James Sprow | Blue Vault

Certainly, one of the greatest concerns hanging over the commercial real estate sector is the need for refinancing property-related debt in a high interest rate environment. With 10-year bond yields hitting 5% for the first time since shortly before the beginning of the major recession that began in 2008, it is obvious that REITs that must refinance their debt in the next 18 months are facing significantly higher interest expense.

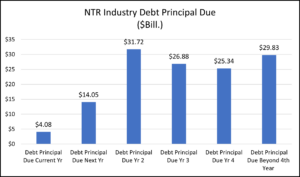

In the chart below, we illustrate the NTR debt that is maturing over future years, beginning with the balance of 2023 and out beyond Year 4. Fortunately for the industry, only 3.1% of the industry’s total outstanding debt principal was due in the final two quarters of 2023. About 10.7% was due in 2024. The $31.7 billion due in 2025 represented 24.0% of the industry total. Of course, much of the industry’s debt is currently hedged with swaps or caps to convert variable rate debt into effectively fixed rate debt. As of June 30, 2023, approximately 76% of the industry’s total debt was at fixed rates, considering hedging contracts. But these hedging methods that fix rates are of limited duration and are not going to help when debt contracts must be refinanced.

As of June 30, 2023, the weighted average interest rate on all NTR debt was 4.34%. As a benchmark, the rate on 30-year mortgages recently reached 8.20%, up about 5.17% over the last three years. The yield on fixed rate MBS was most recently 5.90%. These recent rates indicate that nontraded REITs seeking to refinance the debt principal are looking at significant rate increases on their borrowings.

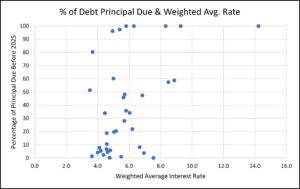

The following chart shows the nontraded REITs plotted by their weighted average interest rates on the X-axis and the percentage of their debt that is due before 2025 on the vertical Y-axis. As one might expect, the seven nontraded REITs with the highest percentage of their debt due before 2025 also had their weighted average interest rates above the industry average. These REITs are using lines of credit and short-term debt contracts and are most vulnerable to interest rate increases. The 13 nontraded REITs that have less than 10% of their outstanding debt principal due before 2025 also appear to have weighted average interest rates below or near the industry average 4.34%.

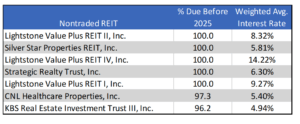

Below are seven nontraded REIT programs with the highest percentage of their debt principal that is due before 2025 and their weighted average cost of debt as of June 30, 2023. These REITs may have significant challenges refinancing their borrowings.

Sources: SEC, Blue Vault