Assessing the Corporate Property Associates 18 – Global Merger

September 6, 2022 | James Sprow | Blue Vault

The merger of Corporate Property Associates 18 – Global (“CPA 18”) with W.P. Carey was completed on August 1, 2022. In this article we look at the financial results for shareholders in the nontraded REIT and use the cash flows received by shareholders who invested in the REIT at different times during the initial public offering and those shareholders who used the distribution reinvestment program (“DRP”) to calculate the average rates of return (IRRs) for those investments held until the full-cycle liquidity event.

The Merger Terms

Shareholders of CPA 18 approved the company’s merger with its advisor, a publicly traded REIT, on July 26, 2022. The proposed merger was first announced on February 28, 2022. CPA 18 had the opportunity to receive alternative proposals from third parties for a period of 30 days that ended on March 30, 2022.

On the date of the merger, CPA 18 stockholders received 0.0978 shares of W. P. Carey common stock (NYSE: WPC) plus $3.00 of cash for each share of CPA 18. The transaction was initially estimated to be valued at approximately $2.7 billion and expected to add approximately $2 billion of real estate assets, after proposed asset sales, the substantial majority of which had been completed. W. P. Carey issued 13.8 million shares of its common stock, increasing its equity market capitalization to approximately $18 billion.

The W. P. Carey shares that were issued in the merger were listed on the New York Stock Exchange at the time of issuance. On August 1, 2022, WPC common closed trading at $87.46, giving the 0.0978 shares a liquidation value of $8.55 per share, which, together with the $3.00 cash payment, results in a total liquidation value of $11.55.

CPA 18’s Pre-Merger Portfolio

As of March 31, 2022, the last quarter for which financial reports were filed for CPA 18, the REIT had a net lease portfolio comprised of full or partial ownership interests in 52 properties, substantially all of which were fully occupied and triple-net leased to 47 tenants totaling 10.4 million square feet. The remainder of the portfolio was comprised of full or partial ownership interests in 65 self-storage properties, three student housing development projects (two of which will become subject to net lease agreements upon their completion) and one student housing operating property, totaling approximately 5.1 million square feet. As of March 31, 2022, CPA 18 owned interests ranging from 50% to 99% in 16 jointly owned investments, with the remaining interests held by third parties or by WPC (four investments).

Prior to the merger, on June 30, 2022, CPA 18 sold 11 net-lease student housing properties in Spain and Portugal (following the exercise of their purchase options) to the tenant at such properties for a contractual sales price totaling approximately $404 million and net cash proceeds totaling approximately $232 million.

Calculating the Returns to Shareholders

CPA 18’s initial offering was declared effective on May 7, 2013. On August 20, 2013, the REIT acquired its first property and on December 18, 2013, it made its first foreign investment with five properties in Europe. The initial public offering was closed on April 2, 2015, after raising gross proceeds of approximately $1.2 billion. The REIT terminated sales of its Class A common stock as of June 30, 2014, and ceased accepting new orders for its Class C common stock as of March 27, 2015. On March 18, 2015, the REIT amended its DRIP to make the purchase price equal to the most recently published estimated net asset value per share.

Blue Vault calculated the cash distributions to investors for each quarter from the first quarter of the REIT’s existence in Q2 2013 until the full-cycle event on August 1, 2022. For the purpose of the analysis, cash flows were assumed to occur at the end of each quarter in which a distribution was paid.

The initial share price for Class A common shares was $10.00 and for Class C common shares the price was $9.35. The initial DRIP price for Class A common shares was $9.60 and for Class C common shares $8.98. The first cash distributions to shareholders occurred in Q4 2013. On July 25, 2013, aggregate proceeds in the offering exceeded $2 million and funds were released from escrow.

The REIT paid distributions on Class A common stock at the rate of 6.20% annualized based upon the $10.00 offering price and 5.64% annualized for Class C common stock based upon the $9.60 share price. In Q3 2015 the distribution rates increased to 6.25% annualized for Class A shares and 5.72% annualized for Class C shares. In Q2 2020, distribution rates were reduced to 2.50% annualized for Class A shares and 1.87% for Class C shares. A special dividend of $0.20 per share was paid to all common shareholders in Q4 2021. From Q4 2015 until Q4 2021, the DRIP prices for Class A and Class C shares varied with the estimated NAVs per share. From $7.90 per share in Q4 2015, these NAVs varied, reaching $9.07 in Q4 2021. The DRIP program was suspended effective February 27, 2022, in light of the proposed merger.

Blue Vault uses the cash distributions paid to Class A and Class C common shareholders for each quarter of the REIT’s life cycle, and the final liquidating value for those shares. Internal rates of return are calculated for three different holding period assumptions: Early Investors (Q2 2013), Mid-Offering Investors (Q1 2014), and Late Offering Investors (Q2 2015). We also calculated the cash flows that would have been reinvested in shares if investors participated in the distribution reinvestment programs (DRIP). Over the holding period for those participating in the DRIP, their share balances increased each quarter that distributions were paid in lieu of cash distributions. When the DRIP was suspended for Q1 2022, those shareholders received cash distributions based upon their effective share balances.

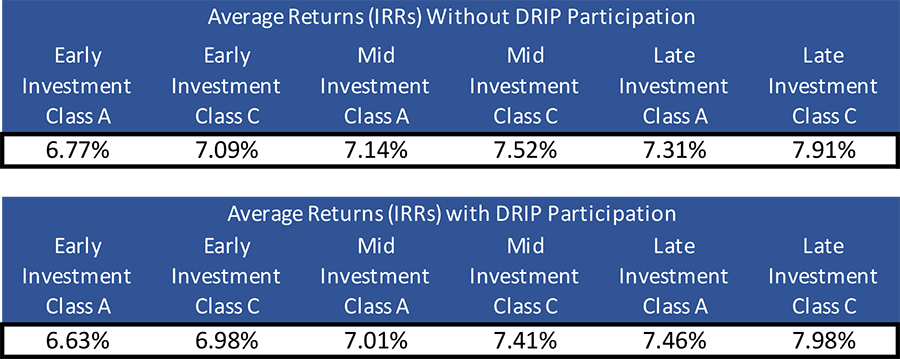

The table below shows the IRRs for investors in Class A and Class C shares using the three different holding period assumptions (Early, Mid, and Late investors in the offering), and the assumptions of no DRIP participation and DRIP participation for every quarter during the holding period.

Interpreting the Results

Differing rates of return for the different holding period assumptions are the result of the timing of distribution yield changes, changes in the DRIP prices, and the capital gain received by investors at the full-cycle event date. Generally, when there is a capital gain at the full-cycle date, those investors who paid the same share price later in the offering did better in terms of average rate of return. This principal also applies to investors who participated in the DRIP.

Investors in the shares of CPA 18 had a capital gain at the full-cycle date, receiving 0.0978 shares of WPC common stock which closed at $87.46 on August 1, worth $8.55 to CPA 18 shareholders who liquidated that day. Adding the $3.00 cash distribution gives a total full-cycle value of $11.55, for a capital gain of $1.55 for the original shares sold in the offering at $10.00.

Sources: SEC, Blue Vault, W.P. Carey