Fed meeting may mark beginning of the end for pandemic-era monetary policy

June 15, 2021 | Brian Scheid and Fatima Aitizaz | S&P Global Market Intelligence

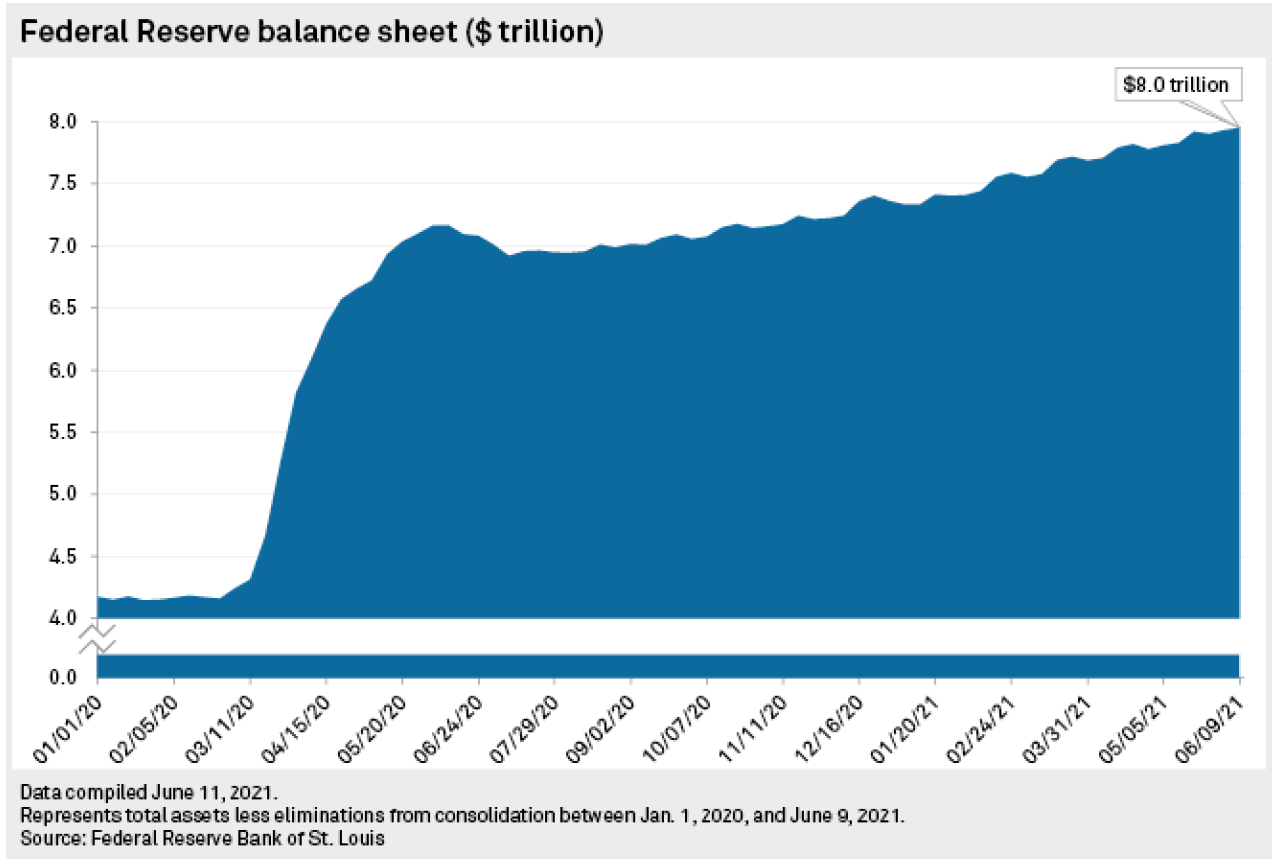

Inflation is surging, COVID infection rates are plunging and the U.S. is rapidly approaching a 50% vaccination rate. Still, no notable change to the Fed’s pandemic monetary policy, particularly its near-zero rates and its $120 billion in monthly bond purchases, is expected as the Federal Open Market Committee meets this week.

This could be the last meeting of its kind for awhile though.

“While no meaningful action is expected, it is the beginning of the end of what has been 16 months of exceptionally easy monetary policy,” wrote Mike O’Rourke, chief market strategist with Jones Trading, in a June 14 note.

The two-day meeting wraps with Fed Chairman Jerome Powell’s June 16 press conference, and bond, equity and currency markets will be listening close for a more hawkish tone as the economy heats up.

The substance of the meeting will likely hinge on what impact the recent run-up in inflation has had on plans to taper bond purchases, which most economists and analysts do not expect Powell to even hint at until August, and whether officials still believe they should keep their benchmark short-term interest rate at effectively 0% through 2023.

