American Healthcare REIT, Inc.

American Healthcare REIT, Inc. (the “Company,” “we,” “our,” or “us”) (NYSE: AHR) announced today its first quarter 2024 results.

Key Highlights:

•Reported GAAP net loss attributable to common stockholders of $(0.04) per basic and diluted share for the three months ended March 31, 2024.

•Reported Normalized Funds from Operations attributable to common stockholders (“NFFO”) of $0.30 per basic and diluted share for the three months ended March 31, 2024.

•Achieved 7.1% total portfolio Same-Store (“SS”) revenue growth for the three months ended March 31, 2024 compared to the same period in 2023, largely driven by improved performance in the Company’s RIDEA-operated assets.

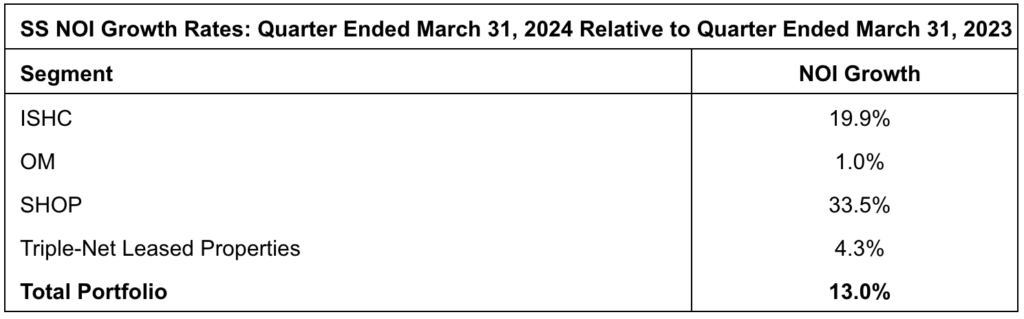

•Achieved total portfolio Same-Store Net Operating Income (“NOI”) growth of 13.0% for the three months ended March 31, 2024 compared to the same period in 2023, highlighted by 33.5% and 19.9% Same-Store NOI growth from its senior housing operating properties (“SHOP”) and integrated senior health campuses (“ISHC”), respectively.

•Disposed of approximately $15.6 million of Non-Core Properties across the Company’s outpatient medical (“OM”) and SHOP segments.

•Acquired a 14-property portfolio in Oregon for approximately $94.5 million that is managed by Compass Senior Living in a RIDEA structure.

•Completed a public offering of 64.4 million shares of its common stock priced at a public offering price of $12.00 per share and listed such common stock on the New York Stock Exchange (“NYSE”) under the symbol “AHR”.

•Paid down approximately $721.5 million of outstanding debt obligations carrying a weighted average interest rate of approximately 7.5%, substantially improving leverage metrics and providing the Company with additional borrowing capacity and flexibility.

“After completing our offering and listing event in February, our main focus is on delivering strong operating performance across our property segments. The year is off to a solid start, as we captured outsized growth within our RIDEA-operated assets due to the supply-demand imbalance present in the senior housing industry. Our assets are well positioned and staffed appropriately to capitalize on further near-term demand tailwinds, which we believe will drive additional occupancy gains and rate growth,” said Danny Prosky, the Company’s President and Chief Executive Officer.

First Quarter 2024 Results

The Company’s active asset management continues to strengthen top-line growth, in addition to effectively managing controllable expenses. In aggregate, NOI growth remains on track to achieve the growth contemplated within the Company’s 2024 total portfolio Same-Store NOI growth guidance range.

“Our hands-on active asset management approach is proving its merits, as evidenced by the stellar performance of our recently acquired Oregon portfolio. After only two months of owning and operating the portfolio, with Compass Senior Living as our operating partner, the properties have meaningfully improved bottom-line performance and, while still early, are trending ahead of our initial expectations,” said Gabe Willhite, the Company’s Chief Operating Officer.

