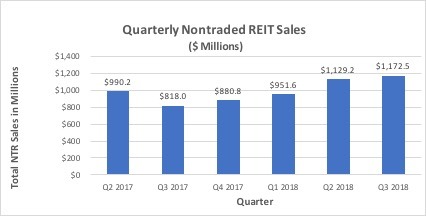

Q3 2018 Nontraded REIT Sales Rise 3.8% and 43% Year-Over-Year

December 4, 2018 | James Sprow | Blue Vault

Sales by nontraded REITs for the third quarter of 2018 were up 3.8% from Q2 2018, totaling $1.17 billion. This was over 43% higher than Q3 2017’s sales of $0.82 billion. Leading the way was Blackstone REIT with sales of $744.3 million, a 63.5% share of the nontraded REIT sales for the quarter. Q3 2018 was the fourth consecutive quarter with increases in nontraded REIT sales.

The leading nontraded REITs with sales reported to Blue Vault in Q3 2018 were:

| Q3 2018 Sales | Market Share | |

| Blackstone Real Estate Income Trust | $744,304,345 | 63.5% |

| Griffin-American Healthcare REIT IV, Inc. | $67,361,406 | 5.7% |

| Black Creek Industrial REIT IV | $51,556,459 | 4.4% |

| Cole Real Estate Income Strategy (Daily NAV), Inc. | $46,500,000 | 4.0% |

| Black Creek Diversified Property Fund | $45,989,701 | 3.9% |

| Jones Lang LaSalle Income Property Trust, Inc. | $33,577,518 | 2.9% |

| Carter Validus Mission Critical REIT II, Inc. | $29,341,993 | 2.5% |

| Rodin Global Property Trust, Inc. | $20,059,050 | 1.7% |

| Strategic Storage Trust IV, Inc. | $19,429,217 | 1.7% |

| Hines Global Income Trust, Inc. | $17,570,709 | 1.5% |

Blackstone REIT’s Q3 2018 sales were up just 3.5% from Q2 2018. On a percentage basis, the largest quarterly increase in sales by a nontraded REIT was by Hines Global Income Trust, with sales of $17.6 million in Q3 2018 compared to just $4.2 million in Q2 2018. Other large quarterly increases were by RREEF Property Trust, up 72.4% to $17.0 million compared to $9.8 million in Q2 2018, and Griffin Capital Essential Asset REIT II, up 49% to $10.8 million compared to $7.2 million in Q2 2018.

Blackstone REIT’s market share in Q3 2018 was down marginally at 63.5% compared to 64.4% in Q2 2018. The market share of the next 9 NTRs totaled 28.3% in Q3 2018, compared to 29.2% in Q2 2018. There were 21 nontraded REITs reporting capital raise in Q3 2018, a number unchanged from the 21 REITs raising capital in Q2 2018. One new REIT entered the market in Q3 2018 as Strategic Student & Senior Housing Trust, Inc., sponsored by SmartStop Asset Management, reported sales for the first time in August.

Among REITs with declining sales figures from Q2 2018 to Q3 2018, the largest percentage decline was by Moody National REIT II, down over 26% from $16.0 million in Q2 2018 to $11.7 million in Q3 2018. Carter Validus Mission Critical REIT II and Cole Real Estate Income Strategy (Daily NAV) both saw declines of approximately 13%.