Continuously Offered Nontraded REITs Continue Strong Performance in May

June 21, 2021 | James Sprow | Blue Vault

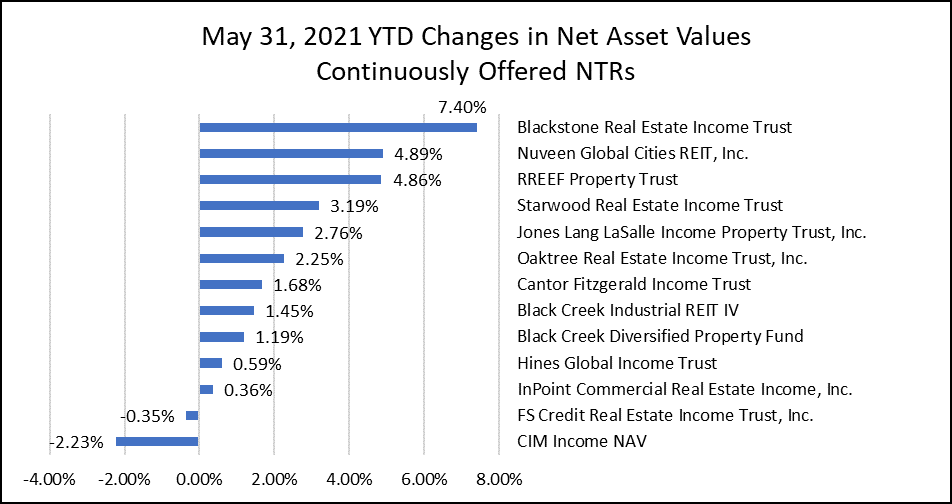

The continuously offered nontraded REITs have shown impressive increases in estimated Net Asset Values (NAVs) so far in 2021. Year to date those values for the 13 REITs that have reported NAVs as of May 31, 2021, have reported an average increase in NAVs of 2.16% and a median increase of 1.68%. The largest increase in NAV was reported by Blackstone Real Estate Income Trust at 7.40%. All but two of the thirteen reported increases with exceptions being CIM Income NAV (-2.23%) and FS Credit Real Estate Income Trust (-0.35%).

The continuously offered nontraded REITs have shown impressive increases in estimated Net Asset Values (NAVs) so far in 2021. Year to date those values for the 13 REITs that have reported NAVs as of May 31, 2021, have reported an average increase in NAVs of 2.16% and a median increase of 1.68%. The largest increase in NAV was reported by Blackstone Real Estate Income Trust at 7.40%. All but two of the thirteen reported increases with exceptions being CIM Income NAV (-2.23%) and FS Credit Real Estate Income Trust (-0.35%).

Chart I

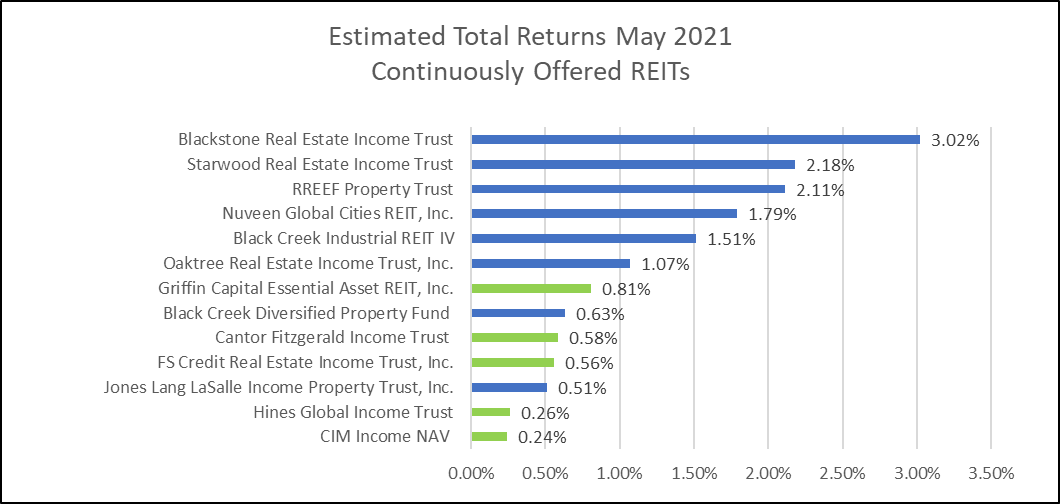

The websites of 8 of 13 of the continuously offered REITs reported their total returns for May 2021. These returns are calculated using the change in NAVs plus the distributions paid (accrued if paid quarterly rather than monthly). For those five REITs that did not report their total returns for the month, Blue Vault estimated the returns using the change in NAVs and the distribution yields calculated for the month by using the annualized yields divided by 12. Chart II shows the reported (blue bars) and estimated returns (green bars) for all 13 REITs. The highest reported monthly return was by Blackstone Real Estate Income Trust (+3.02%) followed by Starwood Real Estate Income Trust (+2.18%) and RREEF Property Trust (+2.11%). These increases, when compared to the YTD returns show May to be a very strong month for most REITs, and a consistently positive return for all 13 REITs.

Chart II

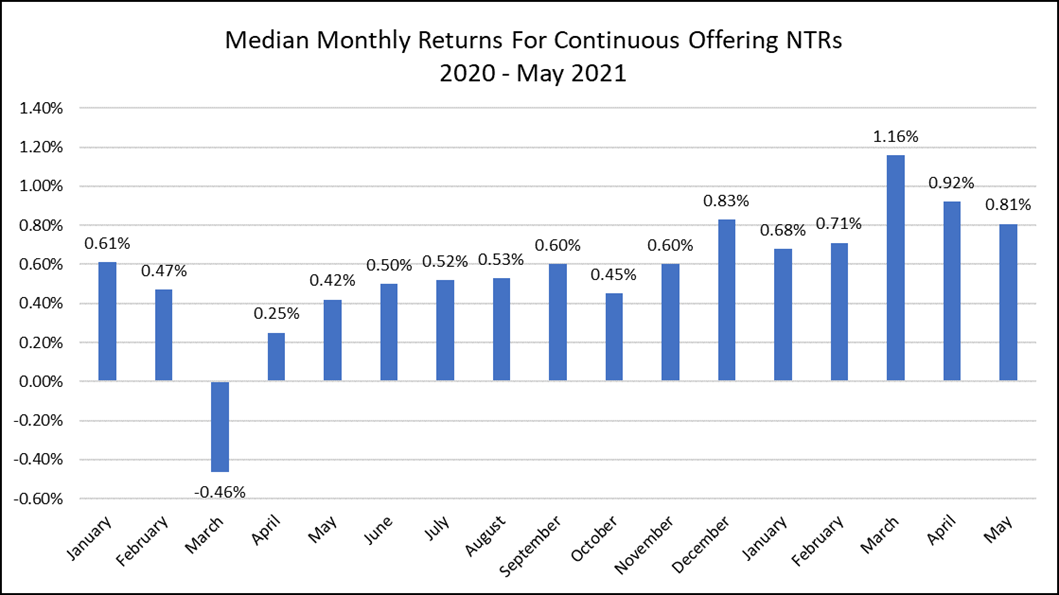

Over the last 17 months, including the COVID-19 pandemic months, the continuously offered nontraded REITs have delivered positive median rates of return in all but one month, March 2020. The consistency of positive returns would rival the consistency of most other investment types. For 2021 YTD, the highest monthly median return for the 13 REITs was in March 2021 (+1.16%), in a very positive mirror image of returns in March 2020 (-0.46%).

Chart III

Sources: SEC, Blue Vault, Individual REIT Websites