Blue Vault Publishes 7th Edition Nontraded REIT Full-Cycle Performance Study

December 7, 2022 | James Sprow | Blue Vault

The 7th Edition Nontraded REIT Full-Cycle Performance Study adds the 16 most recent full-cycle events that provided full liquidity to common shareholders. The Study calculates the average rate of return to shareholders who invested in the shares of nontraded REITs during their public offerings using the cash flows they received based upon three different holding periods, for the earliest quarters of the offerings, the latest quarters of the offerings, and the middle quarters of the respective offerings.

The 16 REIT sample of the latest full-cycle events (excluding Hospitality Investors Trust which declared bankruptcy in June 2022) had an average annualized full-cycle return to early investors of 5.04% and median returns of 6.01%, with three experiencing negative average returns to early investors.

The 7th Edition includes total return data for 84 nontraded REITs that have had full-liquidity events since 1996, over the entire history of the nontraded REIT industry. For the full sample of 84 nontraded REITs, 29 listed on public exchanges, 18 were acquired by or merged with nontraded REITs, 19 merged with publicly traded firms, 7 merged or acquired by unlisted firms, and 11 liquidated their portfolios and distributed the proceeds.

Average shareholder returns were calculated both for investors who did not utilize distribution reinvestment programs and for those who did reinvest in additional shares. The average annual distribution yield over the lives of the 84 NTRs and the quarters in which distributions were paid was 6.20%.

Consistent with prior studies, this updated study also constructs unique custom benchmark return comparisons for each REIT, with FTSE NAREIT indices for the returns of publicly-traded REITs over matched holding periods. Returns over matched holding periods were also compared with the S&P 500 Stock Index and Intermediate-Term U.S. Treasury Bonds benchmarks.

The Study also compared rates of return for those investors who redeemed their shares prior to the full-cycle event. Those investors who redeemed their shares in the last available period prior to the full-cycle event had average holding period returns of 4.65% compared to the average returns of those who held their shares until the full-cycle event of 4.10%.

A sample of 69 third-party tender offers revealed that shareholders who tendered their shares prior to the full-cycle events had average holding period returns of negative 3.52% compared to an average IRR for the full-cycle events of those REITs of 2.34%, a difference in average returns of negative 5.86%. The tender offer prices in the sample averaged 20.9% less than the full-cycle values. This confirms that third-party tender offers are more likely to be made for REITs that have underperformed their industry averages, and that there is a relatively steep price for early liquidation.

The 7th Edition Nontraded REIT Full-Cycle Performance Study contains data for every event since the beginning of the industry and is the only exhaustive study of its type. It is available free of charge to all Blue Vault subscribers.

Click here for the Executive Summary.

Blue Vault subscribers may log in to access the Full-Cycle Study in The Vault. If you are not a subscriber, click here for our store.

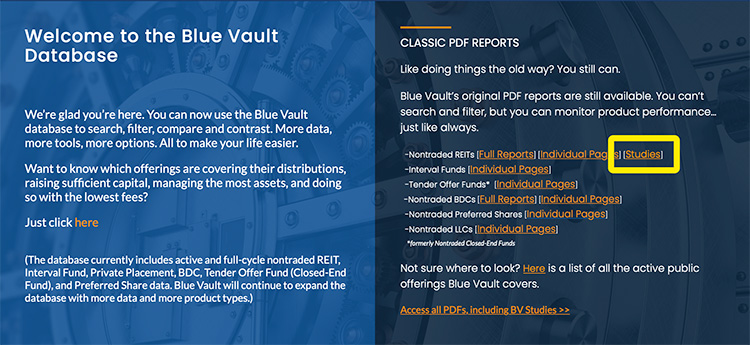

The Link to the PDF versions of Blue Vault’s nontraded REIT studies, is indicated in the image below.