January NTR Sales Down 2.6% From December, Nontraded BDC Sales Up 33%

February 12, 2019 | James Sprow | Blue Vault

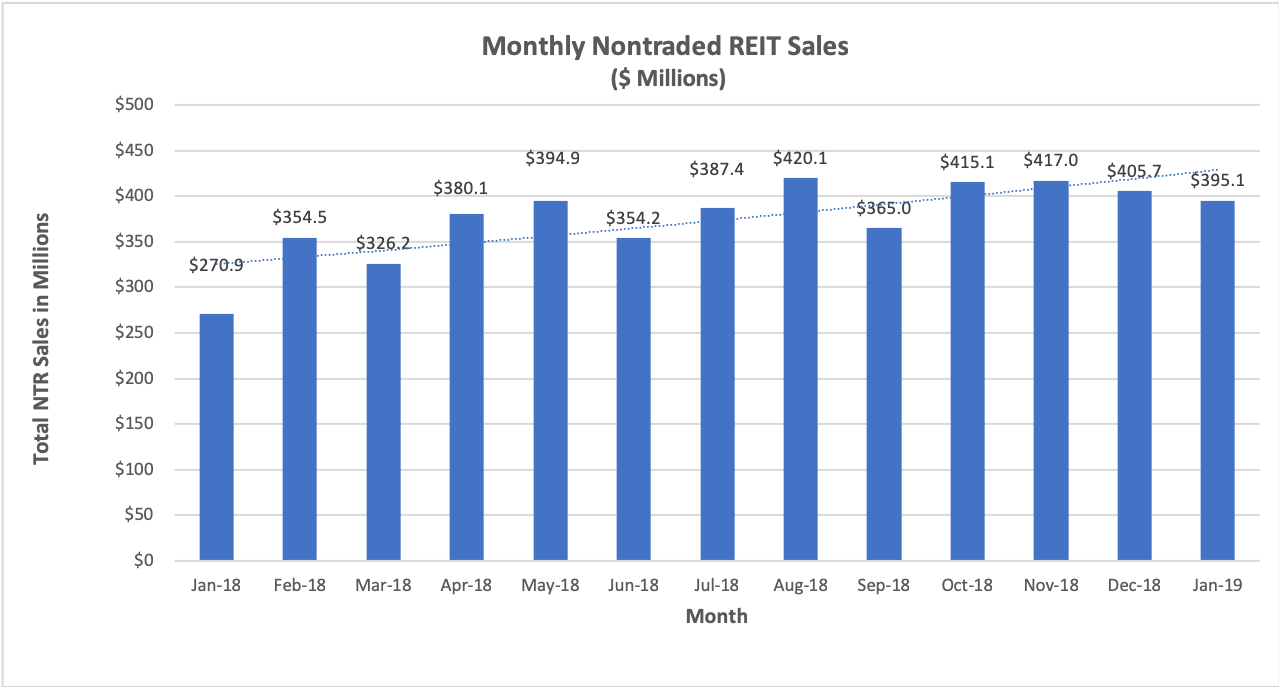

Reporting nontraded REITs booked capital raise of $395.1 million in January*, down 2.6% from the $405.7 million total for December and down 5.2% from the $417.0 million in November. Blackstone REIT saw capital raise fall in January by 7%, but other nontraded REIT offerings reported a combined capital raise increase of 5%, from $150.8 million to $158.4 million, cushioning the month-to-month drop for the industry.

With the Blackstone REIT January sales of $236.7 million, down 7% from sales in December of $254.8 million, the smaller 2.6% decrease in capital raise month-to-month among reporting NTRs was due to several other REIT programs significantly increasing their capital raise. After Blackstone REIT with 60% of the month’s sales, the leading REIT program in capital raise in January was Griffin-American Healthcare REIT IV, Inc. with sales of $35.8 million, up 10% from December’s $32.6 million. Black Creek Industrial REIT IV was next with sales of $29.2 million, down 8% from December. The Hines Global Income Trust total for January was $19.3 million, up from $13.8 million in December. Jones Lang LaSalle’s Income Property Trust raised $14.7 million in January, up 22% from $12.0 million in December. Another Black Creek REIT program, Black Creek Diversified Property Fund raised $14.4 million, down 11% from its December total of $16.1 million.

