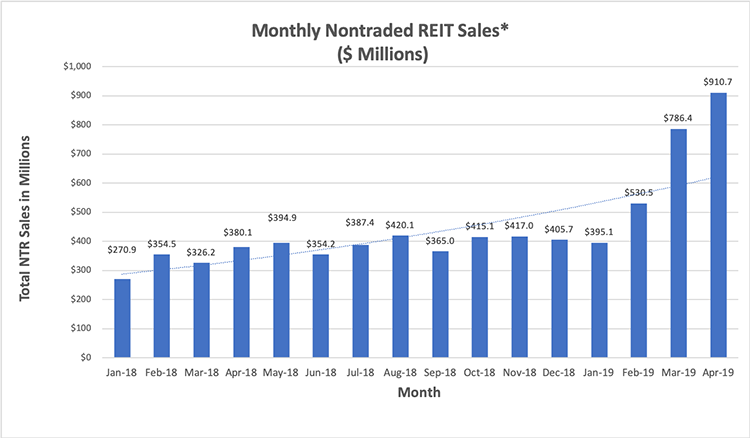

April NTR Sales Climb, Expected to Exceed $910 Million

May 20, 2019 | James Sprow | Blue Vault

Reporting nontraded REITs booked capital raise of $910.7 million in April, up 16% from the $786.4 million total for March and up 121% from the $412.6 million monthly average for the same NTRs in Q4 2018. Blackstone REIT saw capital raise increase in April by 23.7%, but the total for all other reporting effective nontraded REIT offerings showed a decrease of 5.5%%, from $212.4 million to $200.8 million, as Blackstone REIT’s share of total NTR sales jumped from 73% in March to 78% in April. Starwood REIT did not respond to requests for sales figures for the quarter ended March 31, 2019, or for the month of April. Blue Vault estimates that Starwood REIT had sales of $165 million in Q4 2018, which, if continued at that pace, could add significantly to NTR sales totals for the month of April. Phillips Edison Grocery Center REIT III did not report sales for April, but the REIT’s May 9 10-Q SEC filing for Q1 2019 states that subsequent to March 31, approximately $1.4 million was raised. While total sales for reporting REITs, without Starwood, totaled $912.2 million, Starwood’s sales could raise the industry total above $950 million.

*The following NTRs would not provide sales data to Blue Vault: FS Credit Real Estate Income Trust, Phillips Edison Grocery Center REIT III, and Starwood REIT. The following NTRs did not provide sales data to Blue Vault: Nuveen Global Cities REIT and Oaktree REIT.

With the Blackstone REIT April sales of $709.9 million, up 23.7% from sales in March of $574.0 million, the 15.8% increase in total capital raise month-to-month among reporting NTRs was due mainly to that REIT’s success and the pick-up in sales by several other REITs, offsetting the effects of drops in sales by other NTRs. Jones Lang LaSalle Income Property Trust had sales increase over 92%, from $21.6 million to $41.6 million. Cantor Fitzgerald’s two nontraded REITs, Rodin Global Property Trust and Rodin Income Trust, had sales increases of 41% and 21%, respectively. Cottonwood Communities had capital raise of $13.8 million in April, up 47% from the March total of $9.4 million.

In terms of ranking, after Blackstone REIT the next NTR with $41.6 million and a 4.6% share was Jones Lang LaSalle Income Property Trust, followed by Hines Global Income Trust with $37.5 million for a 4.1% share. Black Creek Industrial REIT IV was fourth, with $29.1 million and a 3.2% share.

For the reporting sponsors of nontraded REIT offerings in April, Blackstone was first in capital raised with $709.9 million and a 78.0% share. Black Creek Group, with two open programs, was next with $45.9 million for a 5.0% share. Jones Lang LaSalle ranked third with $41.6 million and a 4.6% share, followed by Hines with $37.5 million and a 4.1% share of all reported NTR sales.

Due to the lack of capital raise reports from four effective NTRs, most notably Starwood REIT, it is likely that the industry total was significantly greater than $911 million for April, possibly over $950 million. Year-over-year, April 2019 NTR sales were up over 140% from April 2018, even without the non-reporting REITs. The estimated four-month YTD total is $2.62 billion, without Starwood, and at least $2.8 billion with Starwood’s estimated sales added. That would yield an estimated Y-O-Y increase of over 190% for the first four months of 2019 compared to the same period in 2018.

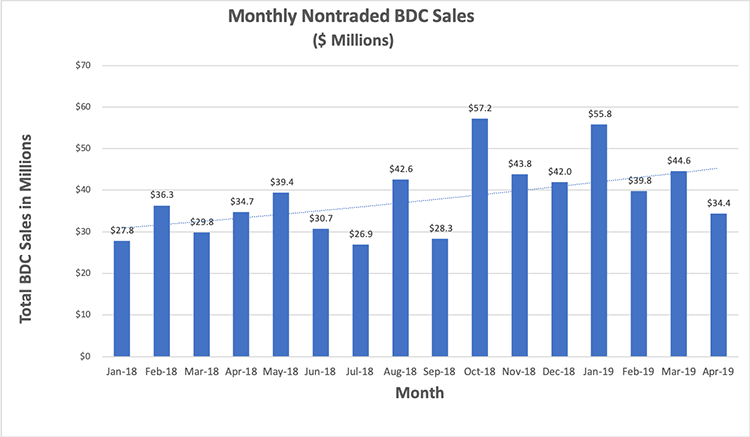

Nontraded BDC Sales Fell 23% in April

Nontraded BDC sales fell 23% from $44.6 million in March to $34.4 million in April, with only two nontraded BDC programs raising funds in April 2019 compared to six in April 2018 and seven in February 2018. Owl Rock Capital Advisors again led nontraded BDC sponsors with sales of $33.0 million by its Owl Rock Capital Corporation II program, 96% of nontraded BDC sales in April, down 23% from its $42.8 million sales in March. MacKenzie Realty Capital was the only other BDC program raising capital with $1.34 million in sales for a 4% share in April, down 24.5% from its March sales of $1.77 million.

Nontraded Preferred Sales by Listed REITs

Blue Vault receives sales reports from three listed REITs that issue nontraded preferred shares. Nontraded preferred sales by these REITs totaled $29.63 million in April 2019, up 28.3% from the $23.10 million total in March. Bluerock Residential Growth had sales of $19.62 million for April, increasing 56% from the $12.58 total for March. Gladstone Land Corp. reported nontraded preferred sales of $5.84 million for April down 19.5% from the $7.25 million in March. CIM Commercial Trust had nontraded preferred sales of $4.17 million in April, up 27.4% from March sales of $3.27.

At least one additional listed REIT issues nontraded preferred stock. Preferred Apartment Communities, Inc. does not report monthly preferred share sales to Blue Vault but SEC filings for Q1 2019 show proceeds of $128.7 million, before offering costs, from sales of units consisting of one share of Series A Redeemable Preferred Stock and one warrant to purchase up to 20 shares of Common. If the pace of preferred sales by this listed REIT continued in April 2019, the total for four listed REITs issuing nontraded preferred would exceed $70 million for the month.

Sources: Reporting NTRs and BDCs, SEC and Blue Vault