Zach Mersman | Blue Vault

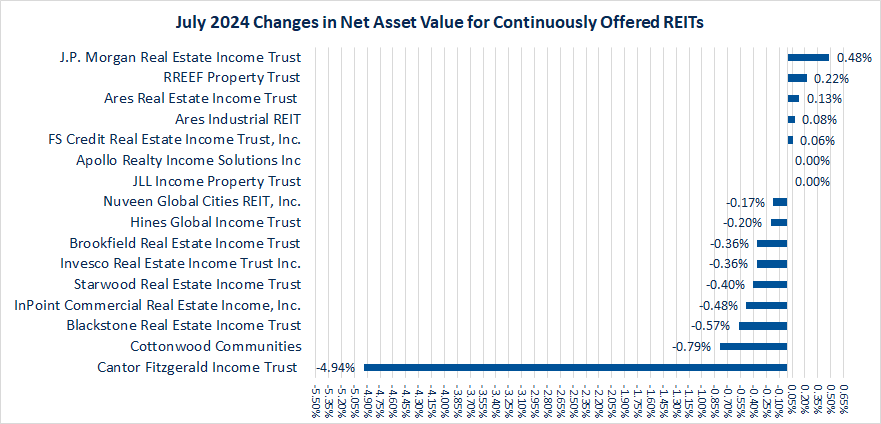

Nine of the sixteen continuously offered nontraded REIT programs reported declines in their Class I NAVs per share in July 2024. Five of the remaining seven REITs reported increases in their Class I NAVs per share. J.P. Morgan Real Estate Income Trust (“J.P. Morgan”) posted the highest positive adjustment at 0.48%. The median monthly change in NAV per share was negative 0.19%. This drop in NAVs per share resulted in a median total return to shareholders of 0.19% for the 14 REITs with available return data (Ares does not make either of their REITs’ return data publicly available). It should also be noted that Blackstone Real Estate Income Trust and Starwood Real Estate Income Trust, which make up approximately 77% (as of Q2 2024) of the total assets for the 16 REITs, experienced a decrease in their NAV per share at negative 0.57% and negative 0.40%, respectively.

Cantor Fitzgerald Income Trust (“Cantor”) suffered the greatest decline in its NAV per share at negative 4.94%. A large reason for this decrease may be due to the increase in debt obligations in the month of July. Over the trailing 12-month period, BV estimated the total return to Cantor Class I shareholders at negative 6.05%, which is an increase from the previous month of negative 8.43%. A contributing factor to this increase is Cantor’s monthly return for July of 0.61%.

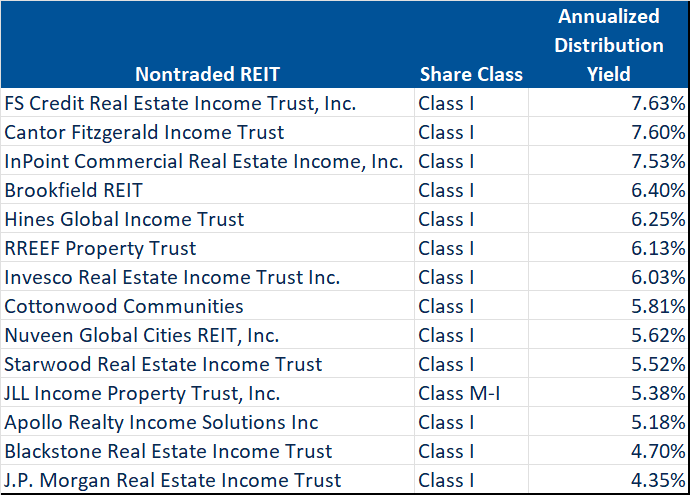

All the NAV REITs were distributing cash to their Class I shareholders at rates above the average dividend yield on the S&P 500 (1.32% as of June 2024) and the NAREIT All Equity REIT Index for listed REITs (3.86% as of July 2024). All NAV REITs had a distribution yield for Class I shares that exceeded the average distribution yield for listed REITs. The median distribution yield for the 14 NTRs was 5.92% as of July 31, 2024. “These distribution rates reinforce one of the primary reasons investors are drawn to alternative investments, recurring income,” said Luke Schmidt, Vice President of Research at Blue Vault. “It’s also no surprise that some of the top distribution rates are coming from REITs that invest in real estate-related debt. Rising interest rates have pushed stronger returns and higher distribution rates for these credit-focused products.”

