Scrutiny of the conventional 60/40 portfolio has been intensifying at a time when investors and advisors are showing more interest in allocating to alternative strategies and private assets. But while it seems a given that wealthy investors will invest more in alternatives, how much more is a matter of debate.

Rising stock and bond correlations, an extended period of low interest rates that decreased bond yields, and shrinking public markets have thrust alternative strategies and private assets into the spotlight. In a 2023 survey by CAIS and Mercer, more than three-quarters, or 78%, of advisors in the CAIS network said access to alternatives helps clients meet their goals and objectives. More than half said achieving total return goals is a “high-level” challenge, while 43% said trying to lower risk with lower-correlation asset classes is challenging.

Indeed, the ability to offer alternatives has become a competitive advantage for some advisors. The survey found that 59% of private bankers said access to alternatives helps win new clients, while 83% said it helps differentiate their practice from peers.

“If you don’t do it, you miss part of the market,” said Agnes Lossi, partner at Indefi, a strategy consultancy focused on investment management. “The market is going from public to private; more companies don’t go public anymore. So if you don’t offer these strategies to your client, you’ve missed opportunities in terms of return.”

Despite the interest, there’s still a long way to go as most high-net-worth investors are just getting started. Industry watchers estimate that high-net-worth investors currently have anywhere from 3% to 5% of their portfolios in alternatives, but allocations could go up to 10% or more.

“Is it going to be 10% of the portfolio? 15% of the portfolio? We’re not exactly sure, but we know it’s higher than where we’re at now,” said Tyler Cloherty, managing director at Casey Quirk, a division of Deloitte.

Dipping a Toe Into Alternatives

There’s a huge range of strategies within private assets and alternative investments. For high-net-worth investors who are just wading into the asset class, there isn’t a single, well-trodden path or introduction to alternatives. Much depends on the investor’s liquidity constraints and strategies in the existing portfolio.

“As soon as you start peeling that onion back, all of a sudden it becomes very overwhelming,” said Sean Connor, president and CEO of the global private wealth business at Blue Owl Capital. “It’s much easier to start simpler with a strategy that complements what you’re already doing.”

To complement portfolios, advisors are adding exposure to alternatives through funds focused on specific strategies, preferring niche over multi-strategy funds, industry observers said. Advisors might trim exposure to public fixed income to add private debt to the portfolio, trim equity holdings to allocate a bit to private equity or reduce exposure to both fixed income and equites to move some assets into real estate and infrastructure.

Secondaries and private credit, in particular, have been getting a lot of attention. Both markets have grown rapidly and lend themselves more easily to semi-liquid, perpetual vehicles.

Raj Dhanda, partner and global head of wealth management at Ares Wealth Management Solutions, said he is seeing advisors rethink equity portfolios in favor of secondaries. “As investors are looking to diversify away from equity risk, many are turning to secondaries to complement existing public market investments,” he said.

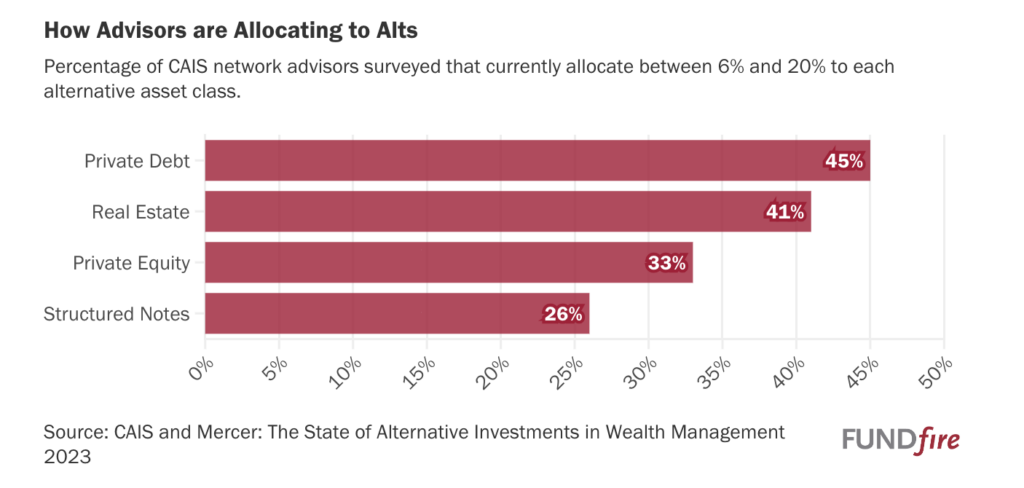

According to the CAIS and Mercer study, 45% of advisors said they currently allocate between 6% to 20% of their clients’ portfolios to private debt. Real estate is the second most popular allocation at 41% of advisors, followed by private equity and structured notes (see chart). Hedge funds, infrastructure and natural resources investment strategies had lower allocations, with fewer advisors putting between 0% to 5% into these asset classes.

Asset managers and advisors expect higher allocations but don’t – given liquidity constraints – expect high-net-worth investors to put 40% to 50% of their investments into alternative assets the way some institutional investors are able to. Liquidity, or the lack of it, is one major challenge to making alternative investments suitable for more mainstream investors. Though perpetual vehicles allow for some liquidity, it’s not necessarily a good fit for all investors.

Ryan Levitt, managing director at alts manager ICG, anticipates more innovation in fund structures and strategies that are specifically designed for high-net-worth investors. “Just because something is suitable for a high-net-worth investor doesn’t mean it’s designed for them,” he said.

One ongoing challenge for individuals and asset managers, he said, is determining the right structure for the investment strategy and target investor. Other than direct feeder funds, most alternative offerings for wealthy investors today are semi-liquid. This makes it easier for more clients to invest, but investors and their advisors still need to carefully check whether the investments in the portfolio fit with their objectives.

“If investors are looking at semi-liquid vehicles, they have to understand the portfolio that supports that liquidity and determine if there is a match between the underlying portfolio, the liquidity options at the fund level, and their individual investment objectives,” he said.

There’s also some hesitation that the asset class is relatively untested for high-net-worth investors. Asset managers are “doing the things that they should be doing” as far as communicating and educating advisors, said Casey Quirk’s Cloherty, but questions remain about how the products will perform throughout market cycles or which asset managers that can be trusted over the long haul.

“That’s just going to come with experience,” he said.