Resource’s Outlook on Late-cycle Real Estate Investing

August 27, 2019 | James Sprow | Blue Vault

The Federal Reserve’s recent pivot to a “mid-cycle adjustment” on interest rates, combined with further tensions in the United States’ trade war with China, have ushered volatility back to equity markets. The S&P continues to dance as we enter the fall, including a near three percent drop on news of China’s currency devaluation in early August.

The Federal Reserve’s recent pivot to a “mid-cycle adjustment” on interest rates, combined with further tensions in the United States’ trade war with China, have ushered volatility back to equity markets. The S&P continues to dance as we enter the fall, including a near three percent drop on news of China’s currency devaluation in early August.

Resource* believes such late economic cycle market volatility will likely persist. In the context of aging economic and real estate cycles, the firm utilizes active, in-house management to identify potentially attractive risk-adjusted investment opportunities. The Resource Real Estate Diversified Income Fund (the “Fund”) is a closed-end interval fund that invests in public and private real estate equity as well as credit investments to seek consistent income, low to moderate volatility, and low correlation through the ups-and-downs of equity markets.

The Fund’s management aims to deliver a turnkey, full-cycle product that maneuvers between offensive and defensive strategies as conditions warrant. Broad diversification across strategies, managers, geographies, and property types allows Resource the flexibility to target the Fund’s objectives. As the current cycle has aged, Fund management has adopted more defensive positioning with an emphasis on income returns.

Resource’s perspective on the commercial real estate cycle is supported by the NCREIF Open End Diversified Core Equity Index (ODCE) delivering negative appreciation in Q2 2019 for the first time in nearly a decade. The ODCE Index comprises approximately 25 real estate private equity funds that historically have owned a diversified portfolio of “core” real estate – office, multifamily, industrial, and retail. This index produced outsized double-digit returns from 2013 through 2015 before returning to more normalized levels through 2018. Returns have taken another step down in 2019 as moderate new building activity continued and the specter of a slowing economy raised the potential for slowing demand. Resource believes these fundamental trends have been further exacerbated by technical factors related to appraisal methodologies and the relationship between interest rates and cap rates.

Because real estate fundamentals move slowly, the technical factors behind the recent rapid deceleration of appreciation in the ODCE Index warrants further examination. By way of background, real estate private equity funds rely on third-party appraisals to set NAVs, and these appraisers are notorious for slowly adjusting to changing market conditions. In this environment, it appears that third-party appraisals have lagged the rapid changes taking place in the retail sector, and are only now lowering their valuations to reflect higher cap rates, slower growth, and higher CAPEX requirements. As a result, the NAVs of some mall properties are being marked down by as much as 50 percent in recent quarters.

The historic correlation between interest rates and cap rates may be another culprit for Q2 ODCE results. Most private funds use fixed-rate leverage to enhance portfolio returns. When rates decline, the value of this fixed-rate debt rises, which results in a lower fund NAV. However, the rising value of fixed-rate liabilities has historically been more than offset by higher building values from lower cap rates, which resulted in higher NAVs. Because cap rates were already near historical lows at the end of 2018, this latest bout of falling rates had a more pronounced impact on private fund NAVs. The anticipation of this dynamic is one reason why Resource fund management shifted away from core private equity and increased allocations to real estate credit investments over the last two years.

While some commercial real estate analysts have a gloomy outlook simply because we are late in the current cycle, Resource anticipates a “smooth landing” in commercial real estate values and does not foresee a crash.

Although a corporate contraction will inevitably occur, Resource expects the consumer to remain healthy. This helps explain the Fund’s public and private equity strategy that is overweight consumer-economy oriented sectors such as apartments, hospitals, movie theaters, and senior housing. Moreover, Resource believes that a shallow contraction in GDP, while dependent on many uncertainties with monetary policy and trade conflicts, will ward off speculative supply and preserve demand, resulting in higher real estate inflows similar to the early 1990 and early 2000 recessions.

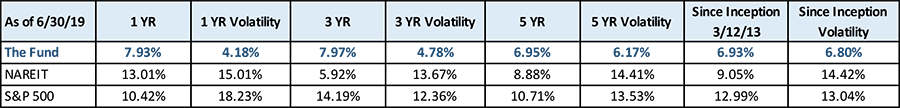

Resource believes its interval fund solution is well positioned in today’s climate: actively managed to navigate through an aging cycle and truly diversified across public and private strategies, equity and debt investments, and fixed and floating rate portfolio sensitivity. The Fund has a six-year track record of utilizing a consistent structure and strategy, with a historically stable distribution and one-year, three-year, five-year, and since inception total return variance of 104 basis points.