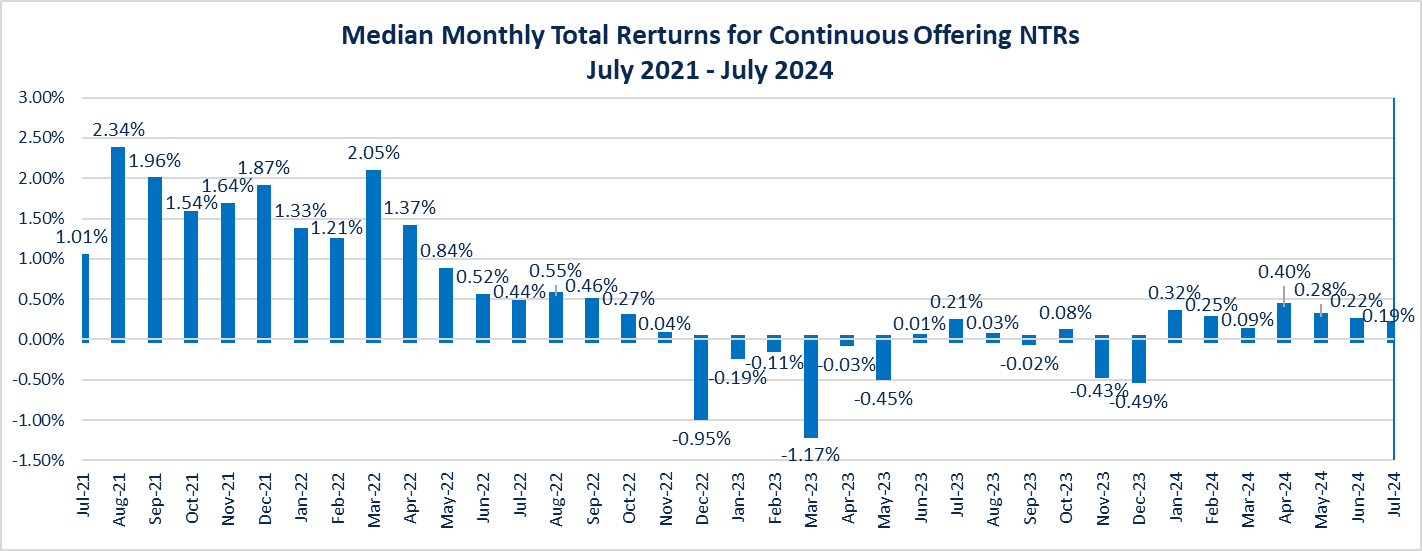

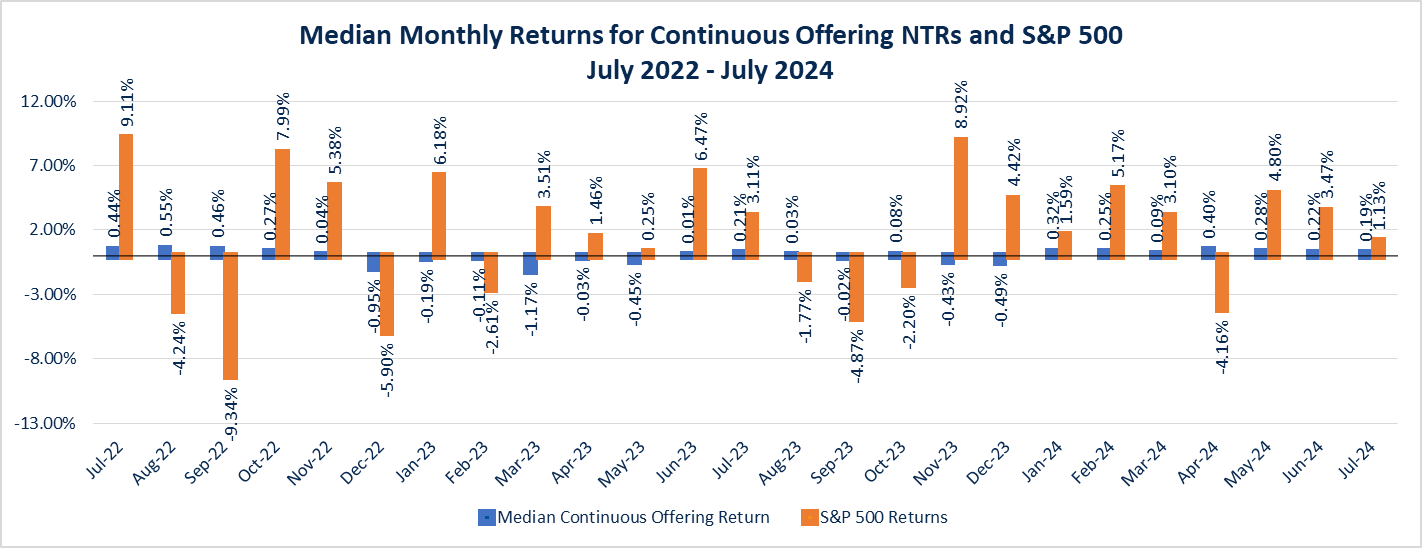

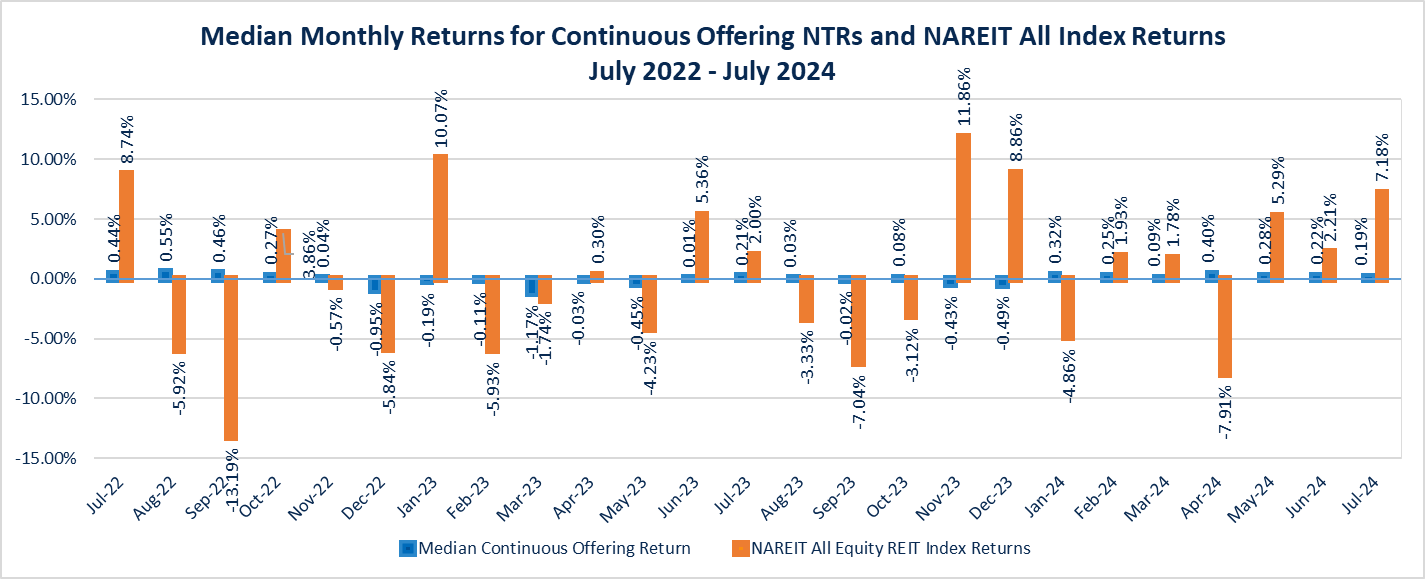

In November 2023, the median monthly total returns for the continuous offering NTRs turned negative for the first time since May 2023 and was negative again in December. Since January 2022, the median total returns for the nontraded REITs were negative nine out of 