James Sprow | Blue Vault |

InPoint Commercial Real Estate Income (“InPoint”) was formed in 2016 by Inland Real Estate Investment Corporation, a member of The Inland Real Estate Group of Companies. Initially, the nontraded REIT program commenced a private offering for up to $500 million in Class P common stock, at a total purchase price of $27.38 per share. By March 2019 the REIT had raised $276.7 million via the private Class P stock offering.

InPoint was to originate, acquire and manage a diversified portfolio primarily comprised of floating-rate CRE debt, including first mortgage loans and subordinate mortgage and mezzanine loans. They also could invest in floating-rate CRE securities such as commercial mortgage-backed securities (“CMBS”) and senior unsecured debt of publicly-traded REITs, loan participations and select equity investments in single tenant, net leased properties.

By year-end 2017, the REIT had a portfolio of $32.1 million in commercial mortgage loans and $26.0 million in CMBS. The REIT initiated the commercial mortgage loans and purchased the CMBS during 2017.

In May 2019 the REIT’s IPO for up to $2.35 billion in Class A, Class T, Class D and Class I shares was effective. By March 2020, the offering had raised only $38.3 million, including DRIP. On March 24, 2020, the REIT’s board suspended the sale of shares in the IPO, the SRP, and the payment of distributions, citing the impact of the COVID-19 pandemic on the economy. On March 1, 2021, the SRP was reinstated for shareholders requesting repurchase of shares due to death or disability. As of March 10, 2022, the REIT had received gross proceeds of $39.9 million in its IPO.

On September 22, 2021, the REIT completed a public offering of up to 3,500,000 shares of 6.75% Series A Cumulative Redeemable Preferred Stock, receiving net proceeds of $86.3 million, having issued 3,600,000 shares.

On April 28, 2022, the Company filed a registration statement on Form S-11 (with the SEC to register up to $2.2 billion in shares of common stock, which was declared effective by the SEC on November 2, 2022 On January 30, 2023, the board of directors approved the suspension of share repurchases, the sale of shares in the public offering, and sales of shares via the DRIP effective February 10, 2023. The board also approved the termination of the Series A Preferred Repurchase Program. As of March 29, 2023, the REIT had received gross proceeds from public offerings of common shares of just $44.9 million.

As of December 31, 2022, the REIT’s investment portfolio consisted of $845.9 million in commercial mortgage loans held for investment. It also owned one 362-room hotel located in Chicago, Illinois, the Renaissance Chicago O’Hare Suites Hotel, through a ground lease interest that it acquired via a deed-in-lieu-of-foreclosure on August 20, 2020, from the borrower under one of its first mortgage loans.

Explanation of the Suspension of Primary Offering, Share Repurchase Plan, and Distribution Reinvestment Plan

In its filing with the SEC, the REIT stated (emphasis ours):

“In light of the pace of fundraising in our current public offering and the amount of monthly redemption requests pursuant to our share repurchase plan (the “SRP”), which are currently in excess of such fundraising, on January 30, 2023, our board of directors (the “Board”) unanimously approved, effective immediately, the suspension of the operation of the SRP. In connection with such suspension, the Board has also unanimously approved the suspension of the sale of shares in the primary portion of our public offering (the “Primary Offering”), effective immediately, and the suspension of the sale of shares pursuant to our amended and restated distribution reinvestment plan (the “DRP”), effective as of February 10, 2023. The Primary Offering, the SRP, and the DRP shall each remain suspended unless and until such time as the Board approves their resumption. In connection with the foregoing, the Board has decided to evaluate strategic alternatives available to us.”

InPoint CRE Income’s Financials Tell the Story

Due to the difficulty InPoint experienced in raising common equity, the REIT never really reached a scale that could weather the storm that both the Covid-19 pandemic, and the steep rise in interest rates used by the Fed to fight inflation, brought upon the sector. The acquisition of the Chicago hotel in August 2020 was just an early hint of what was to come.

