It Should Be Obvious What Rising Rates Are Doing to Commercial Real Estate

September 13, 2023 | James Sprow | Blue Vault

In an article we published on the Blue Vault website on September 6, 2023, we asked the question “What Happened to Ares Industrial REIT’s NAVs.” After looking at the possible relationship between Ares Industrial REIT’s NAVs over the past two years and the monthly returns posted by NAREIT’s listed REITs categorized as “Industrial” REITs, we concluded that the factors impacting listed REITs with similar investments in industrial assets couldn’t be the cause for Ares Industrial REITs relatively lackluster trends in per share NAVs. There was virtually no correlation between the monthly returns to the listed industrial REITs and the monthly total returns to the Ares REIT. The nontraded REIT’s occupancy rates and lease rates trends couldn’t explain how its NAVs per share, after increasing 40.1% from August 2021 to July 2022, decreased 8.1% over the same 12-month period in 2022 through July 2023.

In that article, we looked at the discount rates that were being used to estimate Ares Industrial REIT’s monthly NAVs. Those discount rates were used by the third-party valuation firm hired by the REIT’s board to estimate NAVs by finding the present values of the REIT’s projected future cash flows. What we found was the REIT’s per share NAVs and the resulting monthly returns that turned negative in 2023 could be explained by the increases in the discount rates used by the valuation firm. We concluded that the lackluster performance of the REIT could be explained in large part by the rising discount rates and that rising interest rates in the larger economy could be a major factor impacting its estimated NAVs per share. Discount rates used to value commercial properties are linked to market interest rates.

