Hines Global Income Trust Outperforms Blackstone REIT in 2018

January 30, 2019 | Maria Smorgonskaya and James Sprow | Blue Vault

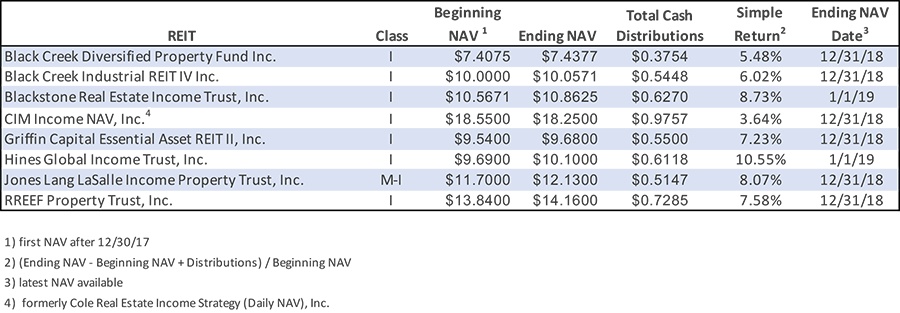

In Blue Vault’s report on the returns to shareholders in daily or monthly NAV continuously-offered nontraded REITs, we estimated the returns to shareholders in 2018 based upon the total distributions paid and the change in estimated NAVs per share from the first estimated NAV announced in 2018 to the last estimated NAV. The results are shown in the table below. Hines Global Income Trust, Inc. had the highest estimated return to its Class I shareholders in the group of eight continuously-offered NTRs, with a 10.55% estimated annual return. Blackstone Real Estate Income Trust, Inc. was next with an estimated return of 8.73% for Class I shareholders.

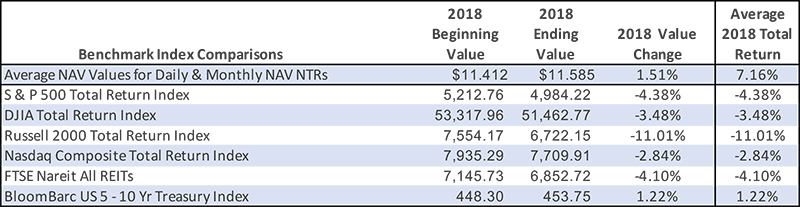

All of the eight nontraded REITs outperformed other investment indices, as shown below. In fact, only the U.S. 5 – 10 Year Treasury Index had a positive return in 2018 among the commonly referenced indices.

Sources: SEC, Blue Vault, Yahoo!Finance, Bloomberg