31 months. The S&P 500 Index had negative total returns for twelve of the 31 months. The listed REIT index had negative total returns in 16 of the 31 months. The median monthly total return for the continuous offering NTRs has been positive in each of the first seven months of 2024 ranging from 0.09% to 0.40%.

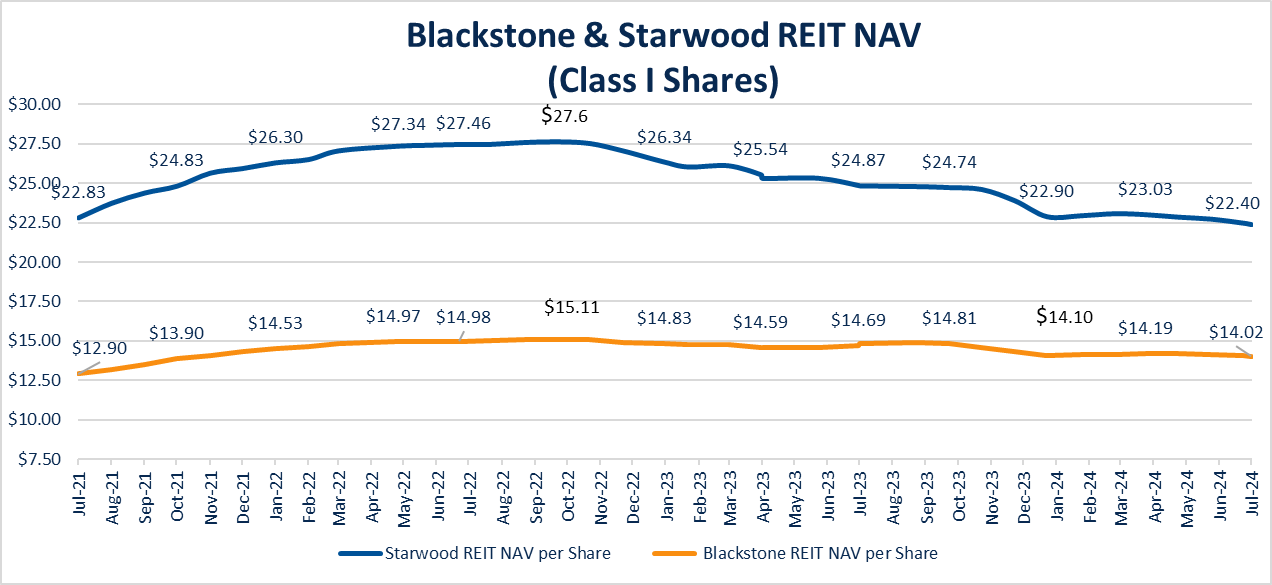

Blackstone REIT posted impressive increases in the net asset values per share from December 2020 until peaking in September 2022. From a high of $15.11 per share for its Class I shares, the REIT suffered decreases in its NAV through 2023, reaching a low for the year of $14.10 in December 2023. From the end of 2023, the NAV peaked at $14.19 in March and April 2024 before dipping below its year end price to $14.02 in July.

