Cottonwood Communities Was the Top Performing NAV REIT in 2021

March 23, 2022 | James Sprow | Blue Vault

Cottonwood Communities, a continuously offered nontraded REIT, achieved a 78.16% total return to Class A shareholders for the 12-month period ending December 31, 2021. According to a report by Robert A. Stanger & Co., the REIT was the top-performing NAV REIT in 2021. Resource REIT, with a total return of 67.27%, was the top-performing Lifecycle REIT.

The report stated that NAV REIT returns have approximated those of their traded counterparts with a total cumulative return of 64.0% over the last 60 months. Over the last 60 months, the total return of the broader REIT market index was 66.8%. Kevin T. Gannon, Chairman and CEO of Stanger stated, “This strong performance is the driving force behind the $36.5 billion of NAV REIT fundraising in 2021, and we expect this trend to continue in 2022.”

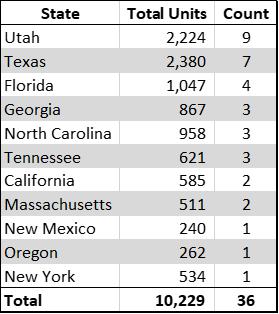

Cottonwood Communities had a portfolio of 36 multifamily properties as of December 31, 2021, that were 95.6% occupied. As of February 28, 2022, the NAV per fully-diluted Class I share of Cottonwood Communities was $18.9882, up from $18.4071 as of January 31, 2022, and $17.28 as of December 31, 2021.

The REIT’s portfolio as of December 31, 2021, included investments across 11 states.

The strategy of the REIT is to invest in employment sectors with high earnings potential, infill locations with high barriers to entry and undergoing favorable redevelopment, identifying markets with dislocation or mispriced assets, areas with high concentrations of skilled labor and above average income, and close proximity to transportation, dining, entertainment, retail venues and schools. The REIT creates a balanced real estate portfolio involving diversification across key investment types with the goal of providing investors with a balance of current income and long-term growth potential. The portfolio will contain high-quality, income-producing multifamily properties, preferred equity, mezzanine loans and B-note loans, and new developments of multifamily communities.

Sources: https://cottonwoodcommunities.com, Robert A. Stanger & Co., Inc., SEC