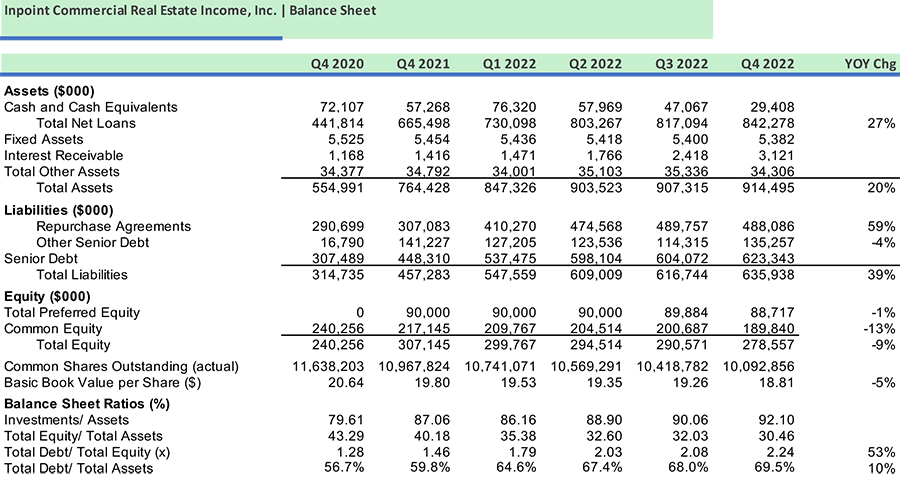

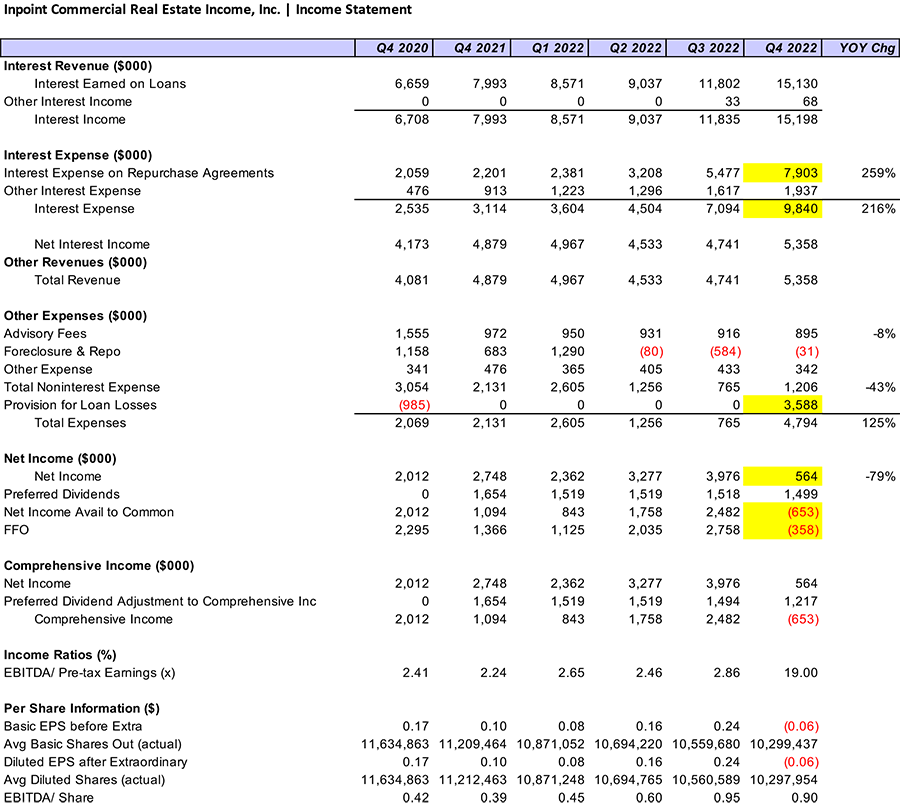

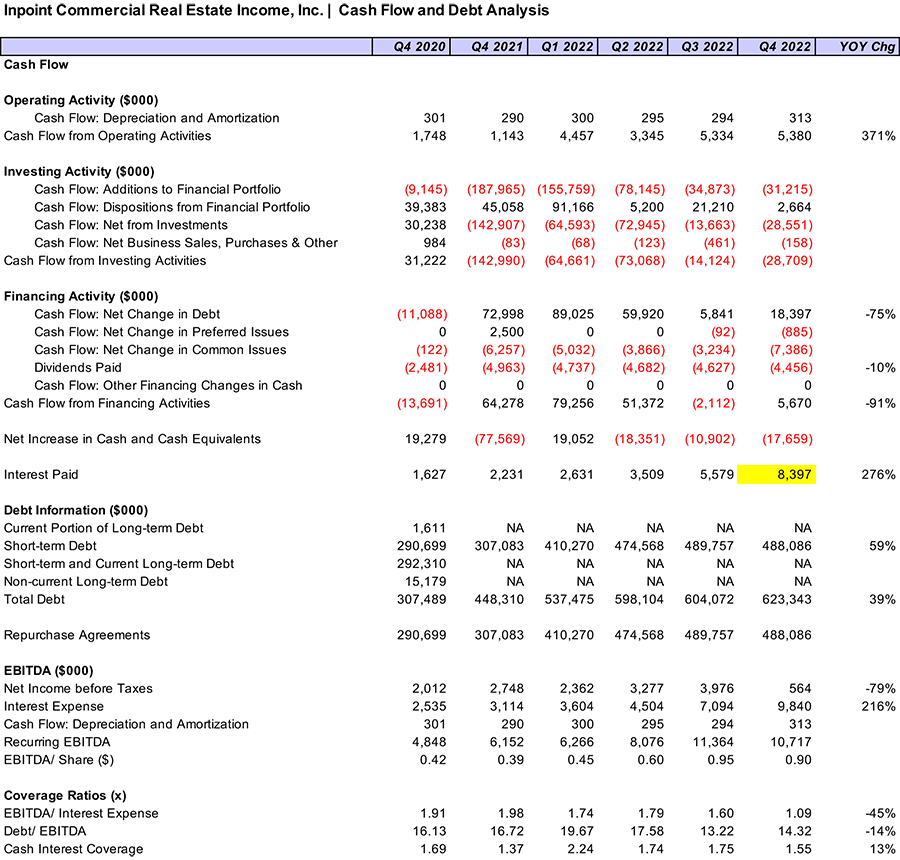

In year over year comparisons of Q4 2022 financial data to Q4 2021, the first item that stands out is Interest Expense, up from $3.1 million in Q4 2021 to $9.8 million in Q4 2022, a rise of 216%. Interest expense on the REIT’s Repurchase Agreements, its most important source of financing, rose 259% over that period. This rise in interest expense occurred while the book value of its debt rose just 39%. Over the same time period, the REIT’s book value of common equity fell 13%.

The REIT’s total assets grew just 20% YOY to Q4 2022, but its total debt increased 39%, raising its debt to total assets ratio from 59.8% to 69.5%, YOY. Dividends paid quarterly fell 10% over the period. In Q4 2022, InPoint’s net income fell to $0.564 million from the previous quarter’s $3.976 million, mainly due to a provision for loan losses of $3.588 million.

For the year 2022, the REIT repurchased a total of 1,135,245 common shares at an average price of $19.70 per share. This amounts to over $22.36 million in repurchases, which explains the net change in common stock issues of $19.52 million for the year 2022 and the reduction of 13% in common equity.

On a positive note, the REIT has reduced both its quarterly Noninterest Expense by 43% YOY, and quarterly Advisory Fees by 8% YOY.

Conclusion

As the board of directors of InPoint Commercial Real Estate Income deliberate their strategy going forward, there doesn’t appear to be an easy solution to the rise in interest expense, from $7.09 million in Q3 2022 to $9.84 million in Q4 2022. That level of interest expense due to the rise in rates instituted by the Fed is going to be an ongoing challenge. While the REIT’s interest income rose from $4.74 million to $5.36 million over the same period, it did not keep pace with interest expense. In our quarterly reports on InPoint we explain that variable rate debt can be hedged somewhat by investments in variable rate mortgage debt. That strategy works unless the mortgage portfolio experiences significant defaults or write-downs, like those the hit the REIT’s financials in Q4 2022. It remains to be seen whether the large provision for loan losses of $3.6 million in Q4 2022 is a one-off, or the beginning of a worrisome trend.

Appendix: Financial Statements for InPoint Commercial Real Estate Income, Inc.