Interval Funds and Nontraded Closed-End Funds: Defined and Demystified

January 17, 2017 | by Jared Schneider | Blue Vault

Although still not as widely used in the financial services sector as nontraded REITs, BDCs and mutual funds; interval funds and nontraded closed-end funds are growing quickly. Why are they gaining popularity? Perhaps if we define and differentiate these fund types, we can better understand the answer to that question.

With the rise of interval funds and nontraded closed-end funds (CEFs) has also come a lot of confusion in the marketplace and some misinformation. We are going to clear up the misconceptions so you can better understand these growing product types and make informed decisions about them.

First, all mutual and closed-end funds fall under the Investment Company Act of 1940 set forth by the U.S. Securities and Exchange Commission. The act sets the regulations for activities, filings, shareholder communications, accounting, investment policy requirements, and others.

The most important items in the Investment Company Act requires funds to do the following:

- Register with the SEC.

- Have a board of directors, 75% of whom must be independent.

- Limit their investment strategies, such as the use of leverage.

- Maintain a certain percentage of their assets in cash for investors who might wish to sell.

- Disclose their structure, financial condition, investment policies, and objectives to investors.

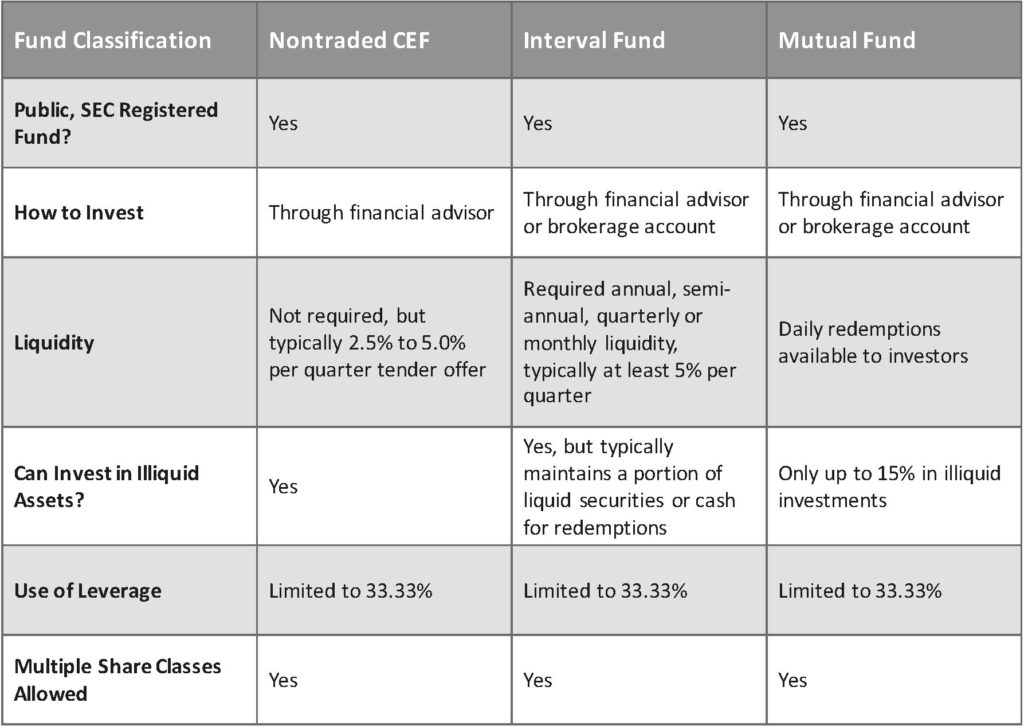

In the Act, there are “closed-end funds” and “open-end mutual funds”. Closed-end funds have one initial public offering and then closes to new investors. Additionally, closed-end fund investors cannot get regular liquidity unless the fund is traded on an exchange, which many are. However, the fund may trade at a significant premium or discount to the NAV (net asset value) and is subject to swings of the stock market.

On the other end of the spectrum, open-end mutual funds are offered daily to investors and typically have daily liquidity for investors at or near to NAV (depending on the share class). Because of the daily liquidity provision, many illiquid alternative asset classes are limited to 15% of the portfolio, which closed-end funds do not have.

Interval funds are a blend of closed-end funds and mutual funds, but are legally classified as closed-end funds. An interval fund is open to investors and may accept new investors daily or weekly. Additionally, interval funds usually have an associated ticker symbol that can be typed in for purchases through an electronic brokerage platform. They also are required to offer a minimum liquidity feature to their investors. Typically, interval funds offer quarterly liquidity at no less than five percent of the total net assets. This limited liquidity allows both the fund to invest in more types of alternative or illiquid investments, while offering the investor a shorter term way out, if necessary.

Nontraded CEFs are closed-end funds that are not listed on an exchange. They are not required to have specific levels of liquidity for investors, but many do have quarterly tender offer programs that buy back shares from investors. Many nontraded CEFs have liquidity features not too different than interval funds, but slightly lower levels per period. Most nontraded CEFs that have tender offer programs provide five percent or less of net assets per quarter.

Note: Technically a nontraded BDC is a type of nontraded closed-end fund, but the BDC election exempts the fund from some of the 1940 Act provisions and adds additional portfolio requirements that other 1940 Act funds do not have.

What They Are Not

Another point of confusion with these fund types has been that they are an asset class. No interval fund or nontraded CEF is an asset class of itself. They are simply wrappers, like candy wrappers. Inside the candy wrapper could be chocolate, hard candy, you name it. Similarly, there are few limitations as to what goes inside one of these fund types. Asset classes inside these funds could be stocks, bonds, real estate, private debt, private equity, insurance linked securities, home mortgages, and the list goes on. This is where doing the due diligence to learn about what assets the fund is investing in, what the investment strategy is, and who the management team is becomes so important. In the Blue Vault subscriber report for these funds, we provide you with answers to some of these questions and more.