FS Credit Real Estate Income Trust to Increase Distribution Rates?

November 17, 2022 | James Sprow | Blue Vault

On November 3, an SEC filing stated that FS Credit Real Estate Income Trust Inc., a monthly NAV REIT sponsored by FS Investments, announced that the company’s adviser has recommended to the board of directors that distribution amounts increase in December 2022 for each of the company’s share classes.

The filing stated “…it is estimated that the annualized distribution rate will be approximately 7.00% for Class I shares, 6.50% for Class D shares, 6.50% for Class M shares, 6.00% for Class S shares and 6.00% for Class T shares based on the anticipated December 2022 distribution and the November 1, 2022, transaction price. The adviser and the board of directors will continue to evaluate the Company’s distribution based on its earnings power, market conditions and the potential impact of interest rates on the portfolio.”

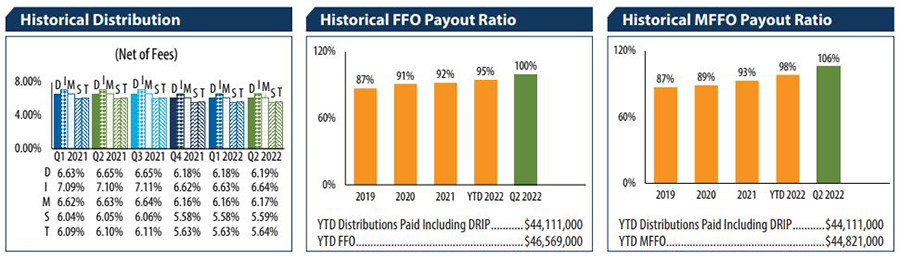

The Q2 2022 Blue Vault report on the REIT shows the distribution yields for each share class. For example, the yield on Class I shares was 6.64% as of June 30, 2022.

While the decision to increase distributions has not yet been announced, Blue Vault’s Q2 2022 NTR Review’s report on FS Credit Real Estate Income Trust reveals that through Q2 2022 the REIT’s ability to cover its distribution (including DRIP) with Modified Funds From Operations has been decreasing slowly and consistently over the past three years. However, distributions reinvested via the DRIP program totaled $21.9 million for the first six months of 2022, or 50% of the total distributions. Given the relatively strong participation in the DRIP and the cash provided by operating activities of $48.9 million over the same period, the REIT currently has the ability to increase distribution yields and cover them with operating cash flow.

Want more useful Blue Vault TidBits? Subscribe to the Blue Vault Database today!

Source: SEC, Blue Vault