As Interest Rates Rise, More Nontraded REITs Have More Variable Rate Debt

July 8, 2022 | James Sprow | Blue Vault

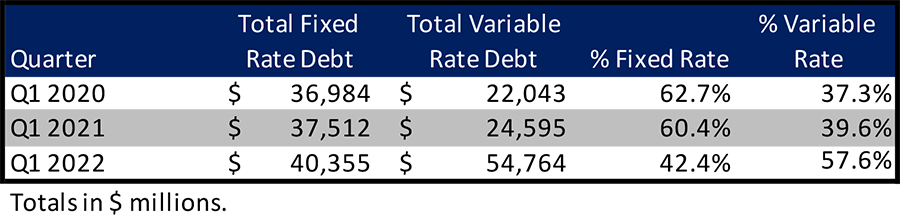

With interest rates rising, many nontraded REITs may be wishing they had more of their debt at fixed interest rates, or rates that were locked in before the current trends toward higher borrowing costs. Blue Vault’s data for all nontraded REITs displays the trend toward using variable rate debt1 since Q1 2020. The table below shows that the percentage of the total debt financing nontraded REIT assets that is at variable rates has increased over the past two years. In the latest quarter, the total for variable rate debt exceeded the fixed rate total by over $14 billion.

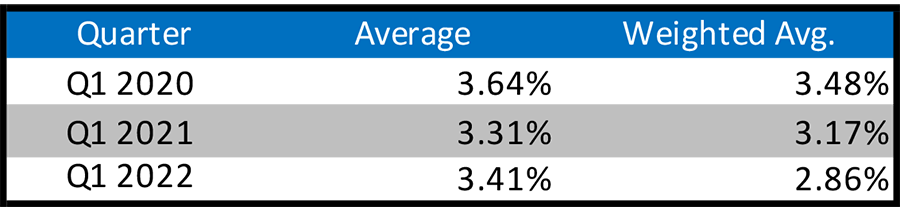

With the use of more variable rate debt, nontraded REITs have lowered the weighted average interest rates on their debt. Unfortunately, this may come at the cost of higher rates in the future. Many debt contracts have their interest rates tied to either LIBOR or the newest index SOFR. As those rates have increased, the rates on the variable-rate REIT debt have also risen. However, up to the 1st Quarter of 2022, the weighted average interest rate across all nontraded REITs actually decreased from Q1 2020 to Q1 2022. This is due to the greater use of variable rate debt as a percentage of all debt, but the trend may be reversing as rates rise. In the table below, the simple average interest rate across all NTRs has decreased since Q1 2020, and the weighted average interest rate which gives greater weight to the larger REITs such as Blackstone REIT and Starwood REIT, has decreased still more.

Footnote

1) Blue Vault may classify a REIT’s debt as variable rate even if there are interest rate caps in place. While interest rate swaps contracts do fix the rates on variable rate debt by exchanging the interest payments due on the debt with a counterparty to the swap (usually a bank), an interest rate cap only fixes the rate on debt when the variable rate reaches the cap. As long as the variable rate (tied to LIBOR or SOFR indices) does not reach the cap, it is still classified by Blue Vault as variable rate debt.