Blackstone REIT Share Repurchases Approaching Quarterly Limits

November 23, 2022 | James Sprow | Blue Vault

Recent comments by industry experts have suggested that share repurchase requests by the common shareholders of continuously offered nontraded REITs may in the coming months exceed the limits contained in the REIT prospectuses. Those prospectuses generally spell out the limitations of share repurchase programs as 2% of the REIT’s aggregate NAV per month and no more than 5% of the aggregate NAV per calendar quarter.1

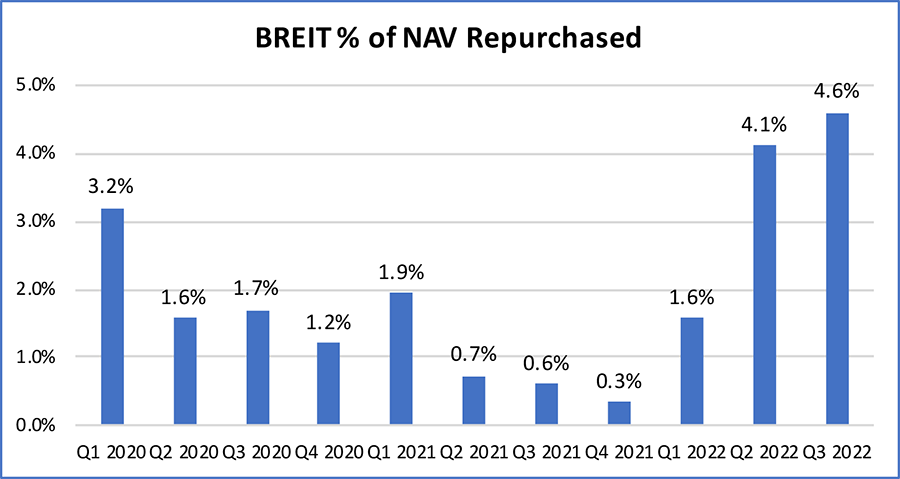

We look at the history of common share repurchases by Blackstone Real Estate Income Trust (“BREIT”) over the past 11 quarters to calculate the percentages of NAV that share repurchases each quarter comprised. Each quarterly 10-Q filed with the SEC shows the monthly repurchases and their respective percentages of NAV. Adding up those monthly percentages of NAV gives a rough estimate of each quarter’s total percentage of NAV.

One adjustment that must be made to the quarterly totals is for shares repurchased or redeemed from the Adviser as payment of the Adviser’s management fee which are not subject to the share repurchase plan. For example, in Q2 2022 the REIT reported that the quarterly total of share redemptions included “…16,865,795 Class I shares previously issued to the Special Limited Partner upon redemption of Class I units.” These types of redemptions occurred in eight of the past 11 quarters and we have deducted them from the total share repurchases in order to calculate the percentage of NAV that each quarter’s repurchases from common shareholders represent and are subject to the stated limitations.2

The chart below illustrates our quarterly estimates of the percentage of NAV repurchased by the REIT.

As the above chart illustrates, recent quarterly repurchases of common shares are approaching the quarterly limits of 5% stated in the prospectus. So far in the history of BREIT the quarterly repurchases have not been subject to the limit and all repurchase requests by shareholders have been met.

Should the total number of shares exceed the monthly or quarterly limits set out in the prospectus, the REIT can restrict the number of shares to be repurchased and satisfy a percentage of the requests on a pro rata basis.5 Shareholders must then submit requests for their remaining shares to be repurchased in the following quarter. Whether those requests will be satisfied is determined by the REIT at its discretion.3

There is also a discount to the repurchase price (the previously declared NAV per share) to be applied to shares held for less than a calendar year. Those shares are subject to a 2% discount in the repurchase price.4

Footnotes

1. From the S-11/A (1/25/22): “We may repurchase fewer shares than have been requested in any particular month to be repurchased under our share repurchase plan, or none at all, in our discretion at any time. In addition, the aggregate NAV of total repurchases of Class T, Class S, Class D and Class I shares (including repurchases at certain non-U.S. investor access funds primarily created to hold shares of our common stock but excluding any Early Repurchase Deduction applicable to the repurchased shares) will be limited to no more than 2% of our aggregate NAV per month (measured using the aggregate NAV attributable to stockholders as of the end of the immediately preceding month) and no more than 5% of our aggregate NAV per calendar quarter (measured using the average aggregate NAV attributable to stockholders as of the end of the immediately preceding three months).

2. From the Q3 2022 10-Q: “The Special Limited Partner continues to hold 24,104,433 Class I units in BREIT OP. The redemption of Class I units and Class B units and shares held by the Adviser acquired as payment of the Adviser’s management fee are not subject to our share repurchase plan.”

3. From the S-11/A (1/25/22): “Should repurchase requests, in our judgment, place an undue burden on our liquidity, adversely affect our operations or risk having an adverse impact on the Company as a whole, or should we otherwise determine that investing our liquid assets in real properties or other investments rather than repurchasing our shares is in the best interests of the Company as a whole, we may choose to repurchase fewer shares in any particular month than have been requested to be repurchased, or none at all. Further, our board of directors may make exceptions to, modify or suspend our share repurchase plan if in its reasonable judgment it deems such action to be in our best interest and the best interest of our stockholders. Material modifications, including any amendment to the 2% monthly or 5% quarterly limitations on repurchases, to and suspensions of the share repurchase plan will be promptly disclosed to stockholders in a prospectus supplement (or post-effective amendment if required by the Securities Act) or special or periodic report filed by us. Material modifications will also be disclosed on our website. In addition, we may determine to suspend the share repurchase plan due to regulatory changes, changes in law or if we become aware of undisclosed material information that we believe should be publicly disclosed before shares are repurchased. Once the share repurchase plan is suspended, our share repurchase plan requires that we consider the recommencement of the plan at least quarterly. Continued suspension of our share repurchase plan would only be permitted under the plan if our board of directors determines that the continued suspension of the share repurchase plan is in our best interest and the best interest of our stockholders. Our board of directors must affirmatively authorize the recommencement of the plan before stockholder requests will be considered again. Our board of directors cannot terminate our share repurchase plan absent a liquidity event which results in our stockholders receiving cash or securities listed on a national securities exchange or where otherwise required by law. There is no public trading market for our common stock and repurchase of shares by us will likely be the only way to dispose of your shares. We are not obligated to repurchase any shares under our share repurchase plan and may choose to repurchase only some, or even none, of the shares that have been requested to be repurchased. In addition, repurchases will be subject to available liquidity and other significant restrictions. Further, our board of directors may make exceptions to, modify or suspend our share repurchase plan. As a result, our shares should be considered as having only limited liquidity and at times may be illiquid.”

4. From the S-11/A (1/25/22): “Repurchases will be made at the transaction price in effect on the Repurchase Date, except that, effective on or around March 31, 2022, shares that have not been outstanding for at least one year will be repurchased at 98% of the transaction price (an “Early Repurchase Deduction”). The one-year holding period is measured as of the subscription closing date immediately following the prospective repurchase date.”

5. From the S-11/A (1/25/22): “In the event that we determine to repurchase some but not all of the shares submitted for repurchase during any month, shares submitted for repurchase during such month will be repurchased on a pro rata basis after we have repurchased all shares for which repurchase has been requested due to death, disability or divorce and other limited exceptions. All unsatisfied repurchase requests must be resubmitted after the start of the next month or quarter, or upon the recommencement of the share repurchase plan, as applicable.”