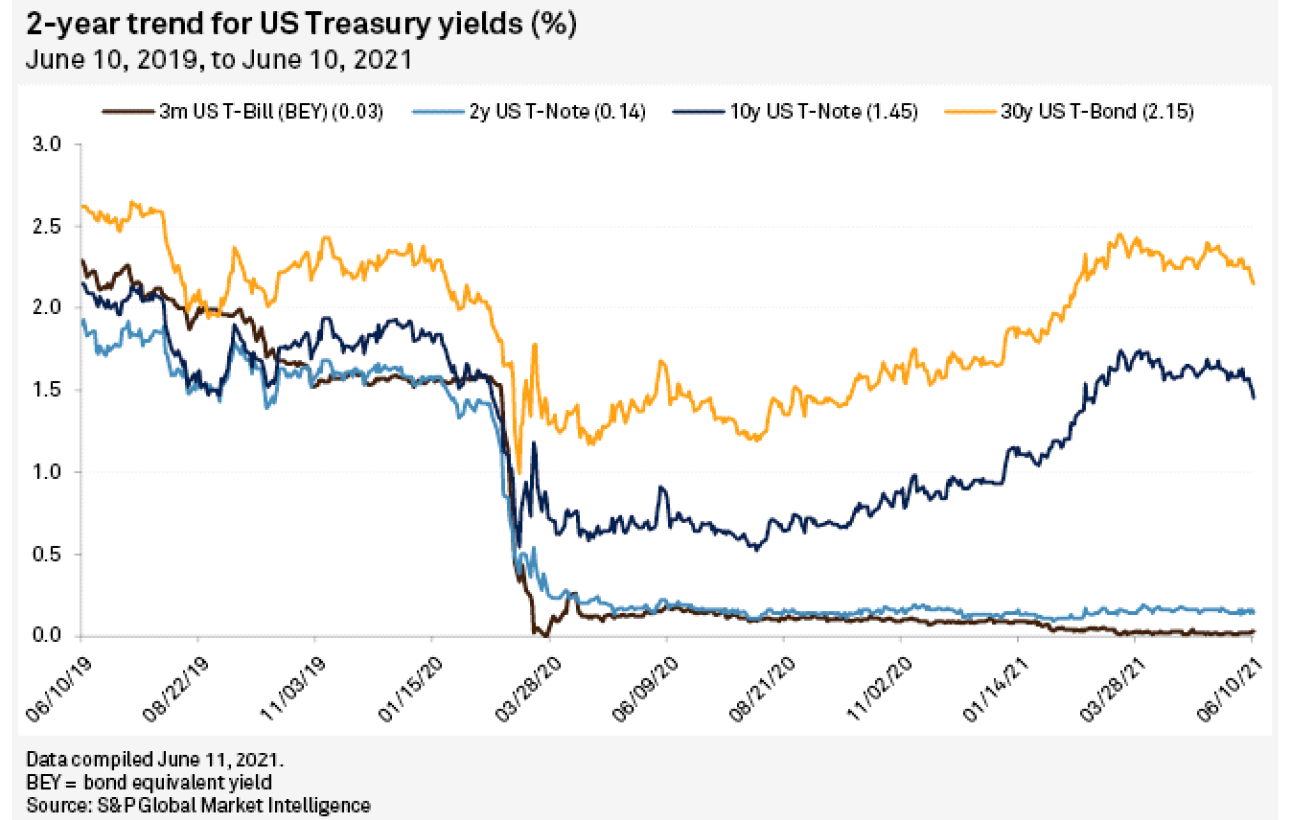

The Fed’s quarterly forecast from March indicated most officials still believe they should keep their benchmark shortterm interest rate at effectively 0% through 2023. Seven of the 18 FOMC members saw at least one rate hike by 2023, and four saw the Fed tightening as early as next year.

Market participants will be watching to see if higher inflation data causes any more FOMC members to move up their expected timeline for the next rate hike.

