Asset Class Snapshot: Senior Loans

Submitted by CION Investment Group, LLC

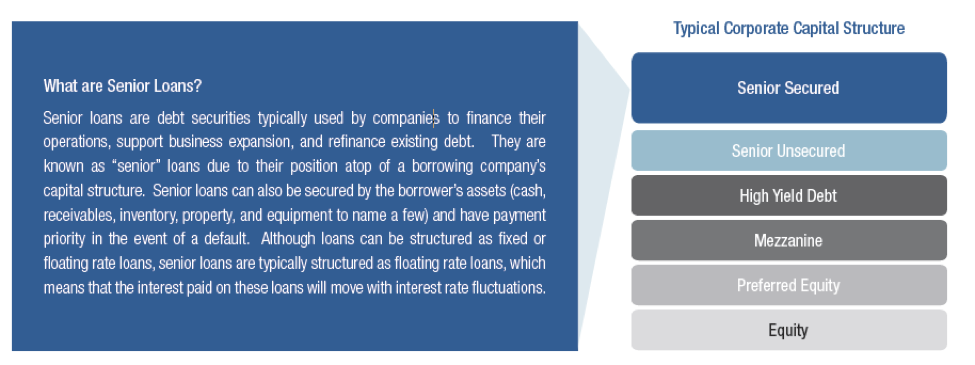

It’s no secret that the vast majority of investment portfolios are typically comprised of various combinations of stocks, bonds and cash equivalents. As the investing landscape evolves and interest rates continue to hover at near-record lows, it’s important to consider alternative asset classes that may help investors reach their financial goals. One such asset class growing in popularity among the retail investing community is senior loans. Senior loans may be an attractive complement to an existing fixed-income allocation as they typically pay higher yields than traditional fixed income investments such as Treasuries and CDs and offer investors the potential for capital appreciation. In this piece we will discuss what senior loans are, how they stand up against more common asset classes and how they can provide diversification to any investment portfolio.

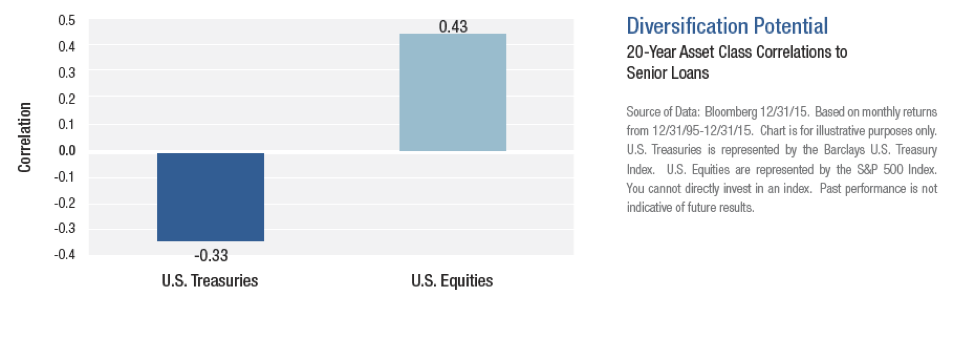

Diversification & Correlation

Senior loans are a great way to add a layer of diversification to an investment portfolio. As an asset class, senior loans typically have low historical correlation to other asset classes. Correlation measures how different investments react to the same market conditions. To summarize, if two different investments have a correlation of +1, that means they are essentially perfectly correlated and will behave almost identically to changes in the economic climate. Alternatively, if two different investments move in exactly the opposite direction (one goes up, while the other goes down by the same amount), then they would exhibit a correlation of -1. Investing in asset classes with lower correlation, typically in between the -.5 and +.5 range, may be an effective way to diversify an investment portfolio. The chart below exemplifies senior loans as having low correlation to U.S. Treasuries and U.S. equities over the past 20 years.

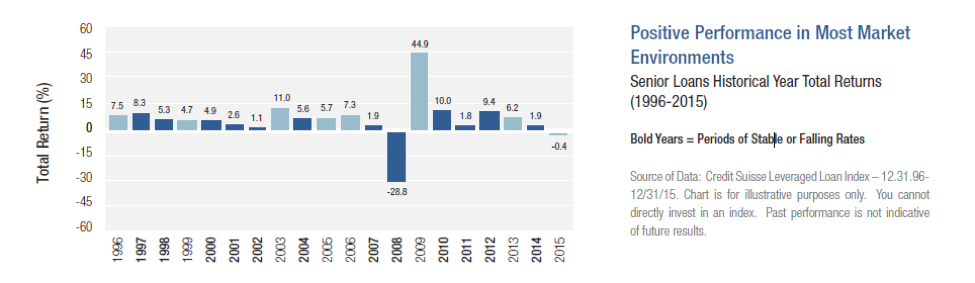

Performance

Because of their income potential and low correlation to other asset classes, senior loans have performed admirably over the past twenty years – having posted positive returns in 18 of the past 20 years.

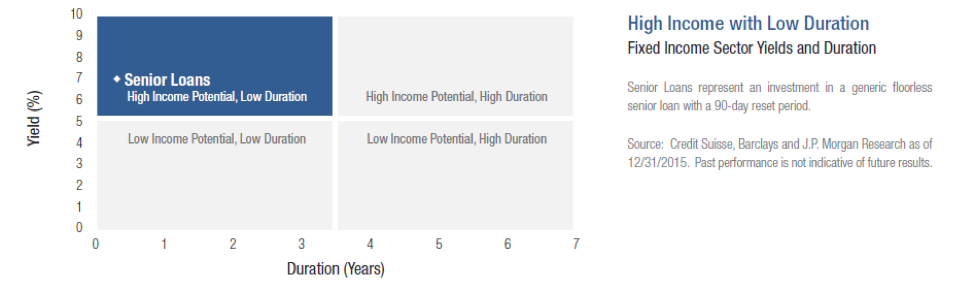

Duration

Duration is a term used to measure the sensitivity of the price of a fixed-income investment to a change in interest rates. A common misconception typically associated with bond investments is that they are risk-free. This is simply not true as there are two main risks that may affect a bond’s value: credit risk (default) and interest rate risk (fluctuations). Duration focuses on the latter. The chart below is evidence that senior loans offer generally high income potential, while maintaining a reasonably low duration.

Risks

As with any asset class, there are certain risks associated with senior loans. Credit risk is the risk of nonpayment of scheduled interest or principal payments on a debt investment. Because senior loans can be made to non-investment grade borrowers, the risk of default may be greater. Should a borrower fail to make a payment, or default, this may affect the overall return to the lender. Interest rate risk is another common risk associated with senior loans. Interest rate changes will affect the amount of interest paid by a borrower in a floating rate senior loan, meaning they move in-step with broader interest rate fluctuations. However, this typically has little to no impact on the underlying value of floating rate debt. Further, senior loans are generally illiquid which require longer investment time horizons than other investments. Senior loans may trade at depressed prices and the underlying collateral may decline in value. For these and other reasons, senior loans may be considered speculative.

To learn more about Senior Loans, please contact your financial advisor.

The information contained herein is intended to be used for educational purposes only and does not constitute an offer to sell or a solicitation to purchase securities. Such offers or solicitations can only be made by means of a prospectus. Prior to making any investment decision, you should read the applicable prospectus carefully and consider the risks, charges, expenses and other important information described therein.

Asset Class: Snapshot Senior Loans in PDF format.