Global Property Fund Returns Remained Strong despite Regional Divergence

September 28, 2022 | Niel Harmse | Commercial Property Executive

Global real estate funds delivered another positive performance in the second quarter of 2022.

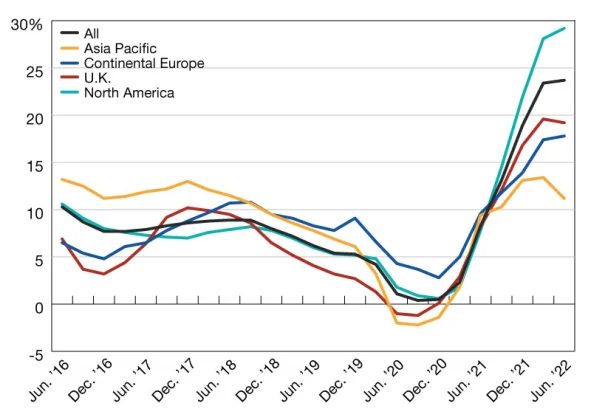

Asset Return by Region

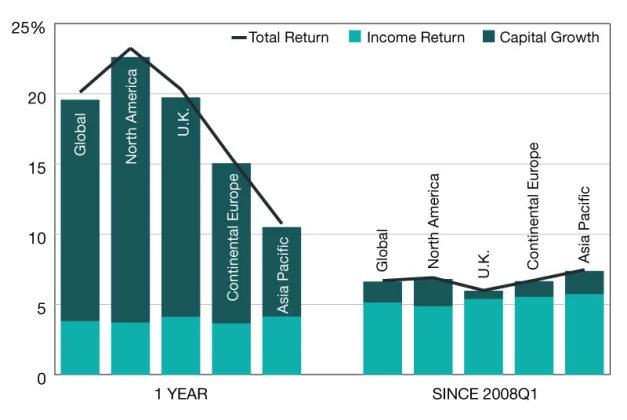

Global real estate funds delivered another positive performance in the second quarter of 2022. A quarterly fund-level total return of 4.0 percent saw the annual return of the MSCI Global Quarterly Property Fund Index accelerate to 23.7percent. While this was the highest annual return since the index’s inception in March 2008 there was a growing divergence among the different region’s fund returns. While North American funds saw their annual fund return reach a new high of 29.2 percent, Asia Pacific domiciled funds experienced a dip in performance as their annual return weakened to 11.2 percent. UK and Continental Europe domiciled funds reported annual fund returns of 19.2 percent and 17.8 percent which were 40bps down and 40bps up respectively from the quarter before.

While the index’s fund-level return reached another new high, the property-level return simmered slightly as it slowed 30bps to 20.1 percent. Among the regions, North American real estate funds had a particularly strong first half of the year as its asset-level return accelerated to 23.2 percent p.a. followed by the United Kingdom at 20.3 percent and Continental Europe at 15.4 percent. While Asia Pacific domiciled funds saw their returns slow, the region’s performance still compares favourably across longer time horizons. In fact, since the index’s inception in 2008, it is the top performing region with an annualized compound total return of 7.5 percent.