June 2, 2023 | James Sprow | Blue Vault

Blue Vault has previously written about the challenges faced by nontraded REIT programs as interest rates rise. Our article about InPoint Commercial Real Estate Income stated that the general rise in interest rates presented a problem for that nontraded REIT, which raised the question, “Are rising interest rates an explanation for decreased income for nontraded REITs that invest in commercial real estate debt?”

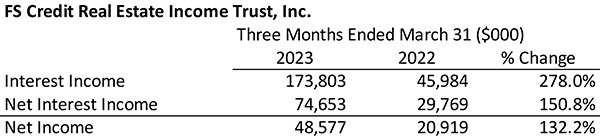

Nontraded REITs that invest in CRE debt instruments generate income based upon the spread between the interest income from those investments and the interest expense for their financing. Rises in market rates impact both the rates earned on the REITs’ assets and the rates paid for their financing. A relatively simple look at the financial statements for the first quarters of 2022 and 2023 for FS Credit Real Estate Income Trust, Inc., a REIT that focuses on CRE credit investments, reveals how their income has changed over the last 12 months.

The rates of YOY change in these data speak for themselves. As interest rates have risen since Q1 2022, interest income for the REIT has risen, but net interest income, which takes into account interest expense, has not risen proportionally. The effect on net income is also less than the increase in interest income. One explanation could be the fall in the spread between rates earned on investments and rates paid for financing those investments.

In our quarterly reports on this nontraded REIT, Blue Vault points out that the REIT uses variable rate financing to finance their variable rate investments, thus hedging interest rate risks to some extent. However, the fly in the ointment, so to speak, is the effects of interest rate rises on the spread between rates earned and rates paid.

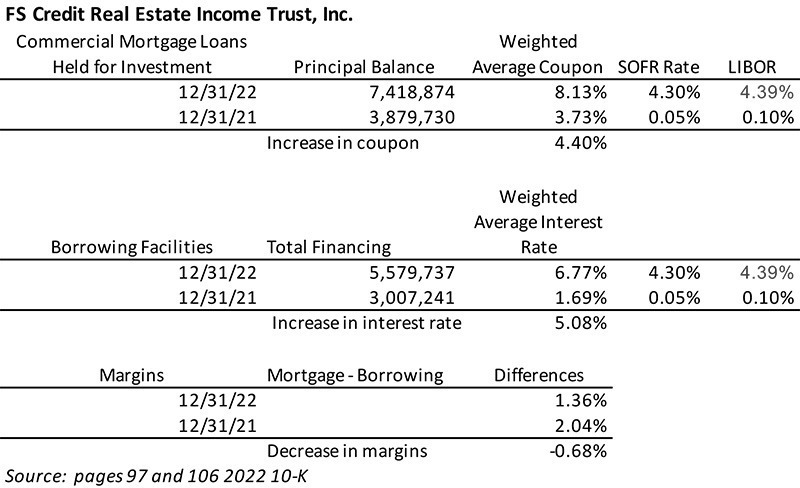

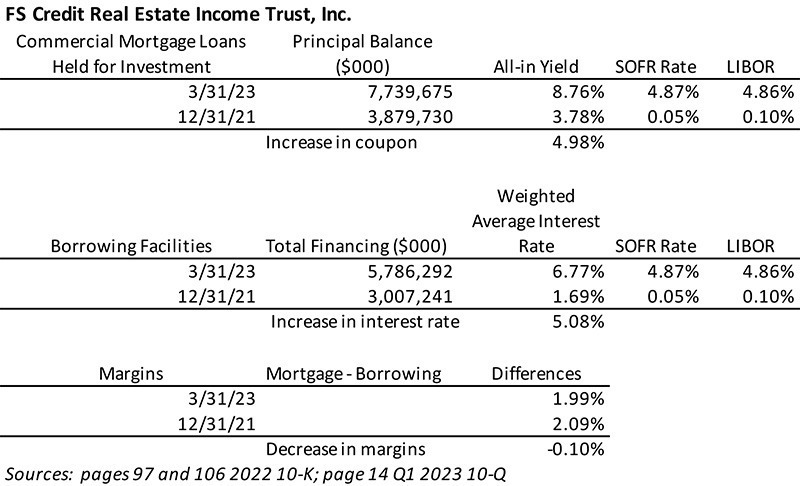

Measuring the changes in interest rates for this REIT is difficult. In the following, we pull weighted average interest rates for both investments in CRE debt and financing with variable rate borrowings. These data are anything but exact, but they do give a general picture. The rates earned and the rates paid are presented in financial statements (10-Qs) and defined differently, and can be tied to LIBOR or SOFR rates.

The two illustrations below illustrate the reduction in spreads between fiscal 2021 and fiscal 2022, and also a comparison for Q1 2023 and year-end 2021.

FS Credit Real Estate Income Trust, Inc. has faced increasing borrowing rates and enjoyed increasing rates on its variable rate investments. What’s important are the effects on the spread between the rates on investments and the rates paid on financing. Our analysis is not perfect, but we believe it does reveal some shrinking of the margins.

Conclusion

CRE credit-focused REITs, pursuing strategies of investing in CRE debt instruments and financing those investments with variable rate debt, have faced challenges as market rates have risen. Have they weathered the rises in rates unscathed? One key variable they must deal with is the spread between rates earned and rates paid. Inexact as our analysis may be, it appears that margins between the weighted average rates for investments and financing may have narrowed. While the margins may have narrowed, we are impressed by the REIT’s ability to minimize the impact of rising rates by using both variable-rate financing and variable-rate investments.

Sources: SEC filings