Hines Global Income Trust Announces $10.12 NAV Per Share

January 18, 2021 | James Sprow | Blue Vault

In an 8-K filing on January 14, 2021, Hines Global Income Trust, Inc. announced its December 31, 2020, NAV per share of $10.12. This represents an increase of $0.30 per share from the November 30, 2020, NAV per share of $9.82.

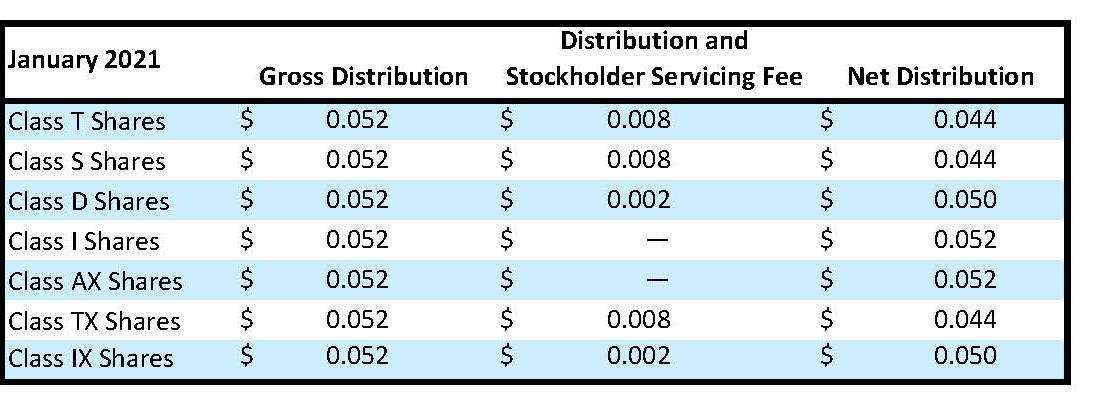

The Company’s board of directors has authorized the Company to declare distributions for the month of January 2021. Distributions for each class of the Company’s common stock will be as follows (as rounded to the nearest three decimal points):

The following is from the 8-K filing:

“As previously disclosed, the Coronavirus (COVID-19) pandemic has had, and is expected to continue to have, an adverse impact on global commercial activity and has contributed to significant volatility in financial markets. While it is difficult to ascertain the long term impact it will have on commercial real estate markets and the Company’s investments, it presents material uncertainty and risk with respect to the current and future performance and value of the Company’s investments. Investments in real properties and real estate-related securities have been impacted by the pandemic and in some cases significantly. For example, the Company’s portfolio has two retail properties that represent approximately 14% of its portfolio, based on the estimated value of its real estate investments as of December 31, 2020. Collections of rent at these properties declined precipitously in the early months of the pandemic. The Company granted rent relief to many of its retail tenants in the form of deferred rent or rent abatements, which reduced rental revenue by $2.3 million for the nine months ended September 30, 2020. While rent collections were adversely affected in the early months of the pandemic, consumer traffic at these properties has recovered to near pre-pandemic levels in recent months and rent collections have recovered to 93% of billed rent for the three months ended September 30, 2020.”

“Additionally, the Company agreed to refund May through August rents for over half of the students across its international student housing portfolio following the closing of nearby universities for the remainder of the 2019/2020 school year. These universities have announced a mixture of in-campus and on-line learning for the 2020/2021 school year with a delayed start.”

“Values of the Company’s retail and student housing properties have also been adversely impacted by the pandemic. While it is difficult to predict the potential long-term impacts the pandemic may have on its business, the Company has invested in well leased, high-quality assets using modest leverage in markets positioned for value retention and resiliency and believes its globally diversified fund is well-situated to weather this challenge.”