Hines Global REIT’s Liquidating Trust to Sell London Office Property

July 27, 2020

On July 24, 2020, Global REIT Cabot Square Holdco S.À R.L. (the “Seller”), a subsidiary of HGR Liquidating Trust, entered into a sale and purchase agreement with Cabot (HK) Limited, (the “Purchaser”) pursuant to which the Seller will sell to the purchaser all of its interests in its wholly-owned subsidiaries that own 25 Cabot Square. 25 Cabot Square is a 17-story Class A office building located in Canary Wharf in London, England.

The contract sales price for 25 Cabot Square is expected to be approximately £380.0 million (approximately $482.6 million), exclusive of transaction costs, rent free adjustments (in respect of units which are currently under rent free periods) and closing prorations. The Purchaser funded an earnest money deposit of HK $375.0 million Hong Kong Dollars (approximately $48.4 million), which is expected to be refunded to the Purchaser at closing. Additionally, the Purchaser may be entitled to a return of its earnest money deposit if the Contract is validly terminated in accordance with the terms in the Contract. HGR Liquidating Trust expects the closing of this sale to occur in August 2020. There is no guarantee that this sale will be consummated on the terms described herein or at all.

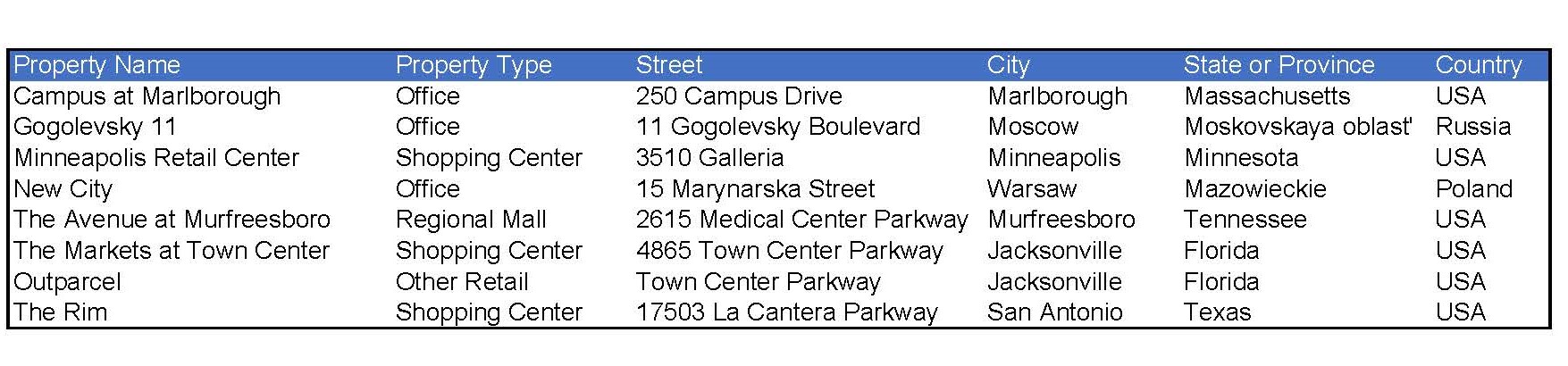

According to S&P Global Market Intelligence, the 25 Cabot Square property was purchased in March 2014 for approximately $371.7 million. The property consists of 477,485 square feet and was 99% occupied as of March 31, 2020. The REIT, which is in the liquidation phase, has eight other properties in its remaining portfolio. Interestingly, among the properties is the Minneapolis Retail Center, a shopping center in downtown Minneapolis that was rocked by rioting earlier in 2020.

Sources: SEC, S&P Global Market Intelligence