Blue Vault’s Analysis of Cottonwood Communities

August 2, 2022 | James Sprow | Blue Vault

As the S&P 500 was down 20.6% from the start of 2022 thru June 30, there is a nontraded REIT that reported a 22.05% total return to its Class I, Class A and Class TX common shareholders. The total returns were the result of increases in the share NAVs and its cash distributions. As of June 30, those common shares had a distribution yield of 3.52%. Cottonwood Communities, Inc. focuses on investments in multifamily real estate, through ownership of operating properties, developments, and real estate-related financial investments.

The performance of Cottonwood Communities, a nontraded REIT, is partly due to the focus on multifamily assets, but it is difficult to square with the total return to the FTSE Property Sector performance YTD in 2022. In the Apartments index based on total returns of sixteen listed REITs, the total return was negative 20.35%. The dividend yield for those REITs was 3.15% as of June 30, 2022.

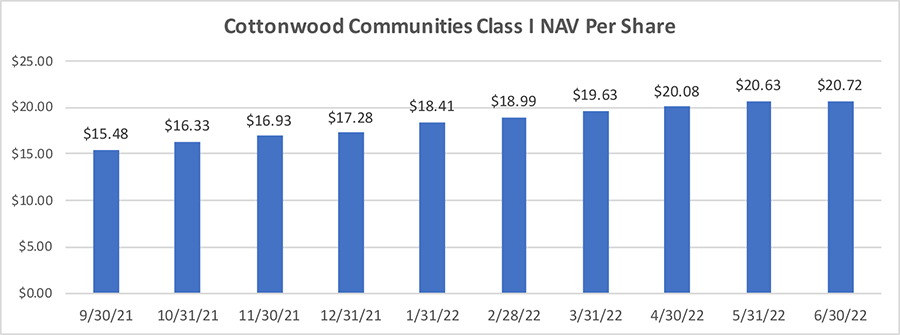

The increase in Cottonwood Communities’ net asset value per share (NAV) has been impressive. Since the end of 2021, the NAV of the Class I shares in the REIT have increased 19.9%. Only one other active continuously offered nontraded REIT program had an NAV increase YTD thru June 30 that exceeded the Cottonwood Communities increase (Ares Industrial REIT, 22.1%).

Updated Cottonwood Communities Portfolio as of June 30, 2022

• $2.5 Billion Gross Asset Value

• 36 Properties

• 7,294 Units in Stabilized Properties, $1.639 billion purchase data property value

• 95.34% Physical Occupancy Rate

• 1,079 Units in Development Properties, $91.857 million investment amount

Merger History

On January 26, 2021, Cottonwood Communities entered into separate agreements with three affiliated REITs and their respective operating partnerships to merge through the exchange of stock-for-stock and units-for-units, respectively. The merger with Cottonwood Residential II, Inc. (“CRII”) closed on May 7, 2021. The mergers with Cottonwood Multifamily REIT I, Inc. (“CMRI”) and with Cottonwood Multifamily REIT II, Inc. (“CMRII”) closed on July 15, 2021.

Through the 2021 mergers CWREIT acquired interests in 22 stabilized multifamily apartment communities, four multifamily development projects, one structured investment, and land held for development. CWREIT also acquired CRII’s property management business and its employees, which currently manage approximately 9,600 units, including 7,294 units the REIT owns or has ownership interests in.

