Jay Serpe | J.P. Morgan Wealth Management

By almost any definition, 2023 proved to be the year of the “everything” rally.

The U.S. stock market soared, with the S&P 500 returning more than 26% for the year, and bonds made a remarkable comeback. The catalyst for this unexpected shift? Lower inflation, a surprisingly resilient U.S. economy and the prospect of easier monetary policy and declining interest rates in the months to come.

Looking ahead, we believe private markets have the potential to deliver competitive returns versus public markets, as well as diversification benefits. And, given the current interest rate headwinds, we think private credit may be a strategy to explore. Investors should consider the risks, particularly liquidity risks, associated with private markets, however, and be prepared to gauge their potential impact on their portfolio.

Here, we look across the landscape of alternatives strategies and ideas for 2024: private equity, private credit, real estate, infrastructure and secondary strategies.

Private equity: In a world of opportunity, the potential to access sources of growth

Over multi-year time horizons, private equity has a historical track record of delivering returns and outperformance versus public markets – irrespective of economic booms and busts.1

The post-pandemic global interest rate reset, however, has proven challenging. Higher interest rates have meant a higher cost of leverage for private equity managers – creating a headwind to achieving target returns. Investors need to be mindful, now, of the balance between access to secular growth opportunities – such as those arising from artificial intelligence (AI), health care, security and fintech – and the leverage that may be embedded in them.

We see a sweet spot for private equity managers that use less leverage and focus their strategies on high quality companies that demonstrate durable growth. These managers often don’t need to rely heavily on rate-sensitive financing to take advantage of powerful thematic growth drivers.

Private credit: Stepping in, when capital is scarce, to provide financing

After the regional bank crisis of 2023, many financial institutions stepped back from the lending business, cutting their balance sheet exposure and tightening their lending standards. As a result, businesses in need of new financing are facing greater difficulty in securing capital: Bank lending has waned and public market debt issuance is still low, even though it is beginning to come back to life.

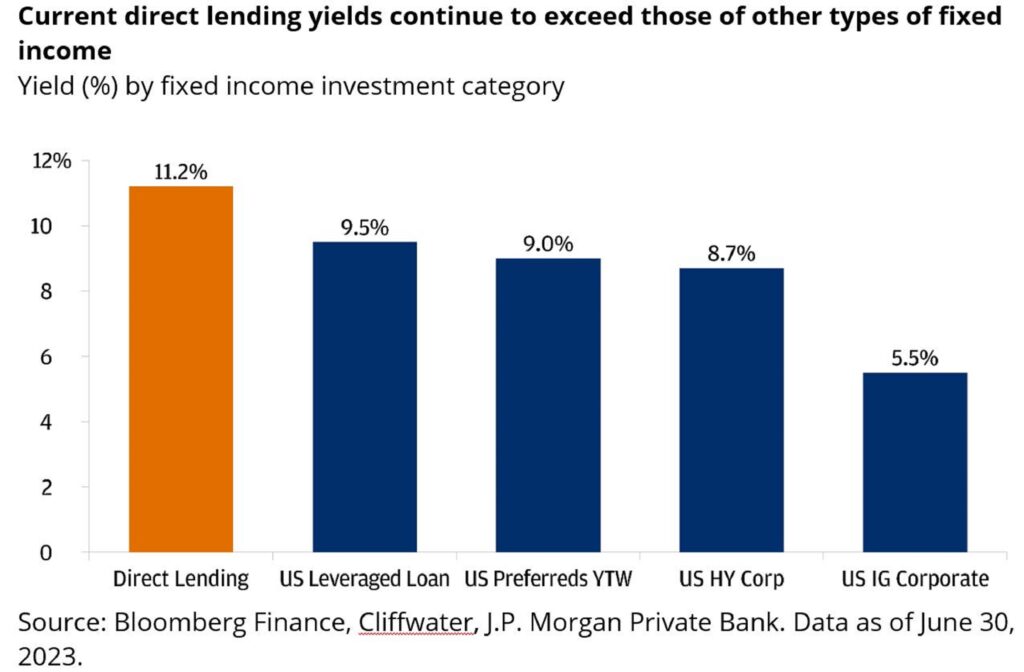

For private credit managers, however, the prevailing market environment offers increasing opportunities to step in and provide access to capital. Today’s elevated base rates have translated into higher yields for investors (see below), and the industry’s use of more protective loan covenants may provide greater investment security relative to other types of fixed income.

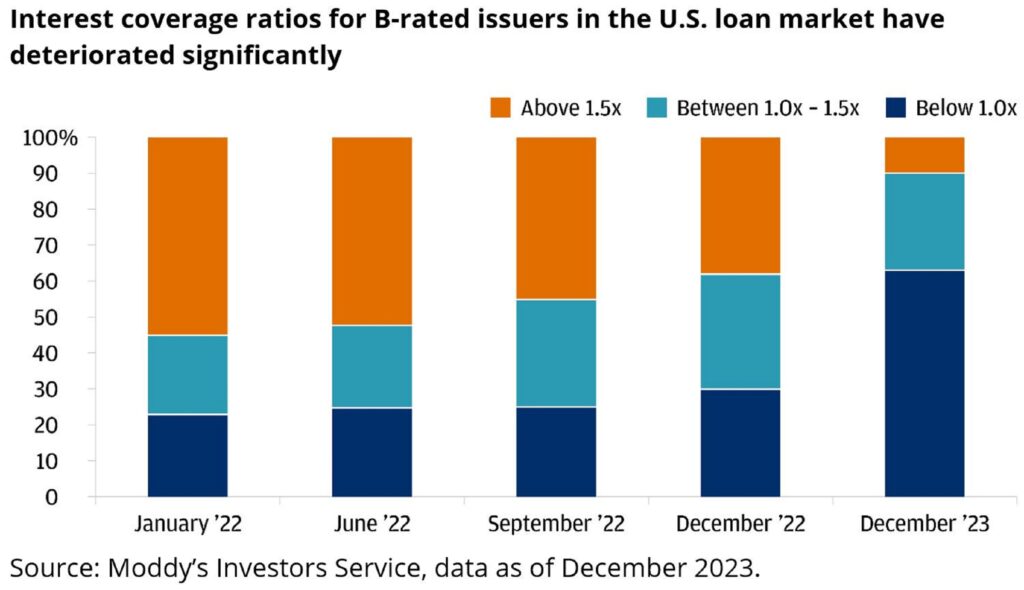

Similarly, companies with floating rate debt are also feeling the squeeze of higher costs, and signs of stress are beginning to emerge in the leveraged loan market (see below). Experienced fund managers may be well positioned this year to benefit from any resulting dislocations.