The Portfolio Re-Balancing Conundrum

July 25, 2022 | James Sprow | Blue Vault

During the May 20 Blue Vault Webinar entitled “Can Real Estate Performance be Sustained in a Recession?” Adam Lotterman, Co-founder and Co CIO of Bluerock Fund Advisors, brought up an interesting point regarding the financial advisor’s need to re-balance a client’s portfolio as public market values shift. For example, since June 30, 2021, the S&P 500 Index has fallen 11.9%. The Vanguard Long-Term Corporate Bond Index Fund has fallen 24.2%. We can imagine a client that has departed from the traditional 60:40 portfolio mix of listed stocks and listed bonds by diversifying with alternatives such as continuously offered nontraded REITs, would now be challenged to re-balance their portfolio. In the following hypothetical example, we imagine a portfolio that was diversified 60:30:10 on June 30, 2021, with 10% invested in the then-available continuously offered nontraded REITs.

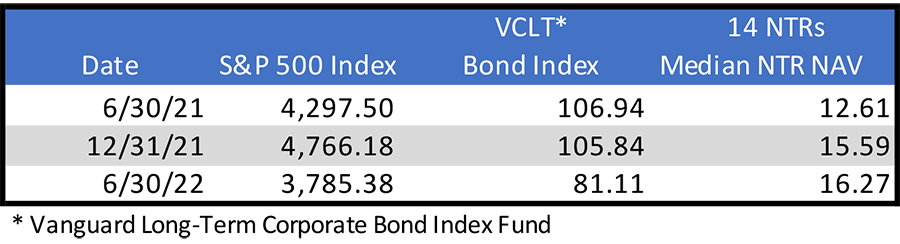

In the table below, we show the index values for the S&P 500, the Vanguard Long-Term Corporate Bond Index Fund (VCLT) and the median net asset values (NAVs) for the continuously offered nontraded REIT programs as of June 30, 2021, December 31, 2021, and June 30, 2022.

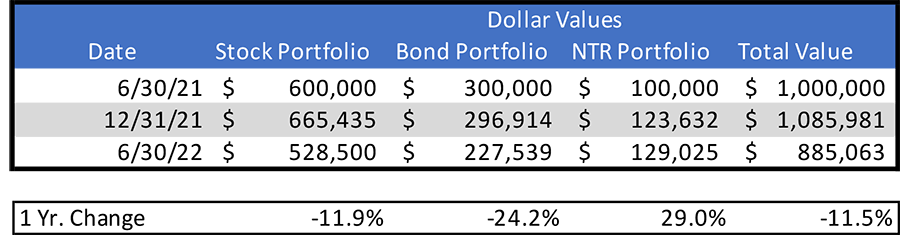

Here’s what that portfolio would have looked like on June 30, 2021, and what would have happened to its values by June 30, 2022. For simplicity, we will ignore dividends, interest and distribution incomes over the one-year holding period.

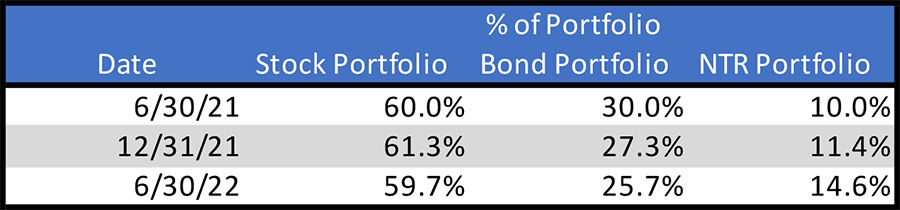

Because the returns on the three asset classes in the portfolio varied significantly, with the listed stocks falling 11.9%, the bond portfolio falling 24.2%, and the median value of the continuously offered nontraded REITs increasing 29.0% Y-O-Y, the client’s portfolio would be significantly out of balance. The portfolio that began with the 60:30:10 allocation between stocks, bonds and alternatives as of June 30, 2021, would now be allocated 14.6% to alternatives and just 25.7% to bonds.

We can see from this simple example that maintaining a given allocation model in turbulent markets can be a challenge. While the advisor might be patting themselves on the back with the knowledge that the client’s portfolio was successful in reducing the losses that a traditional 60:40 mix would have suffered (-16.8%) to a mere negative 11.5% with the 60:30:10 strategy, there is a problem: “How to re-balance the portfolio to the desired values?”

Given that the continuously offered nontraded REIT investments are deliberately designed to be less liquid than listed stocks or the bond mutual fund, the advisor is faced with a conundrum (hence the title of the article!). Due to the wise decision to diversify into alternative investments such as the nontraded REITs, it may be more difficult to re-balance the portfolio.

We’ll leave that to the financial advisor to figure out in their next client meeting. Hopefully, the client will appreciate the benefits of diversifying into nontraded REITs!

Sources: Finance.Yahoo.com; Blue Vault; SEC