JLL Income Property Trust Declares Special Dividend and 31st Consecutive Quarterly Dividend

August 14, 2019

In an August 13 press release, JLL Income Property Trust, an institutionally managed daily NAV REIT (NASDAQ: ZIPTAX; ZIPTMX; ZIPIAX; ZIPIMX), announced that on August 8, 2019, its Board of Directors approved a gross dividend for the third quarter of 2019 of $0.175 per share, which includes a one-time, special dividend of $0.04 per share and a regular dividend of $0.135 per share. The $0.04 per share special dividend allows the company to reduce certain state income taxes due from the capital gains on the sale of 111 Sutter Street. JLL Income Property Trust has declared thirty-one consecutive quarterly dividends to its stockholders beginning with the first quarter 2012.

The dividend is payable on or around November 1, 2019, to stockholders of record as of September 27, 2019. On an annualized basis, the regular portion of the gross dividend is equivalent to $0.54 per share and represents a yield of approximately 4.4 percent on a NAV per share of $12.21 as of August 7, 2019. All stockholders will receive $0.175 per share less applicable share class-specific fees and the annualized yield will differ based on the share class.

“In keeping with our late cycle de-risking portfolio strategy,” noted Allan Swaringen, President and CEO of JLL Income Property Trust, “the 111 Sutter sale earlier this year was strategic in terms of underweighting our portfolio allocation to higher beta markets and property types – in this case, San Francisco multi-tenant office properties.”

The sale generated a $120 million taxable gain that was fully sheltered from federal taxation at the company level and should result in dividends paid throughout 2019 to be characterized as long-term capital gain, a reduced tax rate as compared to ordinary income tax rates for most stockholders. Certain states also assess REITs income taxes.

Swaringen added, “through the special dividend, totaling approximately $6 million, along with other tax mitigation efforts, the company saved over $2 million from our initial state tax estimates. In these situations, which are fairly unique, we would rather pay cash to our stockholders in the form of special dividends than have the company incur taxes.”

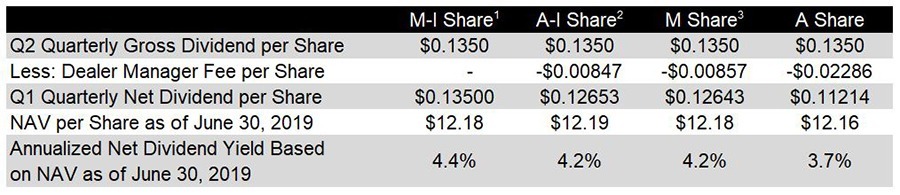

A second quarter dividend of $0.135 per share, less applicable share class-specific fees, was paid according to the table below on August 1, 2019, to stockholders of record as of June 27, 2019.

- A dealer manager fee equal to 1/365th of 0.30% of NAV is allocated to Class A-I stockholders daily and reduces the quarterly dividend paid.

- A dealer manager fee equal to 1/365th of 0.30% of NAV is allocated to Class M stockholders daily and reduces the quarterly dividend paid.

- A dealer manager fee equal to 1/365th of 0.85% of NAV is allocated to Class A stockholders daily and reduces the quarterly dividend paid.