James Sprow | Blue Vault

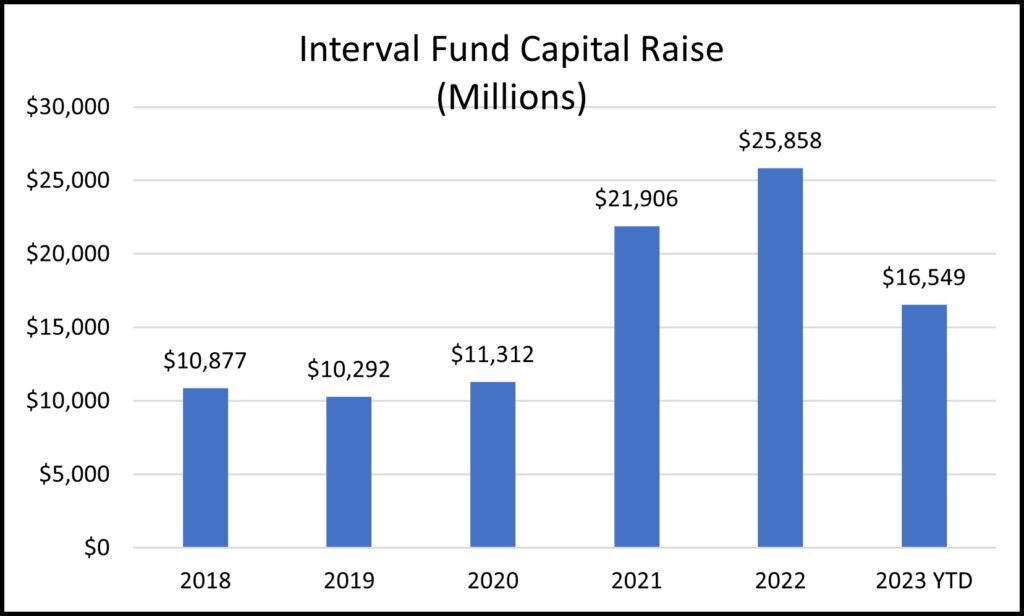

Interval funds have raised a total of over $16.5 billion YTD as of September 30, 2023, as reported by Blue Vault. There were 84 interval funds as of that date, up from 76 in Q3 2022. Those 84 funds reported $87.9 billion in total AUM, up from $82.2 billion in Q3 2022. Over the past 14 quarters, the interval fund industry has recorded an average quarterly growth rate in assets under management of 6.0%.

After a slight downturn in capital raise in 2019, the industry rebounded in 2020 with a 9.9% increase, followed by an almost doubling in 2021 with a 94% increase. Growth continued in 2022 with an 18% increase.

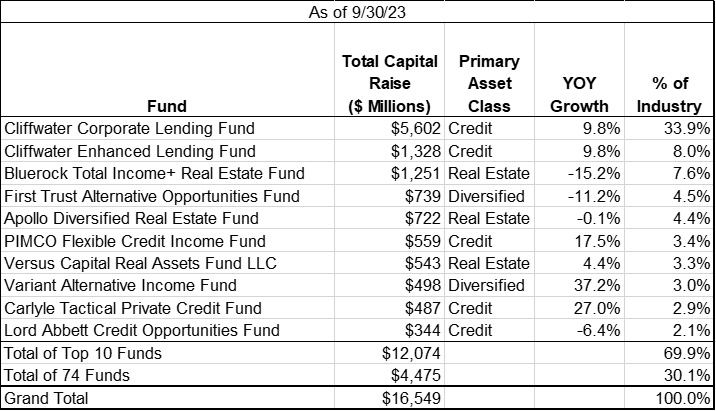

The success of the interval fund sector contrasts markedly with the drop in capital raise by nontraded REITs. Nontraded REITs have raised just $10.6 billion with 17 nontraded REITs actively raising equity YTD through Q3. Interval funds raised $16.5 billion with the top 10 funds raising $12.1 billion over the same time period. Cliffwater Corporate Lending Fund raised over $5.6 billion YTD in 2023, 33.9% of the industry total. Cliffwater Enhanced Lending Fund raised $1.3 billion for an 8.0% share. As indicated, both funds are focused on credit investments.

