New York, NY (February 5, 2021) – Bluerock Capital Markets, LLC (“BCM”), the dedicated dealer manager for Bluerock Total Income+ Real Estate Fund (“TI+” or the “Fund”) (Tickers: TIPRX, TIPPX, TIPWX, TIPLX) announced a 50% increase in new capital inflows into TI+ for the month of January as compared to the prior six-month average. The Fund recorded equity capital inflows of $646 million in 2020 and was ranked as the top capital raising real estate interval fund from the onset of the pandemic through December 2020 and the highest returning real estate interval fund in 2020, generating positive returns for the eighth consecutive year with no down years since inception.1

The increase in new capital coincides with the Fund’s recent performance, having delivered a 3.6% total net return (TIPWX: I-share) over a short time period from September 2020 through January 2021.2

“We are witnessing strong demand from investors seeking portfolio allocations to institutional private real estate in order to potentially bolster their income needs and those seeking to temper high volatility in the equity markets” said Jeffrey Schwaber, CEO of BCM. “We believe advisors and investors are realizing that institutional private equity real estate has delivered positive returns with low volatility in 39 of the previous 43 years, is well positioned coming out of the pandemic and may constitute a core portfolio holding,” added Schwaber.

The Fund has paid 32 consecutive quarterly distributions to shareholders as of December 2020, historically representing an annual distribution rate of 5.25% on current NAV.*

As of December 31, 2020, the Fund reported gross asset value of the underlying portfolio of over $220 billion which was comprised of 4,300+ primarily core, high occupancy, institutional-quality real estate holdings with strategic sector weightings to 2020’s higher performing real estate sectors including 35% industrial, 33% apartment, 14% specialty (including life science, medical office, and self-storage), and a strategic underweight to office and retail sectors.3 Approximately 95% of the Fund’s investment allocations generated positive performance in 2020, despite the ongoing pandemic.4

1 The Stanger Market Pulse, December 2020, April-December 2020, Morningstar Direct, Interval Fund Tracker, real estate interval funds over $200 million AUM.

2 Total Return of TIPWX (I-share) from September 24, 2020 through January 31, 2021.

3 For detailed Fund holdings, please visit http://bluerockfunds.com/investment-holdings/. Holdings are subject to change.

4 Includes real estate sector returns as categorized by the National Council of real Estate Investment Fiduciaries National Property Index and underlying investments in real estate debt and specialty sectors.

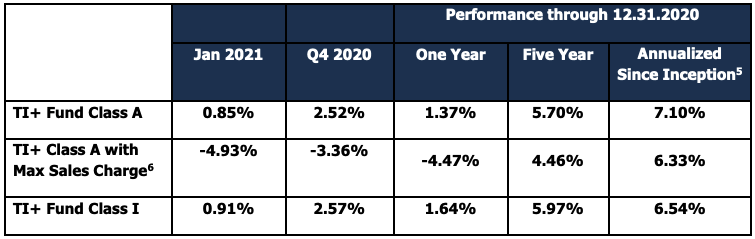

TI+ Fund Class A and I Net Performance

Returns presented are total net return: expressed in percentage terms, the calculation of total return is determined by taking the change in price, reinvesting, if applicable, all income and capital gains distributions during the period, and dividing by the starting price. Returns greater than one year are annualized.

5 Inception date of the TI+ Fund Class A share is October 22, 2012 and Class I share is April 1, 2014.

6 The maximum sales charge for the Class A shares is 5.75%. Investors may be eligible for a waiver or a reduction in the sales charge.

The performance data quoted here represents past performance. Current performance may be lower or higher than the performance data quoted above. Investment return and principal value will fluctuate, so that shares, when redeemed, may be worth more or less than their original cost. For performance information current to the most recent month end, please call toll-free 1-888-459-1059. Past performance is no guarantee of future results.

The total annual fund operating expense ratio, gross of any fee waivers or expense reimbursements, is 2.18% for Class A and 1.92% for Class I. The Fund’s investment advisor has contractually agreed to reduce its fees and/or absorb expenses of the fund, at least until January 31, 2022 for Class A and I shares, to ensure that the net annual fund operating expenses will not exceed 1.95% for Class A and 1.70% for Class I, per annum of the Fund’s average daily net assets attributable to Class A and Class I shares, respectively, subject to possible recoupment from the Fund in future years. Please review the Fund’s Prospectus for more detail on the expense waiver. A fund’s performance, especially for very short periods of time, should not be the sole factor in making your investment decisions. Fund performance and distributions are presented net of fees.

