Digging Deeper into Blackstone REIT Repurchases

December 12, 2022 | James Sprow | Blue Vault

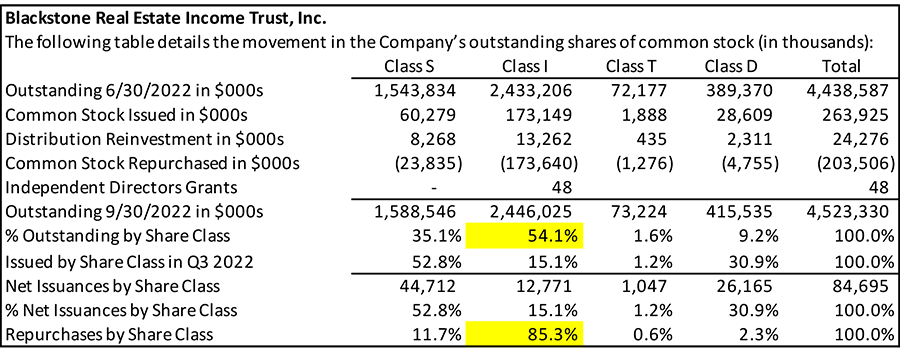

Looking at the recent repurchases of common shares by Blackstone Real Estate Investment Trust, we observe that it appears to be primarily institutional investors who invest in Class I Common Shares who have recently requested repurchases of their shares by the REIT. The following table shows the number of common shares issued by share class and the number of shares repurchased by share class. The difference in the two percentages (highlighted) are worth examining.

Blackstone REIT Capital Raise and Repurchases for Q3 2022

In Q3 2022, 54.1% of the common shares outstanding (as of September 30,2022) were Class I shares. Over the life of the REIT, Class I shares, issued to institutional investors with high minimum purchases ($1 million per the REIT’s prospectus) made up over 50% of the common equity raise. Class I shares have no upfront selling charges, making them the most attractive share class to institutional investors who can meet the minimums for investment.

Institutional investors tend to have higher percentages of their portfolios allocated to real estate. With the underperformance of listed REITs relative to the nontraded REIT NAVs per share, some rebalancing of portfolios might be expected, and it makes sense that those institutional investors would be more inclined to rebalance given their higher real estate allocations. (For more on this topic, see our article entitled “The Portfolio Re-Balancing Conundrum” from July 2022.)

The outperformance of continuously offered nontraded REIT programs is illustrated by their year-to-date total returns. Blue Vault calculated the median YTD total return for 14 continuously offered nontraded REITs was 10.09% thru October 31, 2022, calculated as the changes in NAVs plus their distributions. By contrast, the NAREIT All REIT Index had a YTD return of -12.86% (as in negative!) and the S&P 500 had a total return of -17.70% over the same time period.

Sources: SEC, Blue Vault