These Interval Fund, Tender Offer Fund, and Nontraded LLC Individual Performance Pages (IPPs) are now available for Blue Vault members to view on the Blue Vault website. Newly added IPPs are in bold font.

Interval Funds

ACAP Strategic Fund 3-31-2024

Alternative Credit Income Fund 3-31-2024

Apollo Diversified Real Estate Fund 03-31-2024

Blackstone Floating Rate Enhanced Income Fund 3-31-2024

BlueBay Destra International & Event-Driven Credit Fund 3-31-2024

Bluerock Total Income+ Real Estate Fund 03-31-2024

Bow River Capital Evergreen Fund 3-31-2024

CIM Real Assets & Credit Fund 03-31-2024

Cliffwater Corporate Lending Fund 3-31-2024

Cliffwater Enhanced Lending Fund 3-31-2024

Ecofin Tax-Advantaged Social Impact Fund 3-31-2024

Goldman Sachs Real Estate Diversified Income Fund 3-31-2024

Principal Real Asset Fund 3-31-2024

Thirdline Real Estate Income Fund 3-31-2024

Versus Capital Multi-Manager Real Estate Income Fund 03-31-2024

Versus Capital Real Assets Fund 03-31-2024

Tender Offer Funds

A&Q Multi-Strategy Fund 3-31-2024

AB Multi-Manager Alternative Fund 3-31-2024

AIP Alternative Lending Fund A 3-31-2024

Alpha Core Strategies Fund 3-31-2024

AMG Pantheon Master Fund 3-31-2024

BBR ALO Fund 3-31-2024

BlackRock Private Investments Fund 3-31-2024

CPG Carlyle Commitments Fund 3-31-2024

FS MVP Private Markets Fund 03-31-2024

StepStone Private Markets 03-31-2024

Nontraded LLC

CNL Strategic Capital 3-31-2024

TriLinc Global Impact Fund 03-31-2024

For a complete list of the publicly-filing funds Blue Vault covers in its research, click here.

Blue Vault members may sign in to view full reports or individual pages in the Research Portal. If you are not a member, click here to see our Membership options..

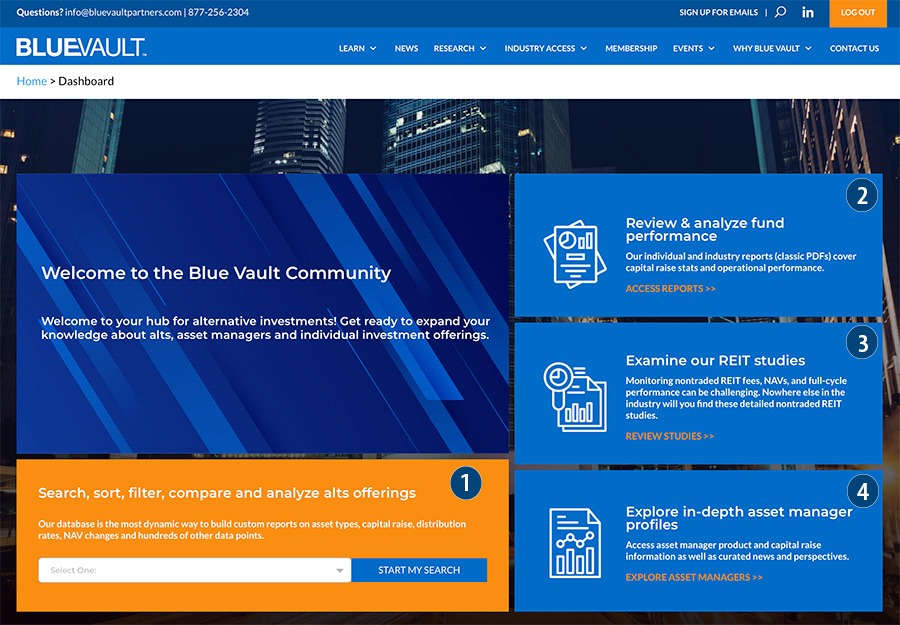

Links to Blue Vault’s Classic PDFs are located in the Review and analyze fund performance section, labelled “2” in the image below.