David Fisher | Phoenix American

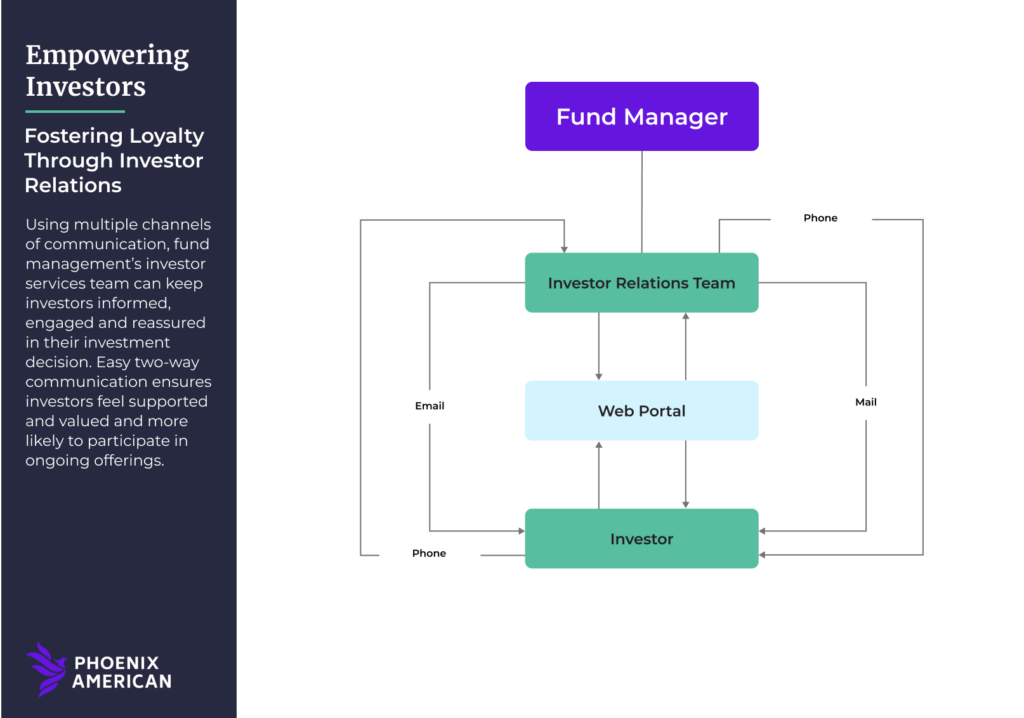

Investor relations plays a key role in private equity fund management, serving as a bridge between fund managers and investors. Continuous investor engagement through investor relations outreach helps investors understand the status of their investment, sets clear expectations and primes them for reinvestment in fund after fund. Six key areas of investor relations outreach serve to empower investors with the knowledge and perspective they need understand and appreciate the performance of fund management.

1. The Fund’s Life-Cycle

Understanding where a fund stands in its life-cycle is crucial for investors. Investor relations should ensure that investors are well-informed about the current phase of the fund, whether it’s in the investment period, maturity phase or the divestment stage, and any major developments. This information allows investors to align their expectations with the fund’s timeline. Regular updates through investor relations helps investors anticipate significant milestones, such as capital calls, portfolio acquisitions and exits, fostering a sense of involvement and trust.

2. Distribution Payments

Distribution payments are a critical concern for investors. Effective investor relations provides clarity on what to expect regarding future distributions. By explaining the fund’s distribution policy and projected timelines, investor relations helps investors plan their financials better. Whether distributions are made periodically or upon specific liquidity events, clear communication ensures that investors are not left in the dark. Continuous education on distribution expectations also includes potential scenarios that might affect payouts, helping investors manage their expectations realistically.

3. Tax Implications

Navigating the tax implications of private equity investments can be complex, especially with tax-advantaged investment funds. Investor relations plays a crucial role in educating investors on how their investments will be taxed, including any benefits they might receive from tax-advantaged structures. This education helps investors optimize their tax positions and understand potential tax liabilities. Investor relations also provides updates on any changes in tax laws or regulations that might impact the investment, ensuring investors are always well-prepared and compliant.

4. Market Trends and Performance

Keeping investors informed about market trends affecting the portfolio assets is vital for maintaining their confidence. Through investor relations, fund managers can provide insights into current market conditions, economic indicators and industry-specific trends that might influence the fund’s performance. This information helps investors understand the broader context of their investment and the factors driving returns. Regular updates and analyses of market trends enable investors to make more informed decisions and appreciate fund management as a trusted source of valuable perspective.

5. Reassurance of Investment Wisdom

Investors need reassurance that their decision to invest in a particular fund was sound. Investor relations can offer this reassurance by comparing the performance of the fund with other available investment opportunities. Highlighting the strategic advantages, historical performance and unique value propositions of the fund helps reinforce investor confidence and encourage reinvestment. By continuously educating investors on why the fund remains a wise choice, investor relations mitigates concerns and fosters long-term loyalty.

6. Reinvestment Opportunities

Effective ongoing investor relations engagement develops a relationship with investors that pays dividends when highlighting opportunities for reinvestment in the current fund or upcoming funds offered by the sponsor. Proactive communication ensures that investors are aware of new opportunities to grow their wealth supported by the same investor relations care they have enjoyed throughout their current investment. Providing detailed information about the terms, potential returns and strategic focus of new funds helps investors make informed decisions about reinvesting. By keeping investors engaged and informed about reinvestment options, investor relations contributes to the sustained growth and success of the fund sponsor.

A Loyal Source of Investment Capital

Proactive investor relations is invaluable in private equity fund management. By ensuring that investors are continuously educated about the fund’s life-cycle, distribution expectations, tax considerations, market trends, the soundness of their investment decision and reinvestment opportunities, effective investor relations builds trust, fosters transparency and enhances investor satisfaction, contributing to the long-term success of both the fund and its investors. By systematically prioritizing investor relations, private equity fund managers foster a more informed, confident and loyal investor base.