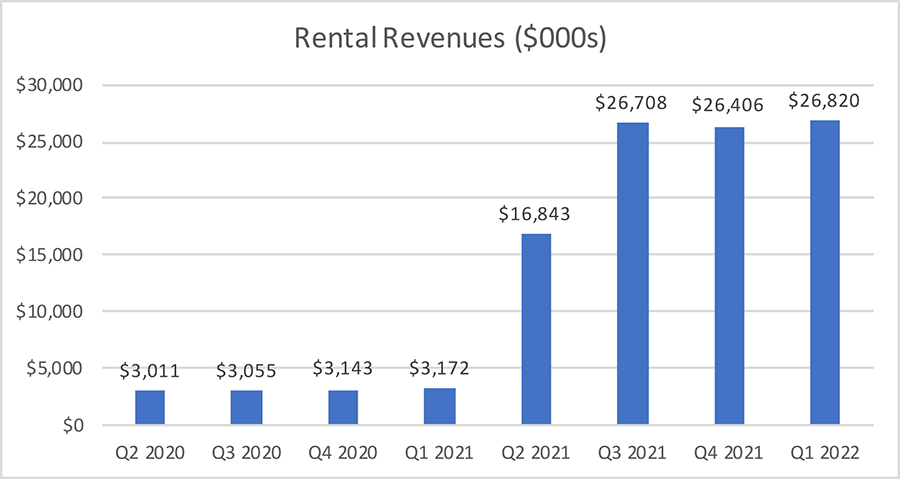

The mergers and their effects on the performance metrics of Cottonwood Communities are evident. Prior to the mergers, Cottonwood Communities owned only two apartment properties, a 245-unit complex in West Palm Beach, FL, and Cottonwood One Upland in the Greater Boston area with 262 units. The rental revenues from the total portfolio jumped up in Q2 2021 with the mergers and have stabilized thereafter.

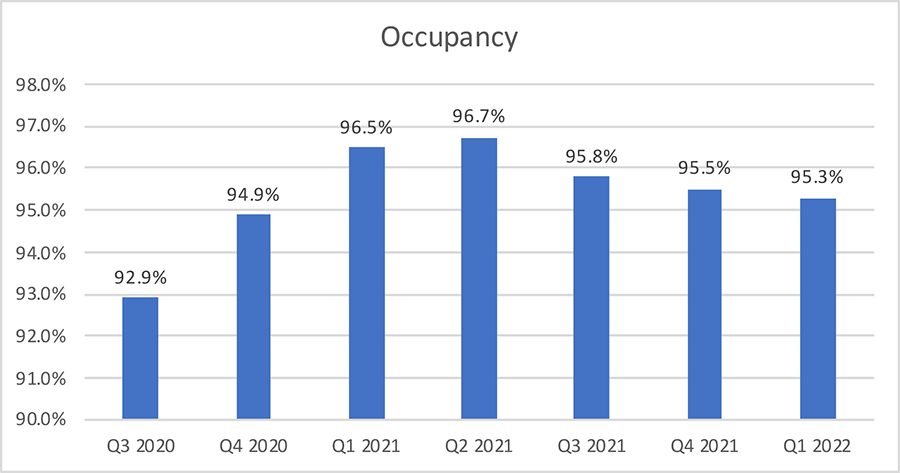

The occupancies across the portfolio have been relatively stable.

Since its inception, Cottonwood Communities has pursued a strategy of investing in multifamily real estate assets in three ways:

1. Operating Multifamily Properties-High-quality, income-producing multifamily properties

2. Real-Estate Related Investments-Preferred equity, mezzanine loans, B-note loans, etc.

3. Ground-Up Real Estate Development-New development of multifamily communities

As of March 31, 2022, the strategy has resulted in 86.2% of the equity value invested in operating properties, 7.7% in development properties, and 6.1% in real estate-related investments. The development properties include three projects in Salt Lake City, UT and one in Millcreek, UT, with a combined total of 1,079 units to be built. They comprise an investment as of March 31, 2022, of $91.9 million. The real estate-related investments are comprised of three preferred equity positions totaling $39.99 million, and a mezzanine loan of $13 million. The REIT also had three parcels of land held for future development in Salt Lake City, UT for an investment amount of $13.0 million.

