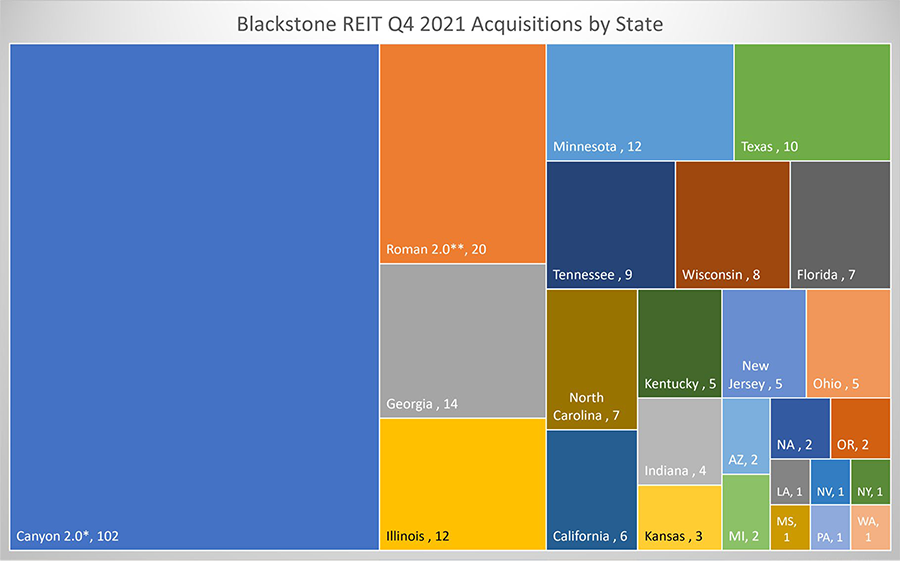

Because property-level data on the portfolio acquisitions aren’t available in detail, we can’t see the locations of the properties. However, we can see the locations of the 119 other properties, all in the U.S. The chart below illustrates the states with the most property acquisitions by BREIT in Q4 2021. Georgia had the most individual properties acquired by BREIT with 14, followed by Illinois and Minnesota with 12 each, and Texas with 10.

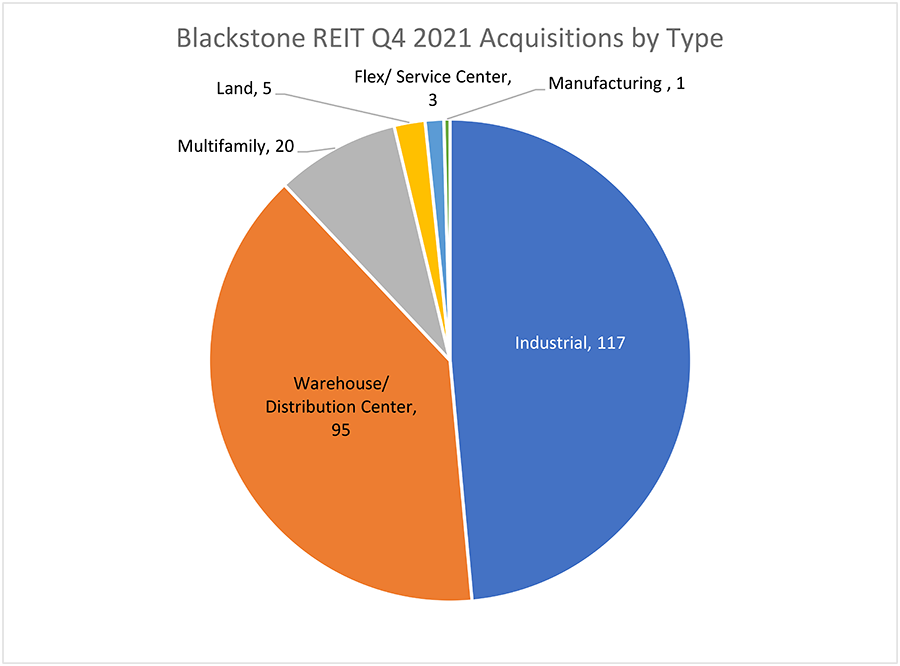

The vast majority of the BREIT acquisitions were in the Industrial and Warehouse/Distribution Center categories, with a combined total of 212 properties. A distant second was the Multifamily portfolio of 20 properties acquired on December 9.

Blue Vault provides property-level data for every active nontraded REIT in its Data Base, available to subscribers at www.bluevaultpartners.com.

Source: Blue Vault, SEC