James Sprow | Blue Vault

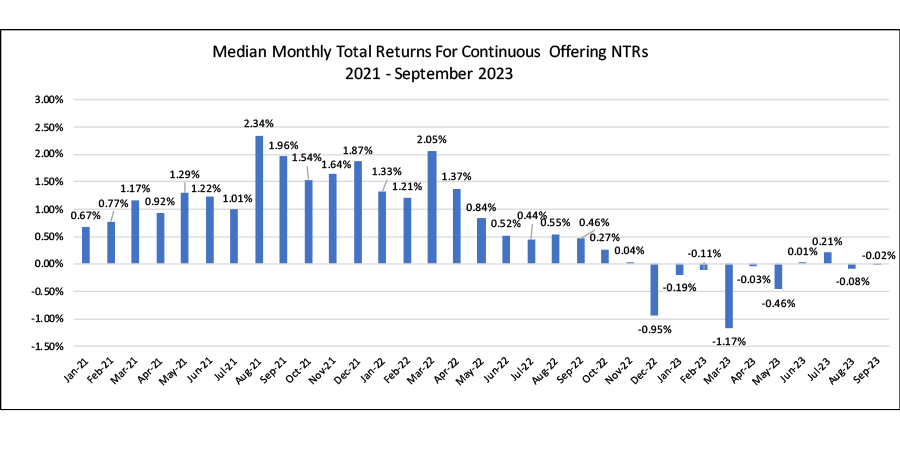

The median monthly total return for sixteen continuously offered nontraded REIT programs (“NAV REITs”) was negative 0.02% in September, compared to -0.08% in August. Eight of the 16 reported positive total returns. Over the past 12 months, the median monthly return among the 16 REITs has been positive just four times. Year-to-date in 2023, the median total return for the 16 REITs was negative 3.29%. By contrast, the S&P 500 Index total return over the same nine-month period was 13.06% and the NAREIT All Equity REIT Index total return was negative 5.62%

Chart 1

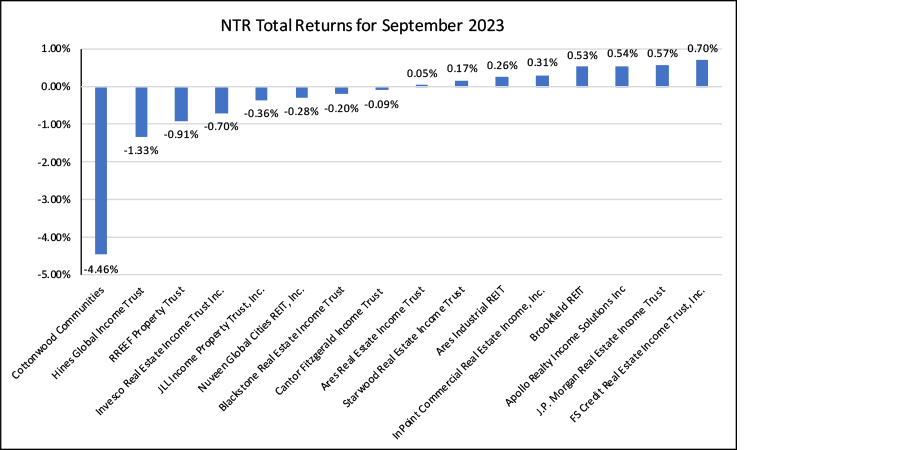

The eight nontraded REITs that posted positive total returns in September were one more than did in August. The highest monthly total return in September was posted by FS Credit Real Estate Income Trust at 0.70%. J. P. Morgan REIT was next with a positive return of 0.57%. Apollo Realty Income Solutions ranked third with a total return of 0.54%. Brookfield REIT had the fourth largest total return at 0.53%, followed by InPoint Commercial Real Estate Income with a total return for September of 0.31%. Both FS Credit REIT and InPoint CRE Income invest in real estate debt rather than real properties.

Cottonwood Communities had a negative total return in September of -4.46%. Hines Global Income Trust had a negative return of -1.33%. RREEF Property Trust’s total return was negative 0.91%.

The median distribution yield for the 16 REITs was 5.26% as of September 30, 2023.

Chart II

The following chart shows the contribution that monthly changes in per share net asset values (NAVs) make to the total returns. In calculating monthly total returns, the monthly distribution rate is added to the change in NAVs to arrive at an estimated total return.