While the NAV increased slightly in each of the first three months in 2024, (representing the first increases since August 2023), the NAV decreased by 1.20% from April to July in 2024. As the largest nontraded REIT by far, with over $55.9 billion in cumulative net asset value as of July 31, 2024, Blackstone REIT’s valuations may be indicative of the trend across the sixteen continuously offered REITs.

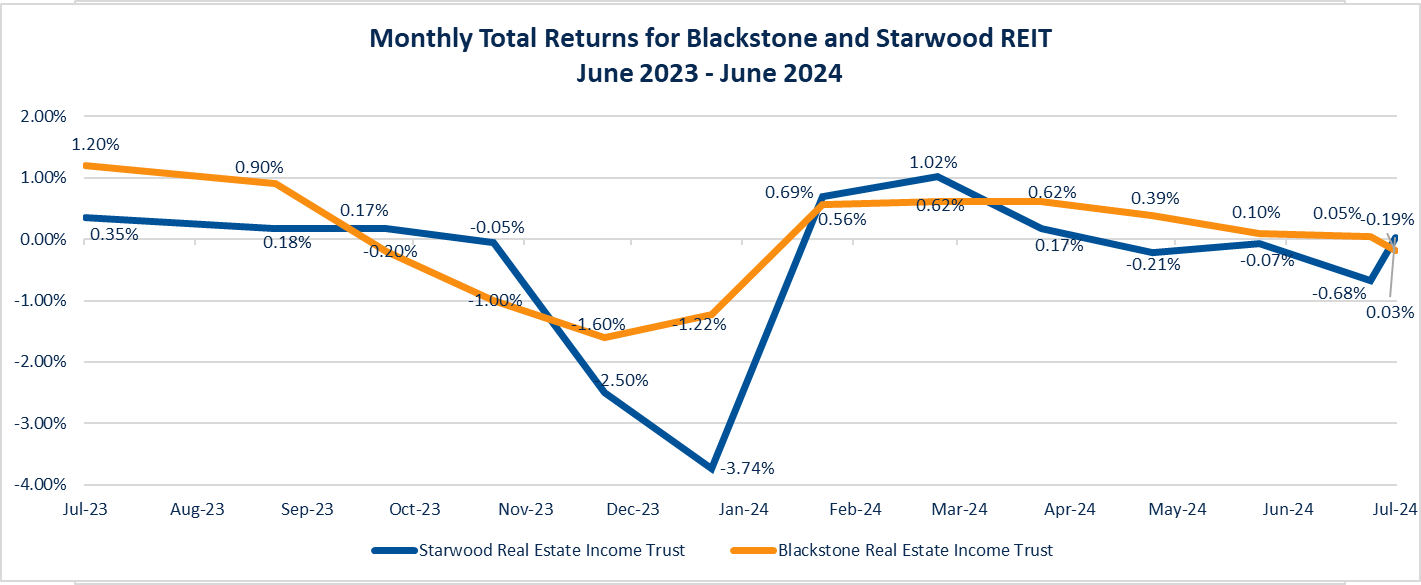

Starwood REIT, with over $9.5 billion in cumulative net asset value as of July 31, 2024, has followed a similar path to Blackstone REIT since 2022. Like Blackstone, Starwood also hit a high in September 2022 at $27.63 followed by a decrease in NAV in 2023. The REIT’s NAV per share has declined by 2.44% since the beginning of 2024 and 9.86% since July 2023. Comparatively, Blackstone REIT’s NAV has dropped 5.33% since July 2023. The resulting total returns for Starwood REIT and Blackstone REIT, offset by their distributions during the quarter, are shown below.

Blue Vault members may sign in to view full reports or individual pages in the Research Portal. If you are not a member, click here to see our Membership options.

Links to Blue Vault’s Classic PDFs are located in the Review and analyze fund performance section.