Triton Pacific

In the United States, there is a common saying – “As American as apple pie.” Perhaps, however, that phrase should be updated to “As American as fast food.”

Today, the United States eats more fast food than any other country.1 According to a study by the National Center for Health Statistics, 36.6% of American adults consume fast food daily.2 Whether its convenience, rising grocery prices or brand loyalty, America’s fast food consumption seems to be at an all-time high. Along with diners’ growing appetite for fast food consumption, certain investors may have a hunger for fast food – or quick service restaurant (QSR) – investments.

The United States eats more fast food than any other country.1 According to a study by the National Center for Health Statistics, 36.6% of American adults consume fast food daily.2

WHAT ARE QUICK SERVICE RESTAURANTS?

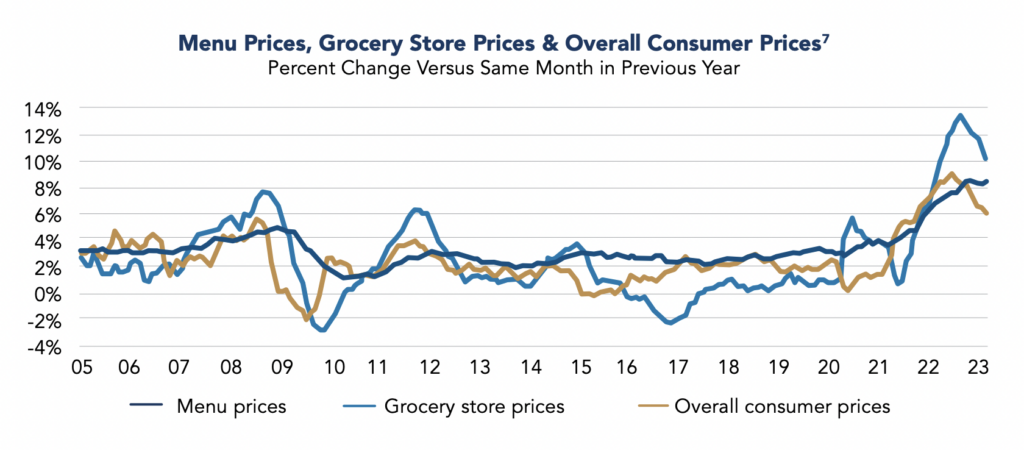

QSRs are typically defined as restaurants with fast service, limited menu options, takeout service and, typically, no table service. Most have drive-thru service, and food cost is normally under $10. Historians generally agree that the first fast food chain to open was White Castle in 1921. Americans found it appealing then for many of the same reasons they find it appealing today – the food was made quickly and in a very systematic way that “fit the tech fascinations of the ‘20s.”3 Today, QSRs are as popular as ever. In 2022, 27% of consumers stated they are eating fast food more often, compared to 2021.4 Additionally, 45% of consumers said they were going to order at least part of their Thanksgiving meal, traditionally the biggest cooking day of the year, from a restaurant.5 All of this could be due, in part, to the fact that, while restaurant food prices have increased, grocery prices have consistently increased more. Between February 2022 and February 2023, the Consumer Price Index Away from Home increased 8.4%, while grocery store prices increased 10.2% during that same time period.6