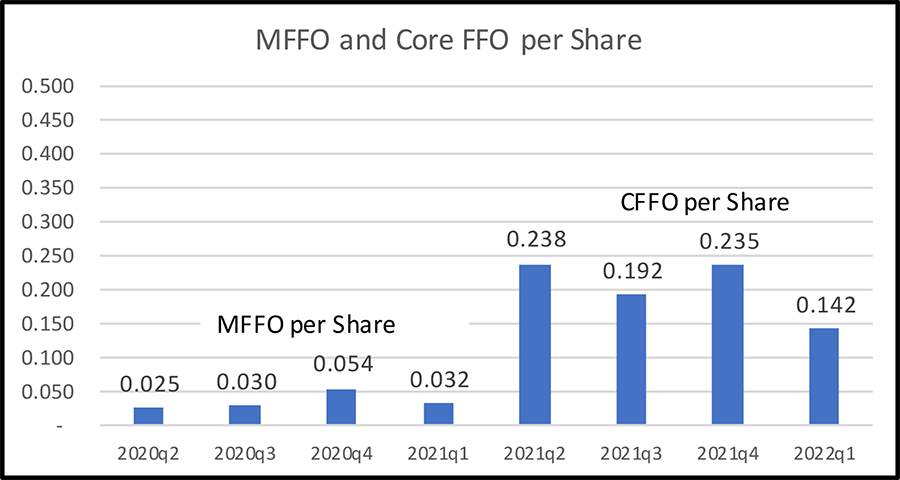

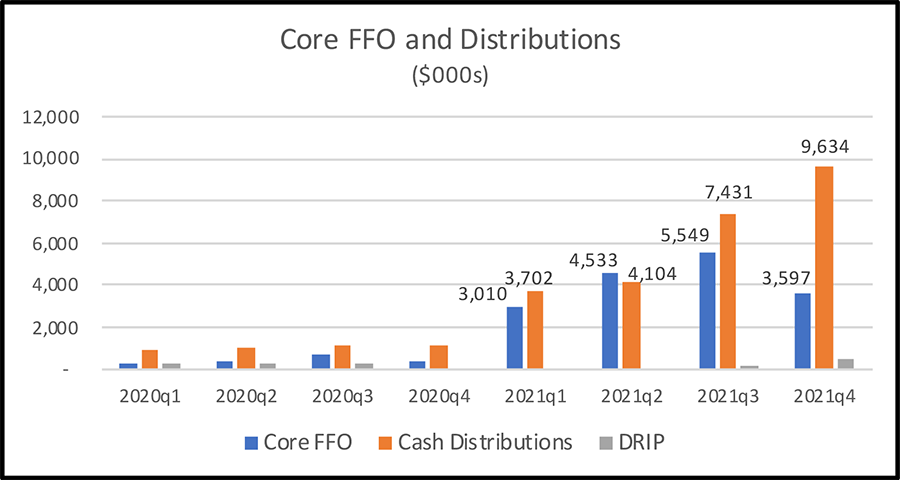

After the mergers with the three REITs, Cottonwood Communities began reporting Core FFO (CFFO) instead of MFFO (Modified Funds from Operations). The chart below shows the reporting of CFFO beginning in Q2 2021. Core FFO is calculated by adjusting FFO for amortization of intangible assets, amortization of loan issuance costs, accretion of discount on preferred stock, performance participation allocation, acquisition fees and expenses, accretion of below-market leases, and adjustments for unconsolidated real estate entities and noncontrolling interests. By far the largest adjustment was adding back the performance participation allocation of $6.455 million to FFO in Q2 2021. This adjustment was zero in the 2020 periods.

Core FFO of $3.597 million in Q1 2022 did not cover the total cash distributions of $$9.634 million for the quarter. It did exceed cash distributions in Q2 2021. Over time, it is important that Core FFO begins to cover cash distributions. This is a metric that bears watching in future quarters. As long as occupancies and rental revenues remain healthy going forward, Core FFO should be expected to eventually exceed cash distributions.

Multifamily assets are expected to be particularly resilient in a recession. As the REIT states on its website, regardless of macroeconomic conditions, people still need a place to live. As interest rates rise, the single-family home market has become out of reach for many households. Also, the ability to vary location and the lease terms associated with renting provide flexibility that appeals to many households, particularly younger groups that prioritize mobility.

From the landlord’s perspective, multifamily assets can adjust to the macroeconomic environment with their annual resetting of lease rates. Cottonwood Communities has also strategically invested in those areas of the U.S. with favorable demographics. Their assets are in locations with high concentrations of skilled labor and above average incomes. Their properties are primarily located in the growth areas of the U.S., including Florida, Texas, Utah, Tennessee, and Georgia. Only two of their operating properties are in the Northeast.

Sources: SEC, www.cottonwoodcommunities.com; Blue Vault

For more insightful research, subscribe to our Blue Vault Database today.