An Alternative to Alternative Investments

Article submitted by: Resource

As a financial advisor, your goal is to create a well-balanced, sound portfolio for your clients. To accomplish this, you probably ask yourself many questions, including: How can I diversify the portfolio without sacrificing liquidity?

Liquid alternative investments are emerging as a possible way to address your clients’ needs. Alternative investments may be the answer.

Alternatives versus liquid alternatives

In the wake of the global financial crisis, investors realized that simply having a range of mutual funds with access to different “sectors” may not be enough to create true diversification. Additionally, low interest rates and plummeting bond yields have left investors struggling to generate income. As a result, investors are becoming increasingly interested in alternative investments.

An alternative investment is a type of investment that doesn’t fit into one of the three traditional asset types — stocks, bonds and cash. Alternative investments offer the following potential benefits:

- Income: As a long-term investment, the investor has the potential to earn more income the longer the investment is left alone.

- Diversification: By adding alternative strategies to a traditional portfolio of stocks, bonds, and cash, investors build a more effective and balanced portfolio.¹

- Uncorrelated: Because alternative investments are not traditional stocks or bonds, they do not rise and fall with the broader markets.

Historically, alternative assets were held by institutional investors or accredited, high-net-worth individuals because they require large minimum investments and typically lack liquidity.² In other words, they were not an ideal option for the mainstream retail investor.

Enter liquid alternative investments. Liquid alternative funds deliver alternative investment strategies in an easy-to-use mutual find structure. Liquid alternatives offer liquidity, competitive fees, low investment minimums, a lower bar for investor suitability requirements, increased transparency, and simplified tax reporting.³

The liquid alternative difference

While liquid alternatives were born from alternative investments, there are several key differences worth noting.

On the rise

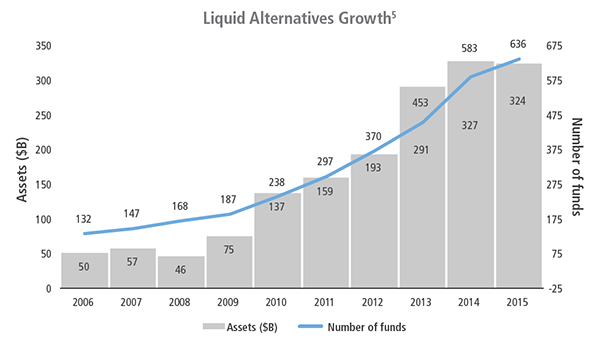

Liquid alternatives are growing rapidly. The number of distinct alternative mutual funds jumped from 132 in 2006 to 661 in June 2016.4 Between 2006 and 2015, assets in liquid alternative funds increased from $50 billion to more than $300 billion, and according to one study, the percentage of participating investors allocating to liquid alternatives increased from 28 percent to 51 percent between 2013 and 2014. 5,6

As alternatives gain popularity, investment managers are replacing the classic 60/40 stocks-and-bonds allocation with a portfolio that includes liquid alternative investments.7

The 60/40 portfolio assumes that bonds will deliver income with low volatility, but in today’s low-interest rate environment, this assumption may not hold true. At the same time, increased global market uncertainty may undermine equity returns and increase stock market volatility.5 As a result, investors may turn to liquid alternatives to help protect portfolios against the ups and downs of the broader market.7

Interval Funds: An innovative alternative investment to offer your clients

An interval fund is an example of the next evolution in liquid alternative investments. An interval fund is a type of mutual fund that offers daily investment opportunities as well as limited liquidity at specific intervals (usually quarterly). Interval funds can provide individual investors with access to alternative investments while also providing fee transparency and lower investment minimums. Additionally, interval funds can lower the expense of investing in alternative assets by aggregating capital, thus decreasing costs as a percentage of assets. Since interval funds are a type of mutual fund, they can be held in both fee-based and commission-based accounts.

Interval funds may help meet the demand for investments that seek to provide yield while also providing diversification and a lower correlation to the equity markets. They provide access to a portfolio of alternative investment securities and may replicate the benefits of an institutional approach that more and more investors desire. In addition, the flexibility of the mutual fund structure may help advisors adapt in an evolving regulatory landscape.

- Baird. The Role of Alternative Investments in a Diversified Portfolio. 2013.

- Wall Street Journal. The Success and Dangers of ‘Liquid Alternative’ Mutual Funds. 4/6/15.

- Hatteras Funds. Defining Liquid Alternative Investments. 2014.

- Goldman Sachs. Liquid Alternative Investment MAPS. Q2 2016.

- BMO Global Asset Management. Finding a new balance with alternatives. 2016.

- Deutsche Bank. Deutsche Bank study shows investor demand fueling dramatic growth of hedge fund liquid alternatives. 8/9/14.

- Daily Alts. Incorporating Alternatives into Traditional 60/40 Portfolios. 4/21/16.