Three Charts That Explain What’s Happening to US Commercial Real Estate

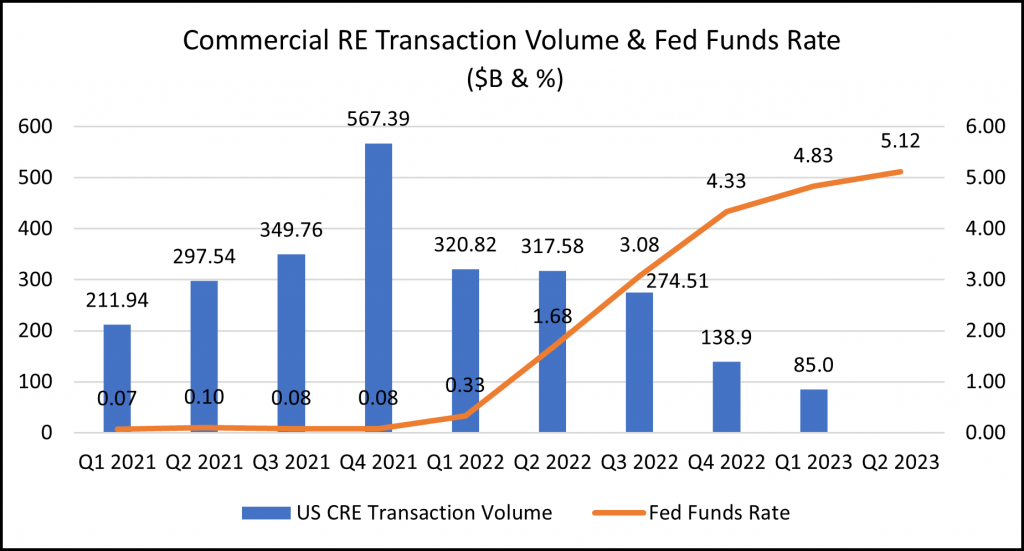

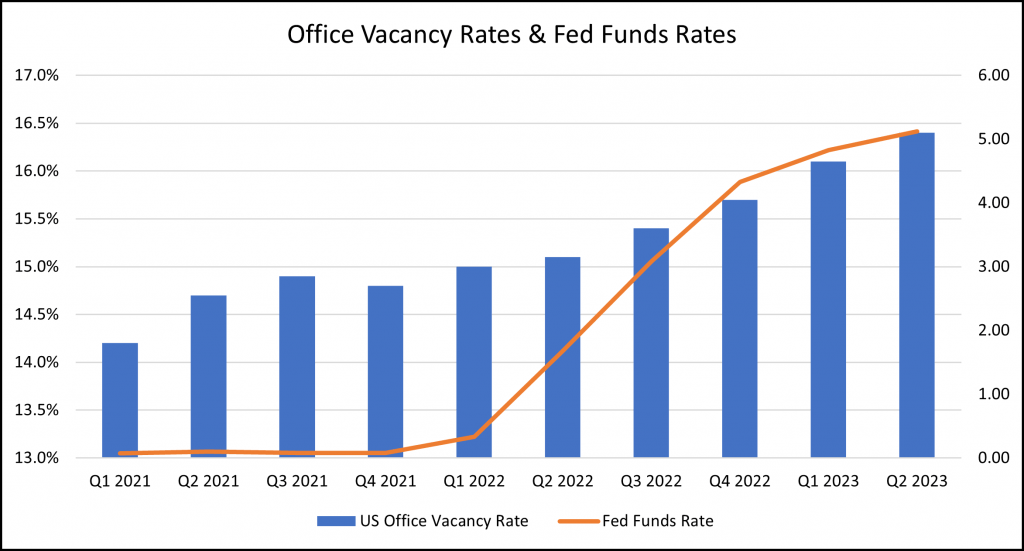

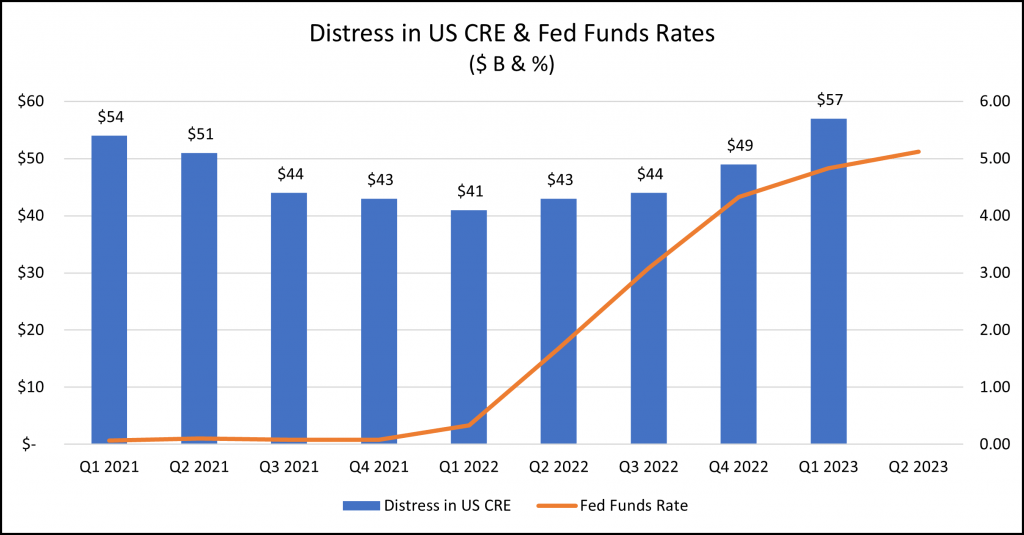

In the following charts, the right axis displays the US Federal Funds Rate and how it has risen from near zero to over 5% in Q2 2023. On each chart, the right axis shows how the rise in interest rates has a possible relationship, first with the reduction in investment volume, then office vacancy rates, and finally, in the dollar value of distressed real estate properties in the US.

We know that office vacancy rates have mostly been impacted by the pandemic and the office sector’s response to it, resulting in a large portion of the office sector’s employees working from home and being slow to return to the office. However, rising interest rates will continue to hammer the office sector as owners face difficulty in securing financing to replace maturing loans. An article by Kyle Campbell that appeared on the PERE website on September 5, 2023, quotes Ryan Cotton, head of Bain Capital Real Estate, “Office is about 20 percent of the equity value of commercial real estate in total, so we’re letting one-fifth of the assets speak for the whole asset class.” The following chart shows how office vacancy rates have increased since Q1 2021, which along with rising interest rates, has negatively impacted the value of office properties.

Distress in US Commercial Real Estate Sector

By making financing for commercial real estate more expensive, and re-financing of existing loans more problematic, more commercial real estate in the US has become distressed. Since Q2 2022, an additional $14 billion in commercial real estate values has fallen into the “distressed” category according to data from the WSJ. It’s no wonder that CRE investment volume has fallen.

What About the 80% of Commercial Real Estate That Isn’t in the Office Sector?

The largest property portfolio in the nontraded REIT sector is owned by Blackstone Real Estate Income Trust. As of June 30, 2023, only 2% of the REIT’s fair value of its real estate portfolio was in office properties. Rental housing and industrial assets made up over 63% of that REIT’s portfolio. The second largest nontraded REIT by assets was Starwood Real Estate Income Trust. That REIT had just 6.6% of its property portfolio in office properties and derived just 7.6% of its net operating income from those properties. The REIT derived 72.6% of its net operating income in Q2 2023 from its multifamily, single-family rental and industrial property investments. Both Blackstone REIT and Starwood REIT were actively using interest rate swaps and caps to effectively convert their respective variable rate borrowings to fixed rates. In fact, Blackstone REIT shows on their website that 91% of their debt is effectively hedged to reduce interest rate risk.

From July 31, 2022, through July 31, 2023, Blackstone REIT’s NAV per share fell just 1.3% in this era of steeply rising interest rates. Starwood REIT’s NAV per share fell 9.5% over that period. In both cases, the fall in the NAVs estimated by third-party valuation firms can be largely explained by rising interest rates rather than falling income projections or lower terminal value estimates for their property portfolios.

Conclusion

The steep rise in interest rates brought about by the Federal Reserve, from near zero for the Federal Funds Rate in Q1 2022 to over 5% in Q2 2023, has had a dramatic impact on commercial real estate values. Combined with the impacts of the pandemic on office vacancy rates, the industry has suffered a year of poor performance and returns that reversed a two-year trend of excellent returns. Nevertheless, investments in office assets are a small portion of the portfolios of two of the largest nontraded REITs. As interest rate increases begin to moderate or even come to an end over the next year, REITs in general and nontraded REITs in particular, can be expected to see their NAVs rebound, and shareholder returns along with them.

Sources: PERE, Blue Vault, SEC, WSJ, Blackstone REIT, Starwood REIT