Blue Vault

Media outlets today tend to lean towards the negative as human evolution has created a bias and higher consumption rate for negative headlines, and many studies have concluded that “negative news sells.” This all-too-familiar approach has come to lay bare with the media’s recent attention on the limit (or cap) on the monthly or quarterly liquidity provisions — typically capped at between 2-5% of outstanding shares per month or quarter — with many popular semi-liquid alternative investment structures. These limits have come into play during the current market correction cycle, which began in early 2022 with the commencement of the Federal Reserve’s unprecedented hike in the Fed Fund rate. It marked the quickest and sharpest increase in over 40 years, rising from 0% to 5.5% in just 16 months to help curb runaway inflation.

This sharp increase in borrowing rates sent shockwaves through public and private markets and prompted many investors to seek liquidity from their semi-liquid alternative investments, including real estate investment trusts (REITs), business development companies (BDCs), and interval funds. These vehicles invest in a multitude of alternative asset classes and are structured to provide access to previously illiquid assets with low minimum investments and frequent liquidity options.

In fact, there has been unprecedented retail investor demand for semi-liquid alternative investment structures due to their historical ability to provide attractive tax-efficient income returns, broader portfolio diversification, and lower correlation and volatility to the broader markets.

A recent study by CAIS-Mercer in 2023 noted more than three-quarters of advisors surveyed — 78% of them — felt that access to alternatives helps their clients meet their goals and objectives. In Cerulli Associates’ recent U.S. Alternative Investments 2024 report, which examined the overall state of alternative investments in the wealth channel, they forecast semi-liquid alternatives growing from $1.4 trillion today to $2.5 trillion by the end of 2028.

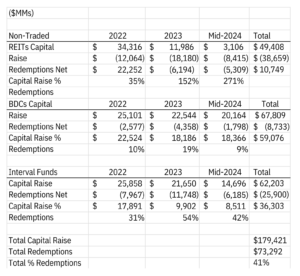

So, with semi-liquid alternatives gaining an increasing allocation in portfolios, what level of liquidity should investors expect should they need it? Turns out, these structures were able to provide a significant amount of liquidity — more than $73 billion of the $179 billion raised (41%) from 2022 to mid-2024. The following table provides a breakdown by investment structure:

Shareholder Redemptions as a % of Capital Raised (2022-Mid-2024)

Source: Blue Vault Partners

In fact, nearly all asset managers within these popular investment structures were able to provide significant, and in many cases full, redemption of shares requested by shareholders in each of the respective redemption windows (typically monthly or quarterly) over this period.

So why, then, do these semi-liquid alternative investment programs place governors or restrictions on the periodic redemption rights of shareholders? The answer should not be surprising to most and are somewhat interrelated to each other.

First, these companies often invest in illiquid asset classes such as real assets and other non-traded or less broadly syndicated asset classes, which allow them to perform very distinctly from freely traded securities. However, the time required to sell assets to meet redemption requests may be longer, and selling assets in a time of market distress may result in losses that could otherwise likely be avoided with patience.

Second, the limit on redemptions provides a proper management tool for the portfolio managers as they seek to balance new capital inflows, capital being placed into new investments while also allowing for share redemptions.

Finally, the limit on redemptions, which at peak levels during this current cycle reached 5-10-15-20% of outstanding shares across these programs, allowed portfolio managers to make sound investment decisions for the vast majority of the shareholders seeking to stay within the investment strategy that has a longer investment horizon or see market disruption as an opportunity for the particular fund manager.

In conclusion, semi-liquid alternative investment programs are doing precisely what they were designed to do — provide better access to highly desirable asset classes at much lower investment thresholds, enhance portfolio diversification and risk-adjusted returns, and provide liquidity options. As such, many advisors are making the smart choice to allocate 10-20% of client portfolios to these and many other alternative investment programs.