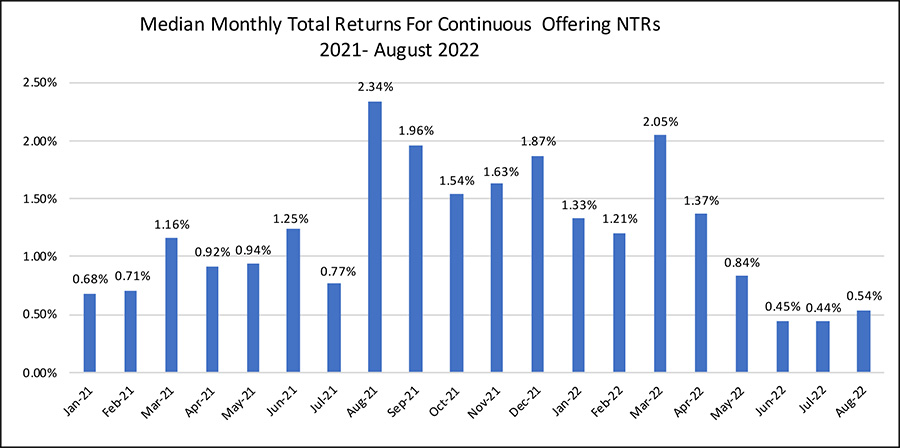

August Total Returns for Continuously Offered NTRs Beat Listed REITs

September 23, 2022 | James Sprow | Blue Vault

All but one of the 14 continuously offered nontraded REITs reported positive total returns in August compared to the NAREIT. All REIT Index had a negative 5.92% return for the month. Leading all continuously offered REITs was Cantor Fitzgerald Income Trust with a total return of 1.48%. Year-to-date the REIT has posted a 7.83% total return and currently has a 5.82% annualized distribution yield. By comparison, the YTD total return on the NAREIT All REIT Index is a negative 12.26%.

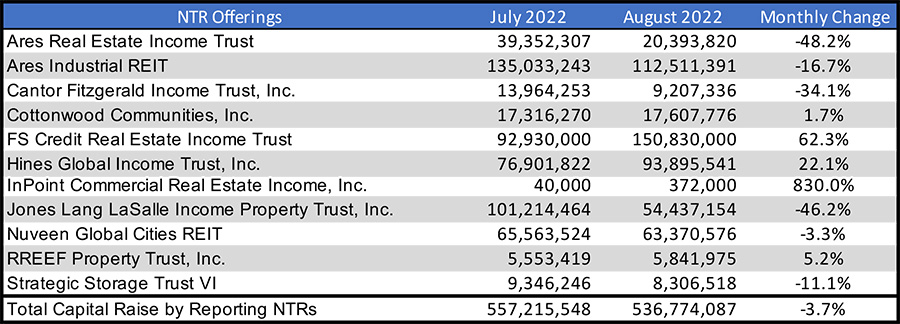

Chart I

The median total return for all 14 continuously offered NTRs in August was 0.54%. In terms of volatility, the nontraded REIT returns had a standard deviation of their median total returns over the first eight months of 2022 of just 0.60% compared to the standard deviation for the S&P 500 Stock Index of 5.91% and the standard deviation for the NAREIT All REIT Index returns of 6.56%.

The median monthly returns for the continuously offered NTRs have cooled over the last three months after a remarkably consistent run since January 2021. Over that 17-month span the median return for the NTRs was never less than 0.68% and reached a monthly high of 2.34% in August 2021 of 2.34%.

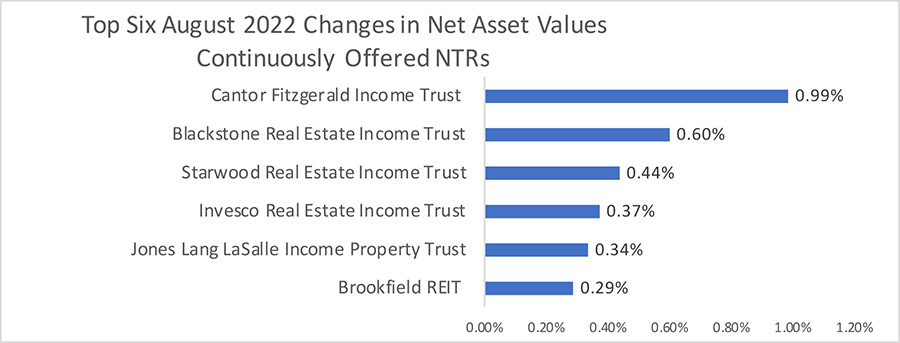

Chart II

Much of the total return to nontraded REITs consists of increases in their net asset values (NAVs) per share. The top five NTRs in terms of increases in their NAVs per share in August 2022 are shown below.

Chart III

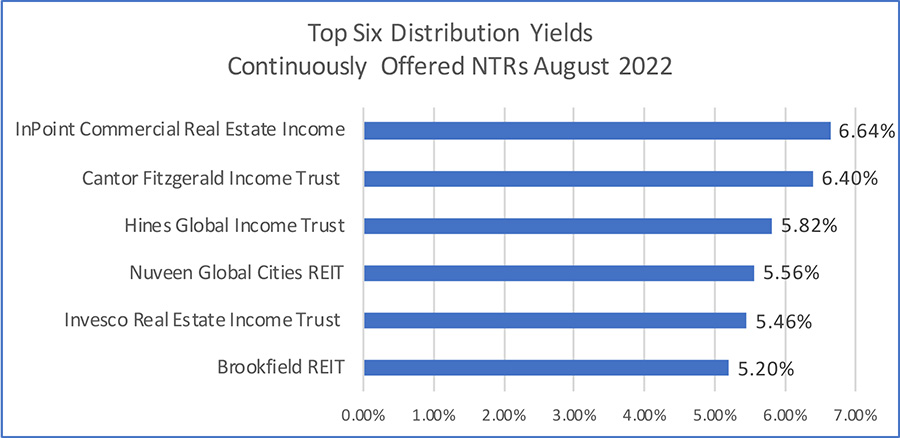

Distribution yields among the 14 continuously offered nontraded REITs range from 6.64% annualized to 3.03%. The top six continuously offered NTRs in terms of annualized distribution yields as of August 2022 are shown below.

Chart IV

Sources: Individual REIT websites; SEC; Blue Vault