Are Starwood REIT Share Repurchases Trending Upward Like BREIT?

December 7, 2022 | James Sprow | Blue Vault

In a recent article, we reported that Blackstone Real Estate Income Trust was approaching the quarterly limits on common share repurchases. In Q3 2022, the REIT repurchased 4.6% of outstanding common shares. Then on December 1, 2022, the news came out that Blackstone REIT had imposed its pre-set monthly limits of 2% of total NAV on common share repurchases. Reuters reported that “Blackstone told investors in a letter it would curb withdrawals from its REIT after it received redemption requests in November greater than 2% of its monthly net asset value and 5% of its quarterly net asset value. As a result, the REIT allowed investors in November to redeem $1.3 billion, equivalent to approximately 43% of investors’ repurchase requests.” According to the REIT’s prospectuses, shares that exceed the monthly limit are not repurchased and repurchases that are executed are on a pro-rata basis.

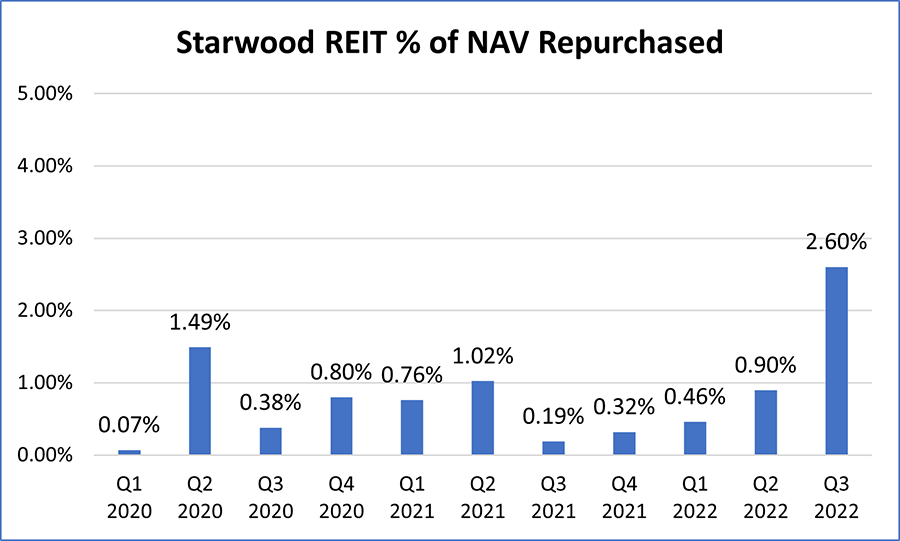

Prior to publishing our article showing how Blackstone REIT had redeemed 4.6% of total NAV in the third quarter of 2022, approaching the quarterly limit of 5%, we looked at Starwood Real Estate Income Trust’s redemptions history. While the trend revealed in quarterly redemptions was potentially worrisome, it was a full two percent lower than that of Blackstone REIT’s redemptions in the quarter.

The Reuters article attributes the high percentage of redemption requests relative to the Blackstone REIT total NAV to arbitrage opportunities, with investors observing the listed REIT valuations by the public market and questioning the NAVs per share reported by Blackstone REIT. Blackstone’s managers argue that the valuations of the REIT’s NAVs are based upon the solid performance of the REIT’s industrial and multifamily portfolio segments which have performed well.

Interestingly, according to Reuters, ”Two sources familiar with the matter said turmoil in Asian markets, fueled by concerns about China’s economic prospects and political stability, contributed to the redemptions. The majority of investors redeeming were from Asia and needed the liquidity, they said.”

Blackstone’s President Jonathan Gray stated that BREIT had ample cash reserves to “weather pretty much any storm.”

Starwood REIT’s real estate portfolio, according to its recent 8-K, was constructed with a “91% allocation to asset classes that are well positioned in the current environment, including: (i) 73% short lease duration assets including rental residential, extended-stay hotel, and self-storage, (ii) 13% industrial, and (iii) 5% floating-rate, senior loans which benefit from rising benchmark interest rates. Through the end of September 30, 2022, our industrial assets are approximately 99% occupied and realizing more than 31% growth in rents on expiring leases, while our market rate multifamily apartments are approximately 95% occupied and experiencing more than 13% year-over-year blended rent growth.”

Starwood REIT makes a strong argument that its portfolio financing with 98% of its debt at either fixed-rate debt or is hedged with interest rate caps or swaps. Its weighted average cost of debt is just under 3.3% with more than five years duration remaining. The 8-K states “In this higher rate environment, our financing structure is a significant asset. The value of our fixed rate debt and interest rate derivatives have contributed to more than half of our total return year-to-date.” This indicates that drops in the market valuations of the REIT’s real estate portfolio are cushioned by offsetting increases in the benefits of fixed, low-interest financing.

With the lower Q3 2022 share redemption rates by Starwood REIT, the question is whether the redemptions will follow the trend we observe with Blackstone REIT or if Starwood REIT will be relatively less vulnerable going forward.

Sources: Reuters, Blue Vault