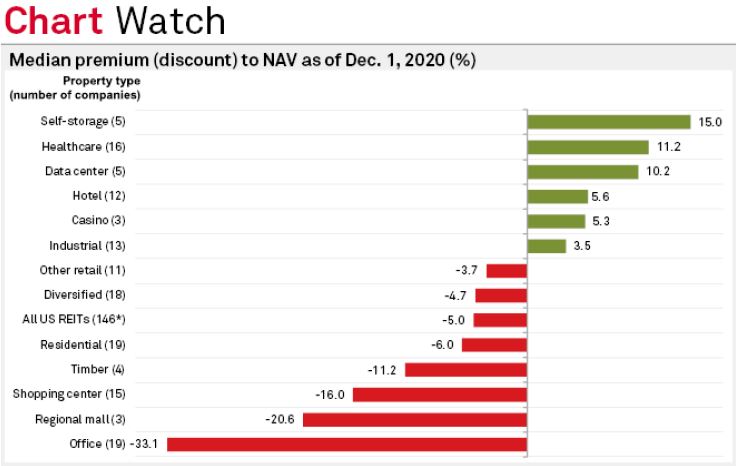

NAV Monitor: US equity REITs trade at median 5% discount to NAV as of Dec. 1

December 3, 2020 | Ronamil Portes | S&P Global Market Intelligence

Publicly traded U.S. equity REITs traded at a median 5.0% discount to their consensus S&P Global MarketIntelligence net asset value per-share estimates as of Dec. 1, a big improvement compared to the 16.7% median discount at which they traded at October-end.

The self-storage sector continued to trade at the largest premium to NAV, at a median 15.0%. Within the self-storage sector, National Storage Affiliates Trust traded at a premium of 34.4%, followed by Extra Space StorageInc. at 24.3% and Life Storage Inc. at 15.0%.

The healthcare sector followed at a median premium of 11.2%, while the data center sector was close behind at 10.2%

On the other hand, office REITs continued to trade at the largest discount to NAV, at a median of 33.1%. The regional mall and shopping center sectors followed closely behind, at median discounts of 20.6% and 16.0%, respectively.