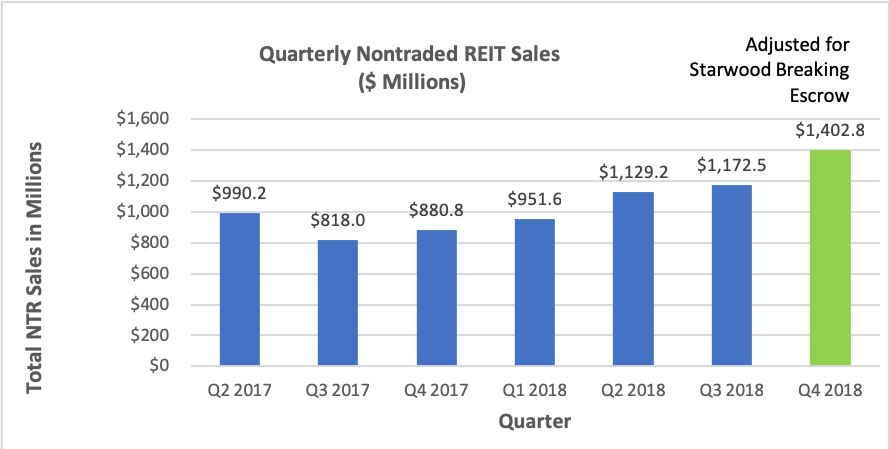

Starwood REIT Breaks Escrow with $165 Million Raised in Q4 2018

A significant addition to nontraded REIT sales in Q4 2018 that was reported as of December 21, 2018, is the breaking of escrow by Starwood Real Estate Income Trust, Inc. The REIT satisfied the minimum offering requirement of subscriptions aggregating at least $150 million on that date, and the escrow agent released gross proceeds of approximately $165 million to the company. As of January 17, 2019, the REIT had issued and sold 8.2 million shares of its Class S, T, D and I shares for estimated total gross proceeds in excess of $168 million. The $165 million raised as of December 21, 2018, when added to the NTR industry’s total for Q4 2018, brings the quarter’s capital raise to over $1.4 billion, up over 19% from Q3 2018.

Among the reporting sponsors of nontraded REIT offerings in January, Blackstone was first in capital raised with $236.7 million, for 60% of the total NTR sales. Black Creek Group, with two open programs, was next with $43.6 million raised and a 11% share, followed by Griffin Capital Company with one program totaling $35.8 million for a 10% share, up from $32.6 million in December and its 8% share of the industry total. Jones Lang LaSalle was next with $14.7 million, followed by CIM Group with $11.3 million.

The latest new nontraded REIT reporting sales in January, Procaccianti Hotel REIT Inc., increased its sales in January to $1.011 million from $0.805 million in December.

Among those REITs with significant increases in capital raised between December and January, the largest percentage increase was achieved by Rodin Income Trust which raised $1.92 million in January after raising $0.25 million in December. SmartStop’s Strategic Student & Senior Housing Trust raised $0.615 million in January, up 193% from the $0.210 million in December. Cottonwood Communities increased their capital raise by 77% from $3.67 million in December to $6.47 million in January.

Year-over-year, January 2019 NTR sales were up 46% from January 2018. The Q4 2018 total was $1,237.8 million, up 5.6% from the Q3 2018 total of $1,172.5 million, and up 40.5% from the $880.8 million for Q4 2017. Due to the lack of capital raise reports from five effective NTRs, it is possible that the industry total is actually significantly greater than $400 million for January. The breaking of escrow by Starwood REIT in December 2018 would alone increase Q4 2018 capital raise by $165 million, and monthly totals accordingly.

Nontraded BDC Sales Rose 33% in January

Nontraded BDC sales increased from $42.0 million in December to $55.8 million in January, an increase of 33%, with only three nontraded BDC programs raising funds in January compared to six in April 2018 and seven in February 2018. Owl Rock Capital Advisors again led nontraded BDC sponsors with sales of $46.7 million by its Owl Rock Capital Corporation II program, 83.7% of all nontraded BDC sales in January, up 21.8% from its $38.6 million sales in December. CION Investment Corporation reported sales of $6.52 million in January, an 11.7% share of nontraded BDC sales for the month, and up over 240% from $1.90 million in December. MacKenzie Realty Capital was a distant third with $2.58 million in sales for a 4.6% share of all January BDC sales, up significantly from its December sales of $1.45 million.

*The following NTRs would not provide sales data to Blue Vault: FS Credit Real Estate Income Trust and Phillips Edison Grocery Center REIT III. The following NTRs did not provide sales data to Blue Vault: Nuveen Global Cities REIT, Starwood REIT, Oaktree REIT.