Full Year 2024 Guidance

The Company’s following guidance ranges for the year ending December 31, 2024, originally announced on March 21, 2024 in the Company’s Fourth Quarter 2023 Earnings Release, remain unchanged:

Certain of the assumptions underlying the Company’s 2024 guidance can be found within the Non-GAAP reconciliations in this earnings release and in the appendix of the Company’s First Quarter 2024 Supplemental Financial Information (“Supplemental”). A reconciliation of Net Loss calculated in accordance with GAAP to NAREIT FFO and NFFO can be found within the Non-GAAP reconciliations in this earnings release. Non-GAAP financial measures and other terms, as used in this earnings release, are also defined and further explained in the Supplemental. The Company does not provide guidance for the most comparable GAAP financial measures of total revenues and property operating and maintenance expenses. Additionally, a reconciliation of the forward-looking non-GAAP financial measures of Same-Store NOI growth to the comparable GAAP financial measures cannot be provided without unreasonable effort because the Company is unable to reasonably predict certain items contained in the GAAP measures, including non-recurring and infrequent items that are not indicative of the Company’s ongoing operations. Such items include, but are not limited to, impairment on depreciated real estate assets, net (gain)/loss on sale of previously depreciated real estate assets, stock-based compensation, casualty loss, non-Same-Store revenues, and non-Same-Store operating expenses. These items are uncertain, depend on various factors, and could have a material impact on the Company’s GAAP results for the guidance period.

Transaction Activity

As previously announced, on February 1, 2024, the Company acquired a senior housing portfolio in Oregon consisting of 856 beds across 14 properties. The total consideration consisted of approximately $94.5 million of assumed debt, plus closing costs, reflecting a price per bed of approximately $110,000. The assumed debt has a fixed interest rate of 4.54% and matures on January 1, 2028. The portfolio is managed by Compass Senior Living through a RIDEA structure. The Company has a longstanding relationship with Compass Senior Living as a tenant in its triple-net leased properties segment and recognized the strength of the operator through the COVID-19 pandemic. The management agreement is the Company’s first RIDEA structure with Compass Senior Living, expanding the Company’s high-quality operator relationships.

Additionally, during the three months ended March 31, 2024, the Company disposed of two Non-Core OM buildings and one Non-Core SHOP facility for approximately $15.6 million in aggregate gross proceeds, of which $11 million was previously announced.

Subsequent to quarter end, through the Company’s Trilogy REIT Holdings investment, the Company redeemed all the remaining equity interests in Trilogy owned by members of Trilogy management and certain members of Trilogy’s advisory committee. As a result, as of April 15, 2024, the Company owns 76% of Trilogy. As previously reported, the Company also has an option to purchase the remaining 24% of Trilogy that is owned by a joint venture partner until September 30, 2025 at a predetermined price.

Capital Markets and Balance Sheet Activity

As previously announced, during the three months ended March 31, 2024, the Company completed a public offering of 64.4 million shares of its common stock, raising gross offering proceeds of $772.8 million, and listed such common stock on the NYSE under the symbol “AHR”. During the quarter, the Company paid down approximately $721.5 million of outstanding debt with a weighted average interest rate of approximately 7.5%. This significant reduction in outstanding debt improved the Company’s leverage by meaningfully reducing near-term maturities and high-interest floating-rate debt. Additionally, during the quarter the Company amended its existing credit facility, extending its maturity date and increasing its borrowing capacity to up to $1.15 billion. The credit facility consists of an unsecured revolving credit facility in the initial aggregate amount of $600 million and an unsecured term loan facility in the initial aggregate amount of $550 million. The revolving portion of the credit facility now matures on February 14, 2028, and may be extended for one 12-month period, subject to certain conditions, and the term loan portion of the facility matures on January 19, 2027.

As of March 31, 2024, the Company’s total Pro-Rata indebtedness was $1.75 billion, and the Company had approximately $914.5 million of total consolidated liquidity comprised of cash and undrawn capacity on its lines of credit.

