‘Inflation Panic’ Driving Fed to Consider Early End to Bond-Buying Program

January 25, 2022 | S&P Global Market Intelligence

In response to soaring inflation and a tight labor market, the Federal Reserve is considering ending its bond-buying program on Jan. 26, starting the end of its ultra-loose monetary policy weeks ahead of schedule.

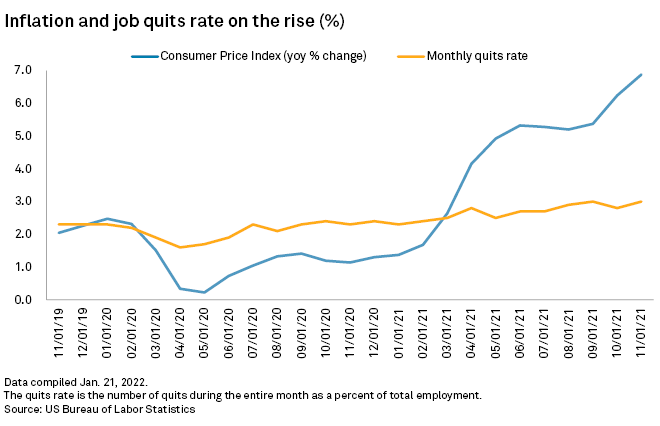

The Fed has been slowing its $120 billion in monthly purchases of Treasurys and mortgage-backed securities with the program set to end in March. But with inflation hitting the highest level in 40 years and Americans quitting jobs at record rates, the Fed is now looking at ending its asset purchases following the rate-setting Federal Open Market Committee’s Jan. 25-26 meeting, economists and analysts said.

“There is a clear sense of inflation panic coming from the Fed,” said Antoine Bouvet, a senior rates strategist with ING.

Ending the bond-buying program during the Jan. 25-26 meeting of the rate-setting Federal Open Market Committee would allow the Fed to “create a bit more space between the end of taper and the first rate hike,” said Neil Dutta, head of economic research at Renaissance Macro Research.

“The optics I think would be good for the Fed because it makes no sense to keep buying assets when it is so obvious hikes are around the corner,” Dutta said

Later this year, the Fed plans to start reducing its balance sheet, which has ballooned to nearly $9 trillion due to its bond-buying program, likely by not replacing bonds that mature. The market also expects the first rate hike to follow the FOMC’s March meeting. The odds of a rate hike at the Fed’s March meeting, non-existent just a few months ago, are now at about 92%, according to the CME FedWatch Tool, which measures investor sentiment in the Fed funds futures market.

“The Fed is changing course pretty rapidly versus where they were six months ago,” said Ed Al-Hussainy, a senior interest rate and currency analyst at Columbia Threadneedle.

Balance sheet reduction

With the first rate hike looming, Fed officials have ramped up talk of reducing the central bank’s balance sheet.

“It’s far above where it needs to be,” Fed Chairman Jerome Powell told the Senate Banking Committee on Jan. 11.

After the December FOMC meeting, the Fed announced it was winding down its bond purchases faster, ending the quantitative easing program by March, boosting market expectations of as many as four rate hikes this year.

“Tapering appears to be a set course that is well understood by markets, but if the Fed wants to sound hawkish they could suggest that runoff may be starting both sooner and may proceed more rapidly,” said Gennadiy Goldberg, a senior U.S. rates strategist at TD Securities.

Fed officials may be hesitant to end the asset purchases early since they fear a sudden change to policy could spook markets, said James Bianco, president of the macro analysis firm Bianco Research.

“Are they so tied to forward guidance that they would not do it because it was never forward guided?” Bianco asked. “I think the answer is yes.”

Similarly, fears of a negative market response to the abrupt end to program could give Fed officials pause, said Bouvet with ING.

“Accelerating tapering or just going cold turkey on QE at this meeting are real possibilities but I think a poor risk-reward,” Bouvet said. “When you see how worried markets are about policy tightening, I am not sure it is worth throwing fuel on the fire when they already have space to start hiking in March.”