Chart III

Lower Volatility for Nontraded REIT NAVs and Total Returns

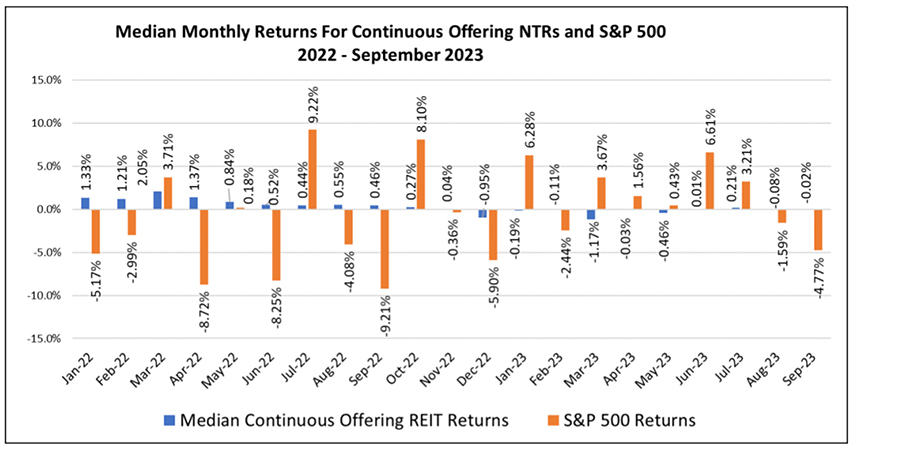

The favorable comparison in the relative volatility of the NAV REIT monthly returns is revealed when plotting the total returns of those REITs with the S&P 500 Index in Chart IV. The S&P 500 Index had a total of 11 months in which returns were negative over the last 21 months while the nontraded REITs had only seven.

Chart IV

Investors who consider the risk vs. return data will appreciate the favorable trade-off found in nontraded REITs with their average standard deviation of monthly total returns at 0.99% compared to the much higher standard deviation of the S&P 500 Index returns at 5.66% over the last 45 months. The average monthly return for the 11 REITs with monthly return data over 45 months was 0.72% compared to that of the S&P 500 Index at 0.77%. This comparison implies that nontraded REITs have much less risk but also have offered just slightly lower (0.05%) monthly average returns compared to those of listed common stocks.

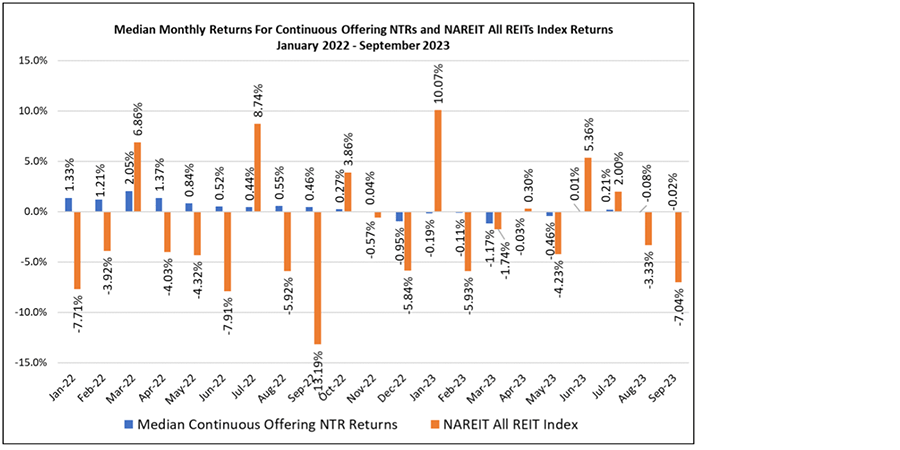

The scatter plot in Chart V illustrates the much lower risk represented by the continuously offered nontraded REIT returns when compared to both the monthly returns of the S&P 500 Index and the NAREIT All Equity REIT Index. Both indices made up of listed common stocks have much higher standard deviations, roughly four times that of the nontraded REITs.

Chart V

The monthly returns for NAV REITs compared very favorably to those of the listed REITs represented in the NAREIT All Equity REITs Index. Chart V shows that the listed REITs had more volatility than the S&P 500 Index and a lower average rate of return over the last 45 months. Since January 2020, the listed REITs have had negative total returns in 21 of 45 months. Since January 2020, the standard deviation of monthly total returns for the listed REITs index was 6.42% while the average monthly return of 0.13% was negative 1.50% when annualized.

The correlations over 45 months of total returns between the median returns for the nontraded REITs and the S&P 500 listed stocks index was just 0.118, which implies potential benefits for risk reduction in a portfolio combining the REITs with listed stocks. Surprisingly, the correlation between the nontraded REIT returns and returns on the NAREIT All Equity REITs Index of listed REITs was just 0.308, implying that the nontraded continuously offered REITs offer diversification benefits in a portfolio of listed REITs as well.

Chart VI

Trends in Total Returns to NAV REITs Since January 2022

Chart VII vividly illustrates the decline in monthly total returns posted by the five largest NAV REITs. Beginning in June 2022, after a strong beginning to 2022, the REITs had modest monthly returns through October, but negative returns began to emerge in November and continued through January 2023. February began an upward trend in NAVs for these REITs that we thought might continue. Unfortunately, the results in March did not support that hope. May returns were encouraging for Blackstone REIT (+0.67%) and Starwood REIT (+0.45). Both REITs had positive total returns with small increases in their NAVs. A surprisingly negative total return for Ares Industrial REIT, one of the top total return performers in 2022, was due to a 3.3% drop in its Class I NAV per share, from $14.91 in April to $14.44 as of June 30, 2023. YTD in 2023 thru September, the REIT has a total return of -7.48%. Blackstone REIT has been the star performer among the nontraded REITs with YTD total returns of 3.28%.

Chart VII

Sources: Blue Vault, Individual REIT Websites, S&P 500, NAREIT, SEC

Sources: Blue Vault, Individual REIT Websites, S&P 500, NAREIT, SEC