“Utilizing proceeds from our public offering in February, we were able to pay down floating-rate indebtedness, bringing our net-debt-to-Adjusted EBITDA ratio down to 6.4x at the end of the first quarter. We believe that the organic earnings growth embedded in our previously announced Normalized FFO and Same-Store portfolio guidance for the remainder of the year should result in further improvement to our leverage ratios,” said Brian Peay, the Company’s Chief Financial Officer.

Distribution

As previously announced, the Company’s Board of Directors declared a cash distribution for the quarter ended March 31, 2024 of $0.25 per share of its common stock, Class T common stock and Class I common stock. The first quarter distribution was paid in cash on April 19, 2024 to stockholders of record as of March 28, 2024.

Supplemental Information

The Company has disclosed supplemental information regarding its portfolio, financial position and results of operations as of March 31, 2024 and for the quarter then ended and certain other information, which is available on the Company’s website at https://ir.americanhealthcarereit.com.

Conference Call and Webcast Information

The Company will host a webcast and conference call at 1:00 p.m. Eastern Time on May 14, 2024. During the conference call, Company executives will review first quarter 2024 results, discuss recent events and conduct a question-and-answer period.

To join via webcast, investors may use the following link: https://events.q4inc.com/attendee/167736636.

Alternatively, to join via telephone, please pre-register at the following link.

A digital replay of the call will be available on our website at https://ir.americanhealthcarereit.com shortly after the conclusion of the call.

CLICK FOR FULL REPORT WITH BALANCE SHEETS

Forward-Looking Statements

Certain statements contained in this press release, including statements relating to the Company’s expectations regarding its interest expense savings, balance sheet, net income or loss per share, FFO per share, NFFO per share, total portfolio Same-Store NOI growth, segment-level Same-Store NOI growth, occupancy, NOI growth, revenue growth, margin expansion and plans for Trilogy may be considered forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. The Company intends for all such forward-looking statements to be covered by the applicable safe harbor provisions for forward-looking statements contained in those acts. Such forward-looking statements generally can be identified by the use of forward-looking terminology, such as “may,” “will,” “can,” “expect,” “intend,” “anticipate,” “estimate,” “believe,” “continue,” “possible,” “initiatives,” “focus,” “seek,” “objective,” “goal,” “strategy,” “plan,” “potential,” “potentially,” “preparing,” “projected,” “future,” “long-term,” “once,” “should,” “could,” “would,” “might,” “uncertainty” or other similar words. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this press release. Any such forward-looking statements are based on current expectations, estimates and projections about the industry and markets in which the Company operates, and beliefs of, and assumptions made by, the Company’s management and involve known and unknown risks and uncertainties that could cause actual results to differ materially from those expressed or implied therein, including, without limitation, risks disclosed in the Company’s periodic reports filed with the Securities and Exchange Commission. Except as required by law, the Company does not undertake any obligation to update or revise any forward-looking statements contained in this release.

Non-GAAP Financial Measures

The Company’s reported results are presented in accordance with GAAP. The Company also discloses the following non-GAAP financial measures: NAREIT FFO, NFFO, NOI, Same-Store NOI, EBITDA and Adjusted EBITDA. The Company believes these non-GAAP financial measures are useful supplemental measures of its operating performance and used by investors and analysts to compare the operating performance of the Company between periods and to other REITs or companies on a consistent basis without having to account for differences caused by unanticipated and/or incalculable items. Definitions of the non-GAAP financial measures used herein and reconciliations to the most directly comparable financial measure calculated in accordance with GAAP can be found at the end of this earnings release.

About American Healthcare REIT, Inc.

American Healthcare REIT, Inc. is a self-managed real estate investment trust that acquires, owns and operates a diversified portfolio of clinical healthcare real estate properties, focusing primarily on outpatient medical buildings, senior housing, skilled nursing facilities and other healthcare-related facilities. Its properties are located in 36 states, the United Kingdom and the Isle of Man. For additional information, please visit www.AmericanHealthcareREIT.com.