InvenTrust Properties Corp. Investor Report

March 11, 2020

On March 6, 2020, InvenTrust Properties Corp. (the “Company”) shared information with investors highlighting 2019 achievements and 2020 goals. Accomplishments brought forth included:

• 3% dividend increase, for the fourth consecutive year

• Announced Share Repurchase Program & Dividend Reinvestment Program

• Repurchased $20 million+ worth of shares through the SRP

• Share value remained stable at $3.14

• 95% ending economic occupancy

The 3G Approach

In 2020, the Company will continue operating under its 3G approach: Geography, Grocery, and Growth. The Company’s portfolio geographically targets the Sun Belt markets with growing populations and increasing household incomes. A reduction in the number of markets allows for improved operational efficiencies and market knowledge. To that end, the Company began capital recycling efforts in 2015. At that time, InvenTrust’s portfolio consisted of 40+ properties in more than 20 states. Today, the portfolio is made up of 13 properties in target markets in 6 states:

• Southern California

• Denver, Colorado

• Texas: Austin; Dallas/Ft Worth/Arlington; Houston; San Antonio

• Atlanta, Georgia

• Florida: Miami/ Ft Lauderdale/West Palm Beach; Orlando, Tampa/St Petersburg

• North Carolina: Charlotte; Raleigh/Durham

• Washington, D.C. (metro area)

Also furthering the mission to improve market knowledge, new corporate offices have been added in cities where markets exist: Southern California, Orlando, and Austin.

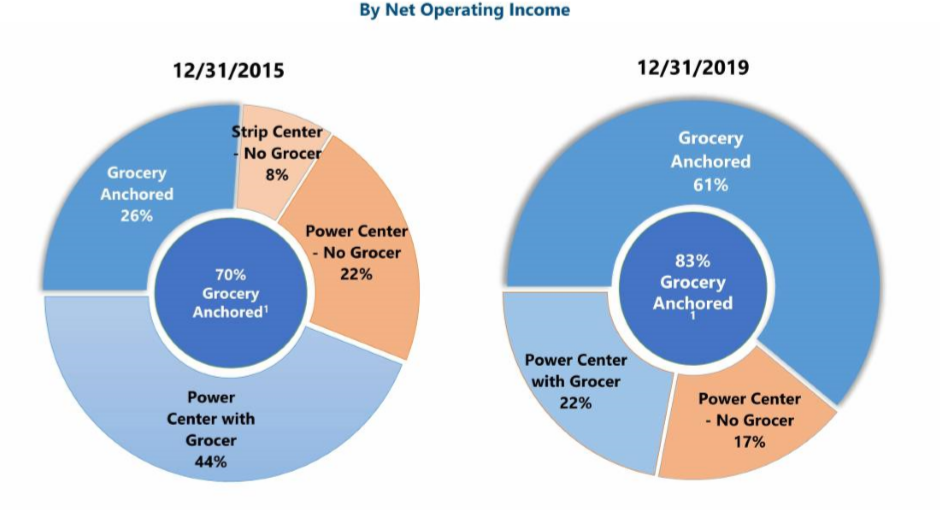

The portfolio focuses on centers containing top grocers in every market with the main component driving foot traffic and customers to the center. Recently, property values for grocery-anchored centers have been more stable than other retail assets. Since year-end 2015, the Company has increased net operating income through grocery-anchored properties by 35%:

Recent acquisitions include:

• Southern Palm Crossing in Royal Palm Beach, FL

· Annualized base rent per SF = $21.45

· Costco anchored

· 95% occupied

· 3-mile avg. household income = $103,700

· 3-mile population = 76,000

• Eldorado Marketplace in Frisco, TX

· Annualized base rent per SF = $22.01

· Market Street anchored

· 97% occupied

· 3-mile avg. household income = $155,700

· 3-mile population = 74,400

• Travilah Square in Rockville, MD

· Annualized base rent per SF = $47.78

· Trader Joe’s anchored

· 78% occupied

· 3-mile avg. household income = $162,000

· 3-mile population = 115,800

The goal for the final “G” is to maximize growth potential of an asset through leasing, redevelopment, and expense management. Increased income from assets will lead to increased distributions and value for shareholders.

For more information about InvenTrust Properties Corp., visit https://www.inventrustproperties.com/.

Source: InvenTrust Properties Corp.