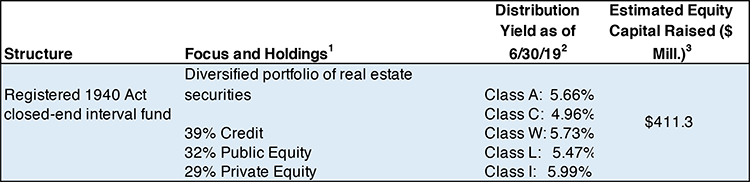

1. Any description of the Fund’s holdings is of as 6/30/19. Holdings are subject to change without notice.

2. Net of applicable fees. The Daily Fund distribution rate is the amount, expressed as a percentage, a Fund investor would receive in distributions if the most recent Fund distribution stayed consistent going forward divided by the applicable Fund’s public offering price per share as of the date indicated. As of June 30, 2019. Source: Resource Real Estate, LLC

3. Blue Vault estimates from inception through July 2019, including DRIP.

As of the most recent quarter-end period ending June 30, 2019, the Fund generated a 5.73% annualized quarterly distribution**, in excess of its five percent target.*** Also, the Fund’s shift to more defensive, income-focused investments contributed to a 4.18% standard deviation over the last 12 months and a one-year total return of 7.93% as of June 30, 2019. On a risk-adjusted basis, the Fund’s one-year Sharpe Ratio of 1.90 was more than double the US NAREIT Index’s 0.87 and well ahead of the S&P’s 0.57.

To learn more about Resource’s real estate interval fund, visit www.ResourceAlts.com.

ALPS Fund Services, Inc. Resource Real Estate Diversified Income Fund Class A shares; Bloomberg. FTSE NAREIT All Equity REITs Index, S&P 500 Total Return Index. You cannot invest directly in an index.

Performance data quoted represents past performance. Past performance is no guarantee of future results and investment returns and principal value of the Fund will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data quoted above. For performance information current to the most recent month-end, please call toll-free (866) 773-4120 or visit www.ResourceAlts.com. Performance information is reported net of the Fund’s fees and expenses, but does not include the Fund’s maximum sales charge of 5.75% for Class A shares. Performance would have been lower if the maximum sales load had been reflected above. Class A gross expenses are 2.97% and net expenses are 2.76%. Net fees are based on a contractual fee waiver and reimbursement agreement by the Adviser to waive its fees and absorb the ordinary annual operating expenses of the Fund to the extent they exceed 1.99% per annum of daily net assets of Class A through at least January 31, 2021.

* Resource is the marketing name for Resource Real Estate LLC (the Fund’s investment adviser) and its affiliates.

** The above annualized distributions are not quarterly returns, rather they are reflective of the actual quarterly dividends that are annualized. To calculate annualized quarterly distributions, the Fund’s management will take the income received from the Fund’s portfolio, subtract expenses and divide the result by the total number of shares the Fund’s investors own. The annualized quarterly distribution represents a single distribution from the Fund and does not represent the total returns of the Fund. A portion of our distribution has been comprised of a return of capital because certain Fund investments have included preferred and common equity investments, which may include a return of capital. Distributions are not guaranteed.

*** Target yield is measured at the Fund level and is not equal to actual returns for a shareholder. As portfolio and market conditions change, future distributions will vary and target yields may not be obtained in the future.

About Resource and C-III

Resource has been a subsidiary of C-III Capital Partners LLC (“C-III”) since being acquired in 2016. C-III is a fully-integrated asset management and commercial real estate services company. Its platform includes investment management and loan servicing, commercial mortgage origination, and diversified real estate services.

Resource is an asset management company that specializes in real estate and credit investments. Its objective is to be a best-in-class asset manager as measured by risk-adjusted returns to investors and the quality of the funds and businesses they manage.

Since 1991, Resource has sponsored a range of investment vehicles, including limited partnerships, joint ventures with institutional partners, publicly traded and non-traded REITs, and interval funds. Resource launched its first nontraded REIT in 2010 and its first interval fund in 2013.

Resource and C-III combined have over $9.3 billion in real estate and debt assets under management as of December 31, 2018.