The Bluerock Total Income+ Real Estate Fund is a closed-end interval fund that invests the majority of its assets in institutional private equity real estate securities that are generally available only to institutional investors capable of meeting the multi-million dollar minimum investment criteria. As of Q4 2020, the value of the underlying real estate held by the securities in which the Fund is invested is approximately $220 billion, including investments managed by Ares, Blackstone, Morgan Stanley, Principal, PGIM, Clarion Partners, Invesco and RREEF, among others. The minimum investment in the Fund is $2,500 ($1,000 for retirement plans) for Class A, C, and L shares.

For copies of TI+ public company filings, please visit the U.S. Securities and Exchange Commission’s website at sec.gov or the Company’s website at bluerockfunds.com.

About Bluerock Total Income+ Real Estate Fund

The Bluerock Total Income+ Real Estate Fund offers individual investors access to a portfolio of institutional real estate securities managed by top-ranked fund managers. The Fund seeks to provide a comprehensive real estate holding designed to provide a combination of current income, capital preservation, long-term capital appreciation and enhanced portfolio diversification with low to moderate volatility and low correlation to the broader equity and fixed income markets. The Fund utilizes an exclusive partnership with Mercer Investment Management, Inc., the world’s leading advisor to endowments, pension funds, sovereign wealth funds and family offices globally, with over 3,300 clients worldwide, and over $15.0 trillion in assets under advisement.

Investing in the Bluerock Total Income+ Real Estate Fund involves risks, including the loss of principal. The Fund intends to make investments in multiple real estate securities that may subject the Fund to additional fees and expenses, including management and performance fees, which could negatively affect returns and could expose the Fund to additional risk, including lack of control, as further described in the prospectus.

*The Fund’s distribution policy is to make quarterly distributions to shareholders. The level of quarterly distributions (including any return of capital) is not fixed and this distribution policy is subject to change. Shareholders should not assume that the source of a distribution from the Fund is net profit. All or a portion of the distributions consist of a return of capital based on the character of the distributions received from the underlying holdings, primarily Real Estate Investment Trusts. The final determination of the source and tax characteristics of all distributions will be made after the end of each year. Shareholders should note that return of capital will reduce the tax basis of their shares and potentially increase the taxable gain, if any, upon disposition of their shares. There is no assurance that the Company will continue to declare distributions or that they will continue at these rates. There can be no assurance that any investment will be effective in achieving the Fund’s investment objectives, delivering positive returns or avoiding losses.

Limited liquidity is provided to shareholders only through the Fund’s quarterly repurchase offers for no less than 5% of the Fund’s shares outstanding at net asset value. There is no guarantee that shareholders will be able to sell all of the shares they desire in a quarterly repurchase offer. Quarterly repurchases by the Fund of its shares typically will be funded from available cash or sales of portfolio securities. The sale of securities to fund repurchases could reduce the market price of those securities, which in turn would reduce the Fund’s net asset value.

Investors should carefully consider the investment objectives, risks, charges and expenses of the Bluerock Total Income+ Real Estate Fund. This and other important information about the Fund is contained in the prospectus, which can be obtained online at bluerockfunds.com. The Bluerock Total Income+ Real Estate Fund is distributed by ALPS, Inc. The prospectus should be read carefully before investing. Bluerock Fund Advisor, LLC is not affiliated with ALPS, Inc.

About Bluerock

Bluerock is a leading institutional alternative asset manager with approximately $8.8 billion of acquired and managed assets headquartered in Manhattan with regional offices across the U.S. Bluerock principals have a collective 100+ years of investing experience with more than $48 billion real estate and capital markets experience and have helped launch leading private and public company platforms.

About Bluerock Capital Markets

Bluerock Capital Markets, LLC serves as the managing broker dealer for Bluerock and is a member of FINRA/SIPC. Formed in 2010, BCM distributes a broad range of institutional investment products with potential for growth, income, and tax benefits exclusively through broker dealers and investment professionals including the Bluerock Total Income+ Real Estate Fund, Bluerock Residential Growth REIT, Inc., and programs sponsored by Bluerock Value Exchange, LLC. BCM ranks #4 for capital fundraising in 2020 among all active managing broker-dealers in the Direct Investments Industry1.