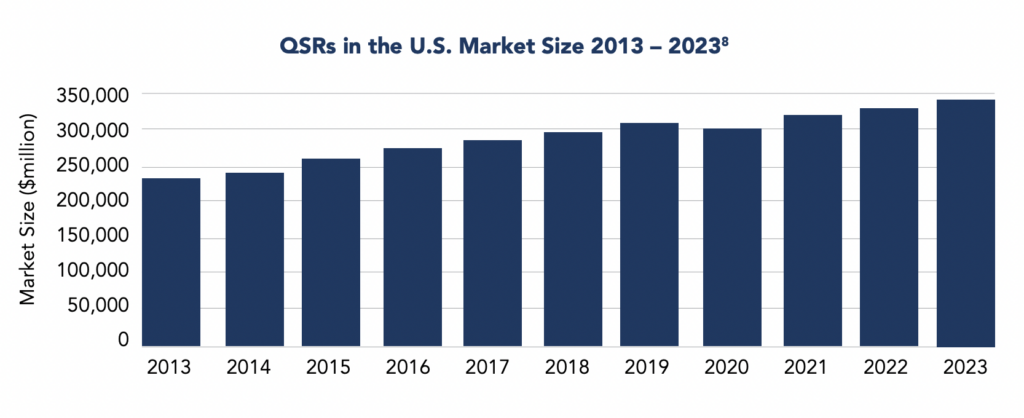

Similarly, QSRs are becoming more ubiquitous. As of January 2023, there were more than 200,000 fast food establishments and over 5 million people employed in the industry.8 Employment growth has increased at a rate of 2.2% since 2018.8 Like employment, market size has increased steadily over the last ten years to a current revenue of $366.9 billion, with a 2.5% annualized growth rate since 2018.8 What does this mean for investors? The opportunity to take part in a growing, often overlooked asset class with several unique advantages.

DELICIOUS TRENDS SHAPING THE INVESTMENT OPPORTUNITY

The growth of the QSR industry has been shaped by several demographic and economic trends. First, many Americans are leading busier lives than ever before. The number of dual income families with children under 18 has risen from 49% in 1970 to 66% in 2019.9 Similarly, with people getting married later in life, the number of one-person households has increased to 29% of all American households, up from 13% in 1960.10 As for one parent family groups, 44% of those have two or more children living with them.9 More Americans are working, and with technology keeping many of those connected to their jobs even after hours, this means less time to cook.

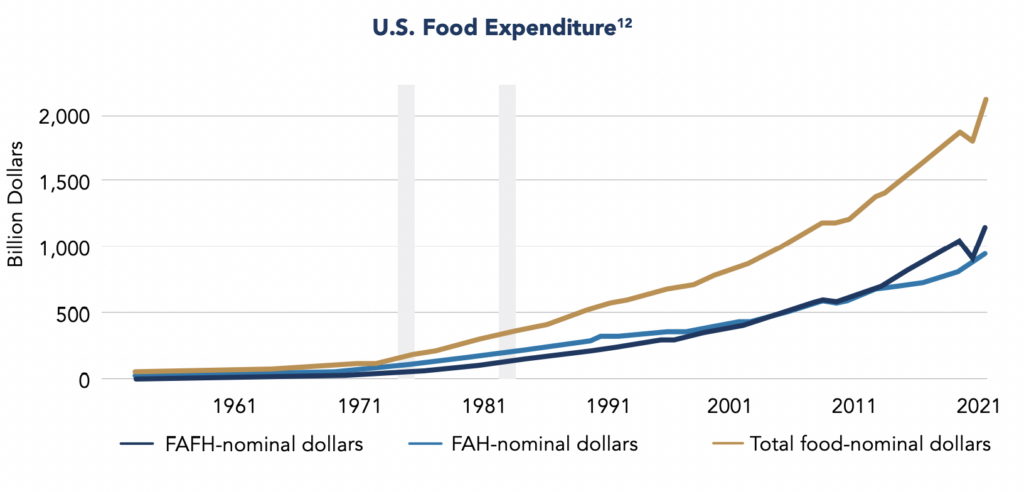

For dual-income families, single parents, and those working long hours, QSRs are often a faster – and less expensive – option than eating at home. As a result, more income has been directed to food away from home (FAFH). In 2021, FAFH expenditure accounted for approximately 55% of the U.S’ total food expenditure, in nominal dollars, up from around 50% in 2011 and around 26% in the 1950s.11

Along with becoming busier, many Americans are also becoming more health-conscious, and QSRs have followed suit. Today, many QSRs offer menu options that are perceived to be healthier, helping them to appeal to a broader market and those potential customers who might not normally eat fast food. Chain restaurants offer options that are allergy friendly or appeal to certain diet trends, such as burgers without buns for the popular “keto” diet. Also, gone are the days of QSRs only serving burgers. Today, there are several fast food segments, including coffee and snacks, seafood, pasta and many more.

To keep reading, download Triton Pacific’s full whitepaper.