S&P Global Market Intelligence

The manageable debt and quality assets are cushioning listed office real estate investment trusts in the US against the elevated interest rate environment.

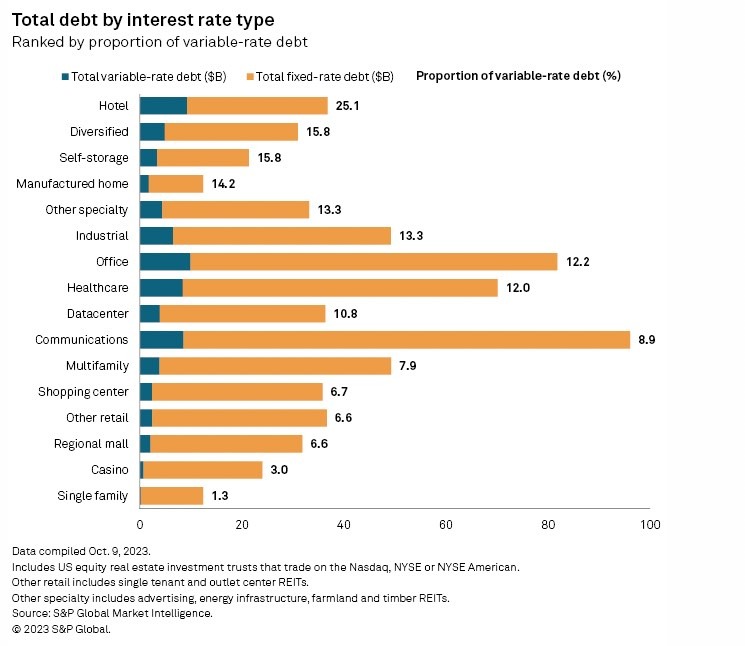

Public office REITs had total debt of $81.69 billion as of the end of the second quarter, 87.8% of which has a fixed rate, according to S&P Global Market Intelligence data.

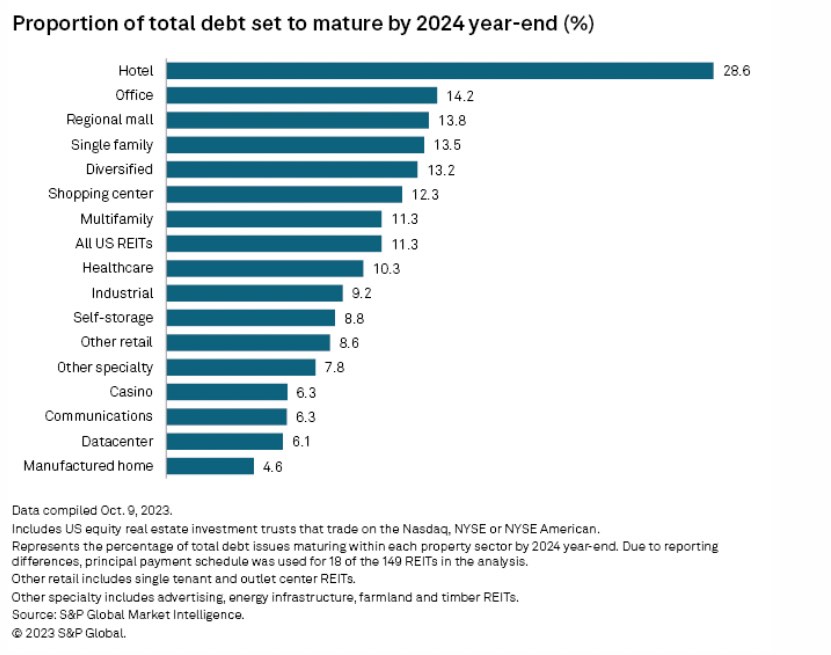

Close to half of the total office REIT debt has a maturity of 2028 or later, while only 14.2% will mature by the end of 2024.

“What we’ve seen is that the whole story on the office sector hasn’t always been told. Office REITs continue to have well-structured debt,” Edward Pierzak, senior vice president of research at National Association Of Real Estate Investment Trusts Inc. (Nareit), told Market Intelligence in an emailed response.

According to Nareit data, listed office REITs’ weighted average interest rate on total debt was 4%, and the weighted average term to maturity of debt was nearly seven years.

Office REITs have not taken on significant leverage, said Sher Hafeez, managing director at JLL Securities. “They are (as typical of public REITs) mostly unsecured issuers, except for a couple of specific cases, not significant debt maturity and have most of their debt fixed for the long term.”

Aside from their manageable debt position, office REITs also own some of the better assets, given the repositioning efforts undertaken to upgrade portfolios over the last few years, Hafeez said.

While the office real estate sector in general faces a higher risk of loan defaults and delinquencies due to declining property valuations and tighter credit conditions, demand for quality office spaces remains intact.

“It’s critical to acknowledge that office performance has been bifurcated. Newer, highly amenitized properties are doing well, and REITs own a lot of these properties,” Pierzak said.

Unlike publicly listed companies, which have low leverage and access to various capital sources, private office companies with lower-quality assets are expected to have a hard time dealing with their debt.

“Private market players … [are] kind of beholden to the secured borrowing market. It’s expensive and tough right now, especially if you’re a borrower that has heavily relied on the regional bank market,” Jonathan Miniman, global portfolio manager at CBRE Investment Management Listed Real Assets, told Market Intelligence in an interview.

“In a lot of cases, you’re just going to see a lot of keys being handed back to the banks. … But as a borrower, that’s the beauty of nonrecourse [debt]. You can just send the keys back and you wipe your hands of the asset.”