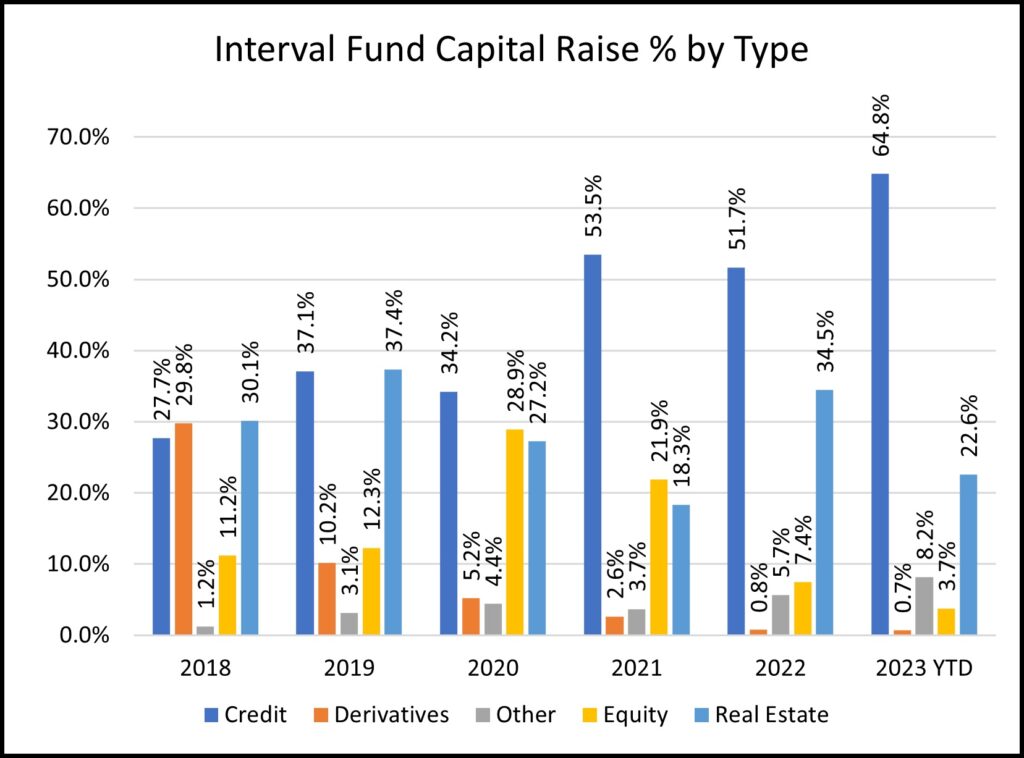

Funds focused on credit investments dominated capital raise YTD in 2023, raising 64.8% of the industry total. A distant second were funds investing in real estate, with 22.8% of the industry’s capital raise. The largest drop-off was experienced by funds focused on equity investments. Those funds raised 21.9% of the capital in 2021, but just a 3.7% share in 2023 so far.

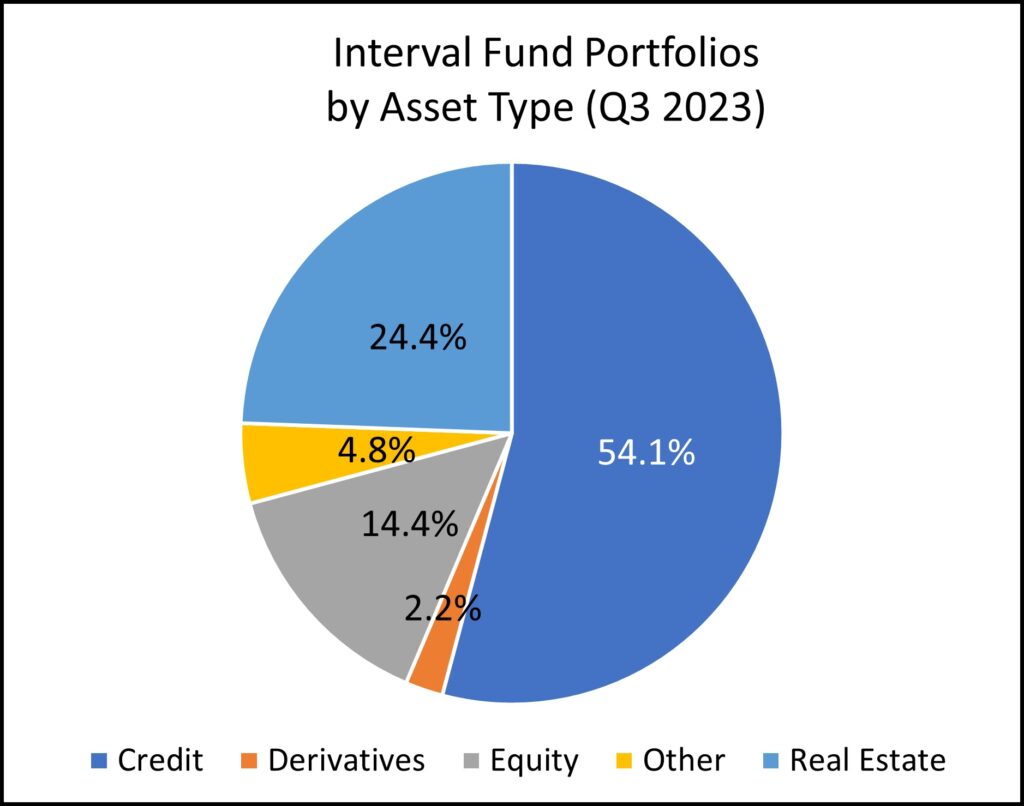

Interval funds focused on credit assets constituted 54.1% of the industry’s total assets, followed by real estate with 24.4% and equity at 14.4% of the industry’s total assets, as of September 30. 2023.

Source: Blue Vault