Black Creek’s Nontraded REITs Perform in First Half of 2020

July 16, 2020 | James Sprow | Blue Vault

Despite the challenges presented by COVID-19 in the commercial real estate market, the two nontraded REITs advised by Black Creek Group have performed consistently. Both Black Creek Industrial REIT IV, Inc. and Black Creek Diversified Property Trust, Inc. have maintained their monthly distribution rates, and while there have been minor fluctuations in their estimated net asset values per share (NAVs) the overall change in those valuations over the first six months of 2020 have been relatively insignificant, especially against the backdrop of volatility in the traded REIT markets.

Despite the challenges presented by COVID-19 in the commercial real estate market, the two nontraded REITs advised by Black Creek Group have performed consistently. Both Black Creek Industrial REIT IV, Inc. and Black Creek Diversified Property Trust, Inc. have maintained their monthly distribution rates, and while there have been minor fluctuations in their estimated net asset values per share (NAVs) the overall change in those valuations over the first six months of 2020 have been relatively insignificant, especially against the backdrop of volatility in the traded REIT markets.

Both of the REITs are offered on a continuous basis. Black Creek Diversified Property Trust is designed as a perpetual REIT, while the offering by Black Creek Industrial REIT IV may have an eventual full-cycle liquidity event. Industrial Property Trust, Inc., another nontraded REIT program sponsored by Black Creek sold most of its industrial portfolio to Prologis in January, netting investors a very impressive capital gain. That REIT still has a small portfolio of properties that have yet to be liquidated, held in a liquidating trust.

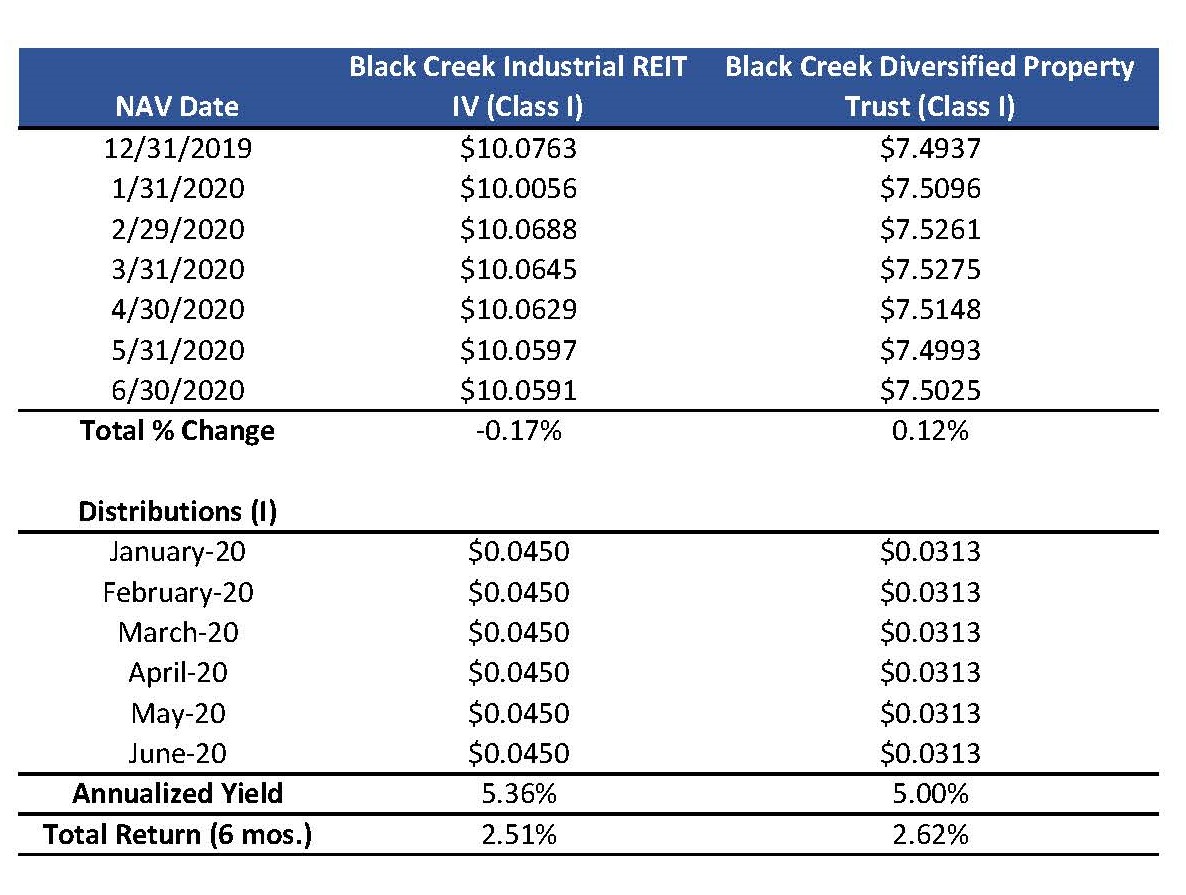

Below is a table that shows the monthly estimated NAVs for each REIT, and the monthly distributions paid, as well as an estimate of the total change in values per share (based on the Class I shares for each REIT) and the distribution yields based upon the 12/31/2019 NAVs per share.

Source: SEC