Estimated Returns for Nontraded REITs with Frequent NAV Estimates

September 20, 2018 | James Sprow | Blue Vault

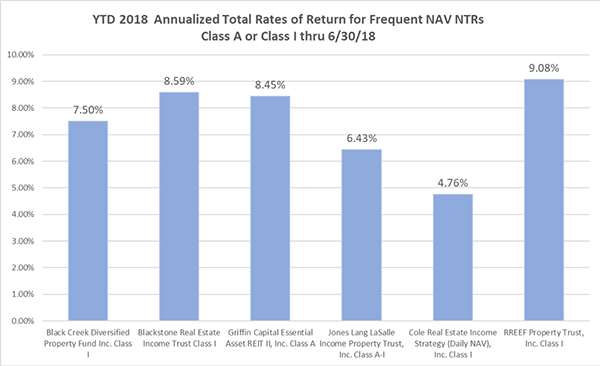

Those nontraded REITs with daily or monthly estimated NAV per share announcements have year-to-date annualized returns based upon changes in their respective NAVs plus distributions paid ranging from 4.76% to 9.08%. These annualized returns are calculated using the internal rate of return function (XIRR) in Excel, which uses the actual dates of every cash flow and revaluation of the NAVs to calculate an annualized average rate of return.

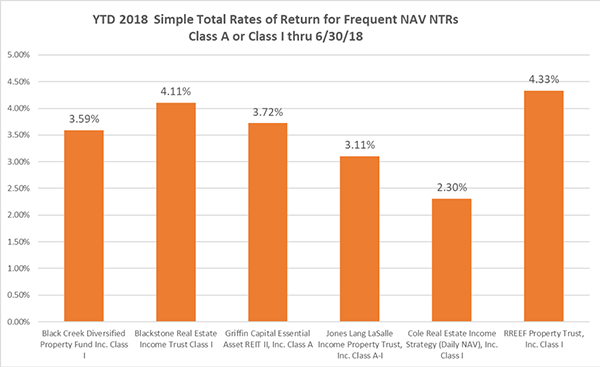

Simple rates of return calculated using the changes in NAVs from 12/29/17 through 6/30/18 and the distributions declared during that six-month period are shown below.

The six-month simple rates of return are calculated as if the NAV as of December 29, 2017, is invested and the distributions during the six months and the NAV value as of June 30, 2018, are received on June 30, 2018. These rates of return are based solely on the estimated NAVs per share and distributions net of any shareholder fees and do not include any upfront loads that would be applied if shares were purchased at the beginning of the period.

Sources: SEC, Blue Vault