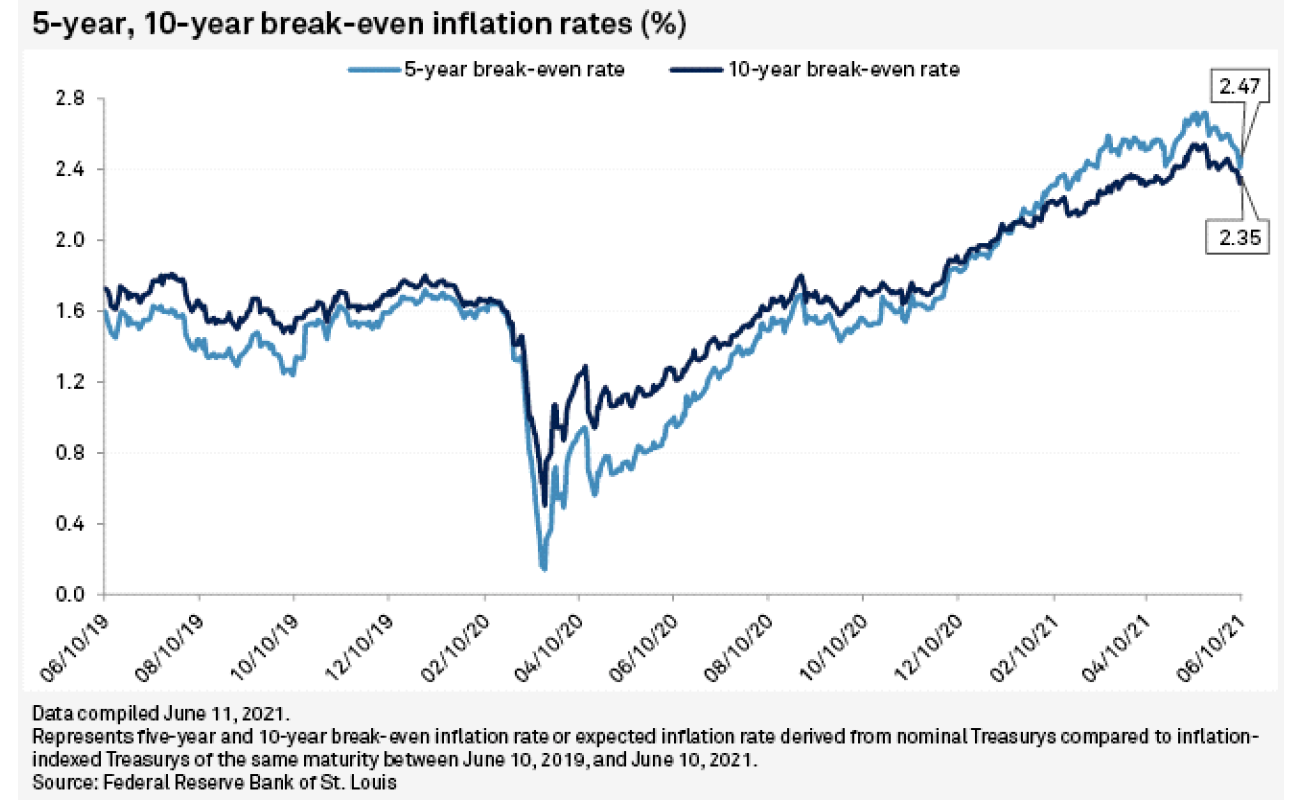

“The key question is whether recent inflation news — strong monthly inflation prints, firm wage pressures, and a rise in inflation expectations — will persuade dovish participants to raise their inflation forecasts as far out as 2023 and pencil in a hike as a result,” Goldman Sachs Chief Economist Jan Hatzius wrote in a June 13 note. “In light of the transitory nature of the recent spike in prices, our best guess is no.”

The meeting opens less than a week after the U.S. Bureau of Labor Statistics reported that the Consumer Price Index climbed 5% from May 2020 to May 2021, the largest year-over-year increase since 2008. Last month, the bureau reported that CPI rose 4.2% year over year.

In a June 11 call with reporters, Michael Pond, a fixed income strategist with Barclays Capital, called those two monthly CPI readings “the equivalent of back-to-back 40-year floods.”

Fed officials may view the CPI increases as transitory, blaming them on “base effects” tied to weak inflation data at the height of the coronavirus pandemic last year as well as “bottlenecks” like the global semiconductor shortage, Pond said. Still, he added, the Fed must make clear it is not neglecting the potential impacts of fast-rising inflation while not squashing the post-pandemic rebound.

“They seem to be trying to thread a needle here,” he said.

In a June 10 note, strategists with TD Securities wrote that they expect Powell to convey a “slightly less dovish” messagefollowing the meeting, “emphasizing that actual tapering will require much more progress than is evident thus far.”

While inflation data has climbed, the Fed has seen two straight months of disappointing labor data, including only 559,000 jobs added in May and 9.3 million people still unemployed.

Languishing employment will likely give the Fed cover to keep its bond purchases in place and put off even discussing tapering, said James Knightley, chief international economist with ING.

“While the economy will have fully recovered all the lost pandemic-related output in this current quarter, it is likely to take another couple of months of strong activity, elevated inflation and rising employment before the Fed agrees that the economy has jumped the hurdle of making ‘substantial further progress’,” Knightley wrote in a June 14 note.

The lag in labor goals and likely temporary nature of the inflation hike will probably keep Fed officials from tapering $120 billion in monthly securities purchases, including $80 billion in Treasurys and $40 billion mortgage-backed securities, until March 2022, TD Securities strategists wrote.

“Action will be signaled well in advance, of course, but we don’t expect anything that could be construed as a taper countdown signal until at least the September meeting,” they wrote. This will likely keep the benchmark U.S. Treasury 10-year rate within its recent range of 1.50% to 1.75%.

The minutes of April’s meeting indicated that some participants pushed for a potential future discussion of tapering, and officials have said those discussions about the timing of future talks are underway.

Powell is unlikely this week to do more than indicate there is agreement to discuss further, said Aneta Markowska, chief financial economist at Jefferies.

“Those future talks will involve specifying conditions for tapering, deciding which assets to taper first, and how to communicate the policy shift to the public,” she wrote in a June 10 note. “But, [Powell is] also likely to say that those discussions are conditional on continued progress on the employment front, which to date has been insufficient.”

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.